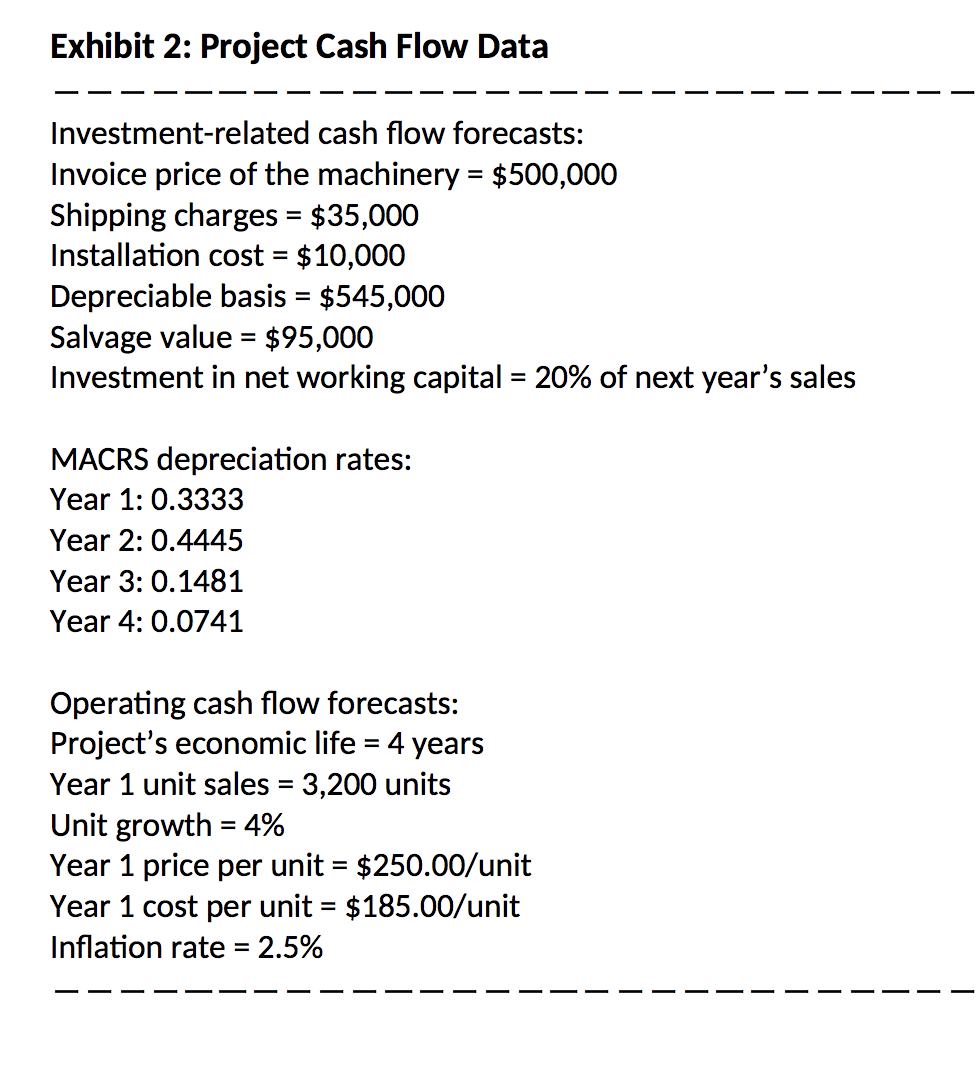

Exhibit 2: Project Cash Flow Data Investment-related cash flow forecasts: Invoice price of the machinery = $500,000 Shipping charges = $35,000 Installation cost = $10,000 %3D Depreciable basis = $545,000 Salvage value = $95,000 Investment in net working capital = 20% of next year's sales %3D %3D MACRS depreciation rates: Year 1: 0.3333 Year 2: 0.4445 Year 3: 0.1481 Year 4: 0.0741 Operating cash flow forecasts: Project's economic life = 4 years Year 1 unit sales = 3,200 units Unit growth = 4% Year 1 price per unit = $250.00/unit Year 1 cost per unit = $185.00/unit %3D %3D Inflation rate = 2.5%

Exhibit 2: Project Cash Flow Data Investment-related cash flow forecasts: Invoice price of the machinery = $500,000 Shipping charges = $35,000 Installation cost = $10,000 %3D Depreciable basis = $545,000 Salvage value = $95,000 Investment in net working capital = 20% of next year's sales %3D %3D MACRS depreciation rates: Year 1: 0.3333 Year 2: 0.4445 Year 3: 0.1481 Year 4: 0.0741 Operating cash flow forecasts: Project's economic life = 4 years Year 1 unit sales = 3,200 units Unit growth = 4% Year 1 price per unit = $250.00/unit Year 1 cost per unit = $185.00/unit %3D %3D Inflation rate = 2.5%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 7P

Related questions

Question

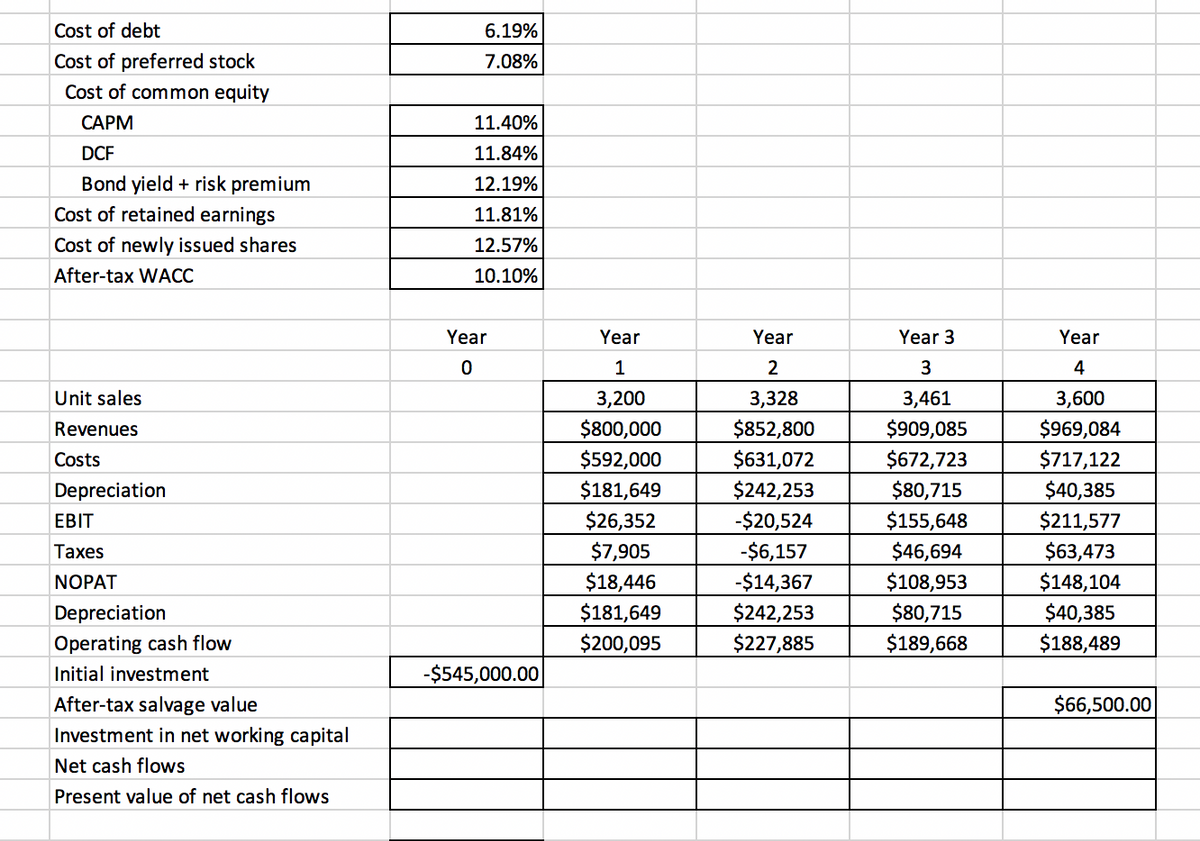

Please calculate investment in net working capital, net cash flows, and present value of net cash flows! Thank you!

Transcribed Image Text:Exhibit 2: Project Cash Flow Data

Investment-related cash flow forecasts:

Invoice price of the machinery = $500,000

Shipping charges = $35,000

Installation cost = $10,000

Depreciable basis = $545,000

Salvage value = $95,000

Investment in net working capital = 20% of next year's sales

%3D

MACRS depreciation rates:

Year 1: 0.3333

Year 2: 0.4445

Year 3: 0.1481

Year 4: 0.0741

Operating cash flow forecasts:

Project's economic life = 4 years

Year 1 unit sales = 3,200 units

Unit growth = 4%

Year 1 price per unit = $250.00/unit

Year 1 cost per unit = $185.00/unit

Inflation rate = 2.5%

Transcribed Image Text:Cost of debt

6.19%

Cost of preferred stock

Cost of common equity

7.08%

САРМ

11.40%

DCF

11.84%

Bond yield + risk premium

12.19%

Cost of retained earnings

11.81%

Cost of newly issued shares

12.57%

After-tax WACC

10.10%

Year

Year

Year

Year 3

Year

1

2

4

Unit sales

3,200

3,328

3,461

3,600

$969,084

$717,122

$40,385

$211,577

$63,473

$800,000

$592,000

$181,649

$26,352

$852,800

$631,072

$242,253

-$20,524

-$6,157

$909,085

$672,723

$80,715

Revenues

Costs

Depreciation

$155,648

$46,694

ЕBIT

Таxes

$7,905

NOPAT

$18,446

-$14,367

$108,953

$148,104

$181,649

$200,095

$242,253

$80,715

$40,385

$188,489

Depreciation

Operating cash flow

$227,885

$189,668

Initial investment

-$545,000.00

After-tax salvage value

$66,500.00

Investment in net working capital

Net cash flows

Present value of net cash flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning