Darius is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $54,000. The purchase of this equipment is expected to save his company $5,802 at the end of every year for 10 years. At the end of the 10 years, he expects the excavation equipment to have a residual (inflow) value of $20,000. The company requires a 6% rate of return. Round PV to the nearest cent. Round NPV to the nearest whole number. 1) What is the Net Present Value (NPV) of this equipment investment? Cash Inflows Cash Inflows P/Y = C/Y = N = I/Y = PV = PMT= FV = Payments (Savings) पी SA % Residual (Inflow) SA SA SA % (If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.)

Darius is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $54,000. The purchase of this equipment is expected to save his company $5,802 at the end of every year for 10 years. At the end of the 10 years, he expects the excavation equipment to have a residual (inflow) value of $20,000. The company requires a 6% rate of return. Round PV to the nearest cent. Round NPV to the nearest whole number. 1) What is the Net Present Value (NPV) of this equipment investment? Cash Inflows Cash Inflows P/Y = C/Y = N = I/Y = PV = PMT= FV = Payments (Savings) पी SA % Residual (Inflow) SA SA SA % (If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5PB: Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated...

Related questions

Question

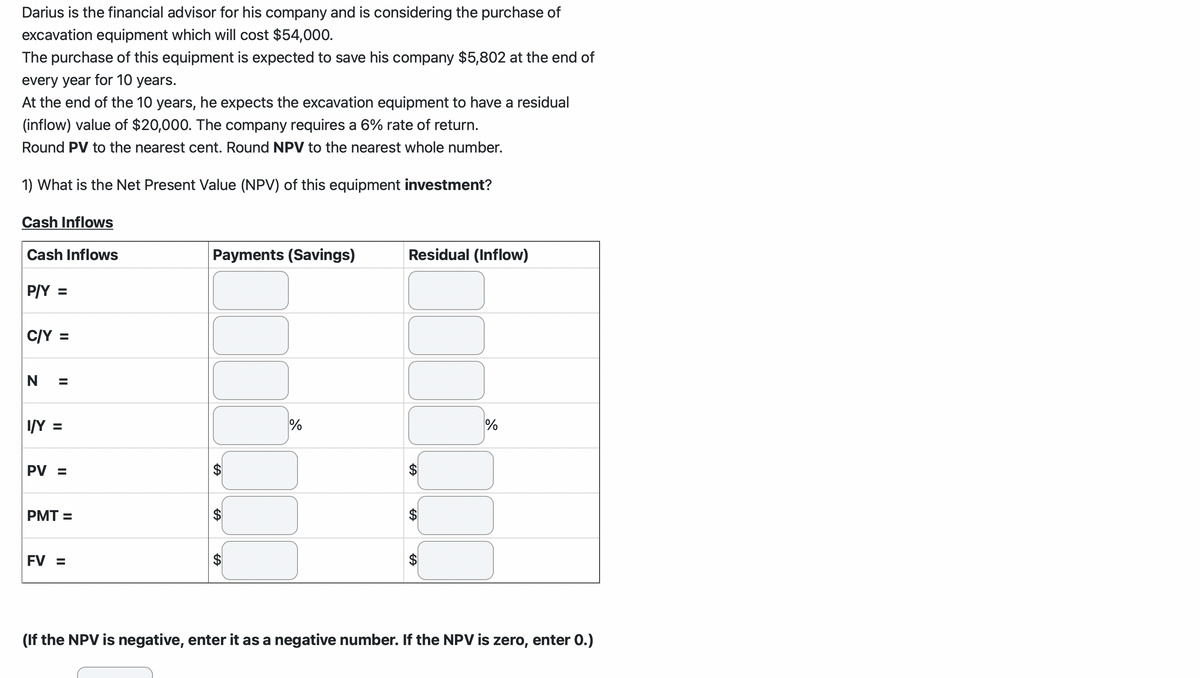

Transcribed Image Text:Darius is the financial advisor for his company and is considering the purchase of

excavation equipment which will cost $54,000.

The purchase of this equipment is expected to save his company $5,802 at the end of

every year for 10 years.

At the end of the 10 years, he expects the excavation equipment to have a residual

(inflow) value of $20,000. The company requires a 6% rate of return.

Round PV to the nearest cent. Round NPV to the nearest whole number.

1) What is the Net Present Value (NPV) of this equipment investment?

Cash Inflows

Cash Inflows

P/Y =

C/Y =

N =

I/Y =

PV =

PMT=

FV =

Payments (Savings)

A

$

$

%

Residual (Inflow)

A

GA

A

%

(If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.)

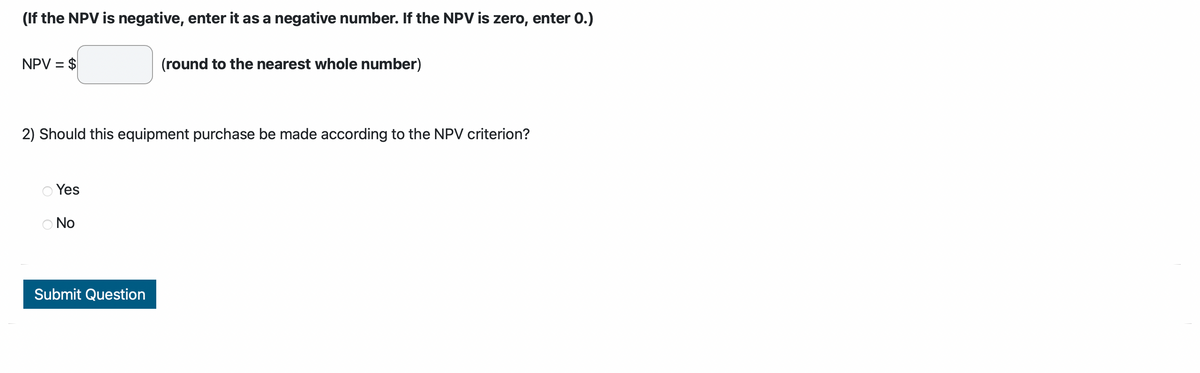

Transcribed Image Text:(If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.)

NPV = $

2) Should this equipment purchase be made according to the NPV criterion?

Yes

Ο No

(round to the nearest whole number)

Submit Question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning