Damage None Minor Major Decision Alternative S1 S2 S3 Purchase Insurance, d, Do Not Purchase Insurance, d, Probabilities 10,000 10,000 10,000 100,000 200,000 0.96 0.03 0.01

Damage None Minor Major Decision Alternative S1 S2 S3 Purchase Insurance, d, Do Not Purchase Insurance, d, Probabilities 10,000 10,000 10,000 100,000 200,000 0.96 0.03 0.01

Chapter17: Property Transactions: §1231 And Recapture Provisions

Section: Chapter Questions

Problem 19DQ

Related questions

Question

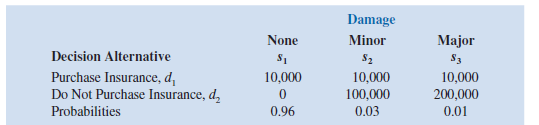

Alexander Industries is considering purchasing an insurance policy for its new office

building in St. Louis, Missouri. The policy has an annual cost of $10,000. If Alexander Industries

doesn’t purchase the insurance and minor fire damage occurs, a cost of $100,000

is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including

the state-of-nature probabilities, are as follows:

a. Using the expected value approach, what decision do you recommend?

Transcribed Image Text:Damage

None

Minor

Major

Decision Alternative

S1

S2

S3

Purchase Insurance, d,

Do Not Purchase Insurance, d,

Probabilities

10,000

10,000

10,000

100,000

200,000

0.96

0.03

0.01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning