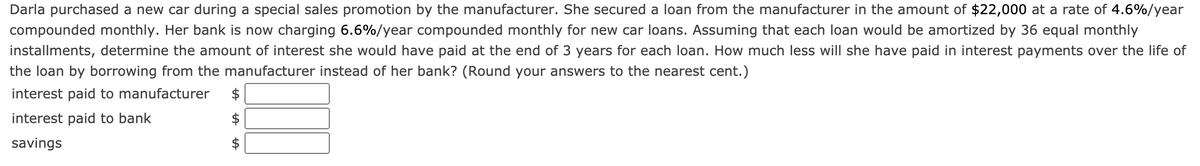

Darla purchased a new car during a special sales promotion by the manufacturer. She secured a loan from the manufacturer in the amount of $22,000 at a rate of 4.6%/year compounded monthly. Her bank is now charging 6.6%/year compounded monthly for new car loans. Assuming that each loan would be amortized by 36 equal monthly installments, determine the amount of interest she would have paid at the end of 3 years for each loan. How much less will she have paid in interest payments over the life of the loan by borrowing from the manufacturer instead of her bank? (Round your answers to the nearest cent.) interest paid to manufacturer %24 interest paid to bank savings

Darla purchased a new car during a special sales promotion by the manufacturer. She secured a loan from the manufacturer in the amount of $22,000 at a rate of 4.6%/year compounded monthly. Her bank is now charging 6.6%/year compounded monthly for new car loans. Assuming that each loan would be amortized by 36 equal monthly installments, determine the amount of interest she would have paid at the end of 3 years for each loan. How much less will she have paid in interest payments over the life of the loan by borrowing from the manufacturer instead of her bank? (Round your answers to the nearest cent.) interest paid to manufacturer %24 interest paid to bank savings

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 25PROB

Related questions

Question

100%

Transcribed Image Text:Darla purchased a new car during a special sales promotion by the manufacturer. She secured a loan from the manufacturer in the amount of $22,000 at a rate of 4.6%/year

compounded monthly. Her bank is now charging 6.6%/year compounded monthly for new car loans. Assuming that each loan would be amortized by 36 equal monthly

installments, determine the amount of interest she would have paid at the end of 3 years for each loan. How much less will she have paid in interest payments over the life of

the loan by borrowing from the manufacturer instead of her bank? (Round your answers to the nearest cent.)

interest paid to manufacturer

interest paid to bank

savings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning