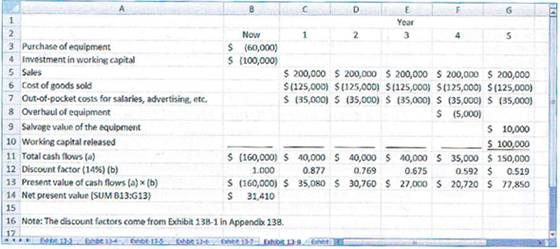

D. Year Now 3 Purchase of equipment 4 Investment in working capital 5 Sales 6 Cost of goods sold 7 Out-of-pocket costs for salaries, advertising, etc. 8 Overhaul of equipment 9 Salvage value of the equipment $ (60,000) S (100,000) S 200,000 $ 200,000 $ 200,000 S 200,000 $ 200,000 $125,000) S(125,000) S(125,000) $(125,000) $(125,000) $ 135,000) S (35,000) S (35,000) S (35,000) S (35,000) $ (5,000) 10 Working capital reieased 11 Total cash flows (a) 12 Discount factor (14%) (b) 13 Present value of cash flows (a) x (b) S 10,000 $ 100,000 $ (160,000) S 40,000 S 40,000 $ 40,000 S 35,000 $ 150,000 1.000 0.877 0.769 0.675 0.592 $ 0.519 S (160,000) S 35,080 $ 30,760 $ 27,000 S 20,720 $ 7,850 31,410 14 Net present value (SUM B13:G13) 15 16 Note: The discount factors come from Exhibit 138-1 in Appendb 138.

D. Year Now 3 Purchase of equipment 4 Investment in working capital 5 Sales 6 Cost of goods sold 7 Out-of-pocket costs for salaries, advertising, etc. 8 Overhaul of equipment 9 Salvage value of the equipment $ (60,000) S (100,000) S 200,000 $ 200,000 $ 200,000 S 200,000 $ 200,000 $125,000) S(125,000) S(125,000) $(125,000) $(125,000) $ 135,000) S (35,000) S (35,000) S (35,000) S (35,000) $ (5,000) 10 Working capital reieased 11 Total cash flows (a) 12 Discount factor (14%) (b) 13 Present value of cash flows (a) x (b) S 10,000 $ 100,000 $ (160,000) S 40,000 S 40,000 $ 40,000 S 35,000 $ 150,000 1.000 0.877 0.769 0.675 0.592 $ 0.519 S (160,000) S 35,080 $ 30,760 $ 27,000 S 20,720 $ 7,850 31,410 14 Net present value (SUM B13:G13) 15 16 Note: The discount factors come from Exhibit 138-1 in Appendb 138.

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 14SP

Related questions

Question

Is the return on this investment proposal exactly 14%, more than 14%, or less than 14%? Explain.

The

Transcribed Image Text:D.

Year

Now

3 Purchase of equipment

4 Investment in working capital

5 Sales

6 Cost of goods sold

7 Out-of-pocket costs for salaries, advertising, etc.

8 Overhaul of equipment

9 Salvage value of the equipment

$ (60,000)

S (100,000)

S 200,000 $ 200,000 $ 200,000 S 200,000 $ 200,000

$125,000) S(125,000) S(125,000) $(125,000) $(125,000)

$ 135,000) S (35,000) S (35,000) S (35,000) S (35,000)

$ (5,000)

10 Working capital reieased

11 Total cash flows (a)

12 Discount factor (14%) (b)

13 Present value of cash flows (a) x (b)

S 10,000

$ 100,000

$ (160,000) S 40,000 S 40,000 $ 40,000 S 35,000 $ 150,000

1.000

0.877

0.769

0.675

0.592 $

0.519

S (160,000) S 35,080 $ 30,760 $ 27,000 S 20,720 $ 7,850

31,410

14 Net present value (SUM B13:G13)

15

16 Note: The discount factors come from Exhibit 138-1 in Appendb 138.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you