Danks, Vernersen, and Walsh are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Danks $40,000; Vernersen, $26,000; and Walsh, $16,000. The profit-and-loss-sharing ratio has been 3:1:1 for Danks, Vernersen, and Walsh, respectively. The partnership has $65,000 cash, $42,000 non-cash assets, and $25,000 accounts payable. Read the requirements. Requirement 1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries for the sale of non-cash assets, allocation of gain distribution of remaining cash to partners. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) loss on liquidation, the payment of the outstanding liabilities, and the Journalize the sale of the non-cash assets for $49,000. Date Accounts and Explanation Debit Credit Requirements Dec. 31 1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. 2. Assuming the partnership sells the non-cash assets for $17,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. Print Done

Danks, Vernersen, and Walsh are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Danks $40,000; Vernersen, $26,000; and Walsh, $16,000. The profit-and-loss-sharing ratio has been 3:1:1 for Danks, Vernersen, and Walsh, respectively. The partnership has $65,000 cash, $42,000 non-cash assets, and $25,000 accounts payable. Read the requirements. Requirement 1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries for the sale of non-cash assets, allocation of gain distribution of remaining cash to partners. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) loss on liquidation, the payment of the outstanding liabilities, and the Journalize the sale of the non-cash assets for $49,000. Date Accounts and Explanation Debit Credit Requirements Dec. 31 1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. 2. Assuming the partnership sells the non-cash assets for $17,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the distribution of remaining cash to partners. Print Done

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

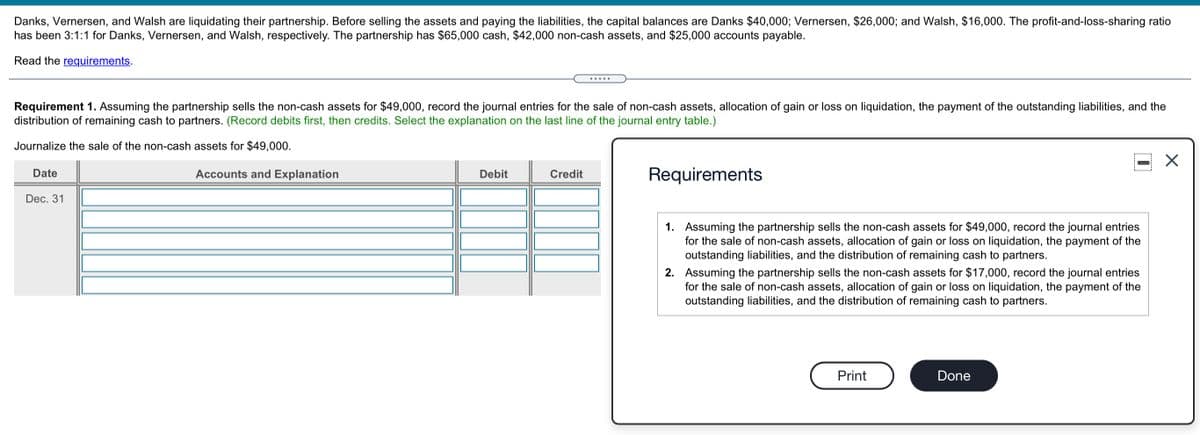

Transcribed Image Text:Danks, Vernersen, and Walsh are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Danks $40,000; Vernersen, $26,000; and Walsh, $16,000. The profit-and-loss-sharing ratio

has been 3:1:1 for Danks, Vernersen, and Walsh, respectively. The partnership has $65,000 cash, $42,000 non-cash assets, and $25,000 accounts payable.

Read the requirements.

.... .

Requirement 1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the outstanding liabilities, and the

distribution of remaining cash to partners. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Journalize the sale of the non-cash assets for $49,000.

Date

Accounts and Explanation

Requirements

Debit

Credit

Dec. 31

1. Assuming the partnership sells the non-cash assets for $49,000, record the journal entries

for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the

outstanding liabilities, and the distribution of remaining cash to partners.

2. Assuming the partnership sells the non-cash assets for $17,000, record the journal entries

for the sale of non-cash assets, allocation of gain or loss on liquidation, the payment of the

outstanding liabilities, and the distribution of remaining cash to partners.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you