daily volatility is 1%. Use the quadratic change in the portfolio value.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 14P

Related questions

Question

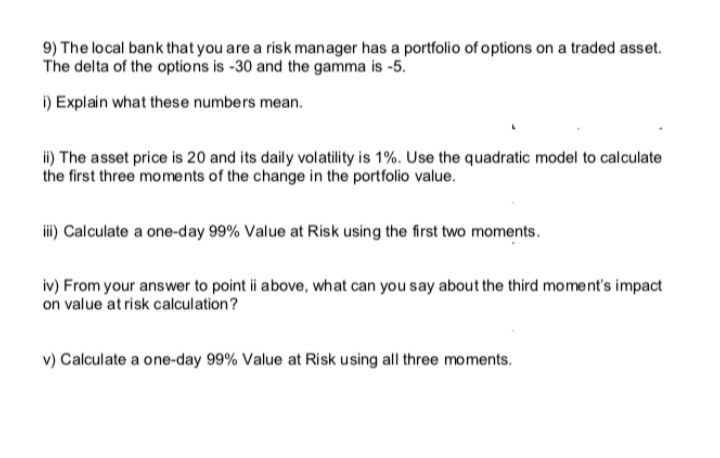

Transcribed Image Text:9) The local bank that you are a risk manager has a portfolio of options on a traded asset.

The delta of the options is -30 and the gamma is -5.

i) Explain what these numbers mean.

i) The asset price is 20 and its daily volatility is 1%. Use the quadratic model to calculate

the first three moments of the change in the portfolio value.

i) Calculate a one-day 99% Value at Risk using the first two moments.

iv) From your answer to point ii above, what can you say about the third moment's impact

on value at risk calculation?

v) Calculate a one-day 99% Value at Risk using all three moments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning