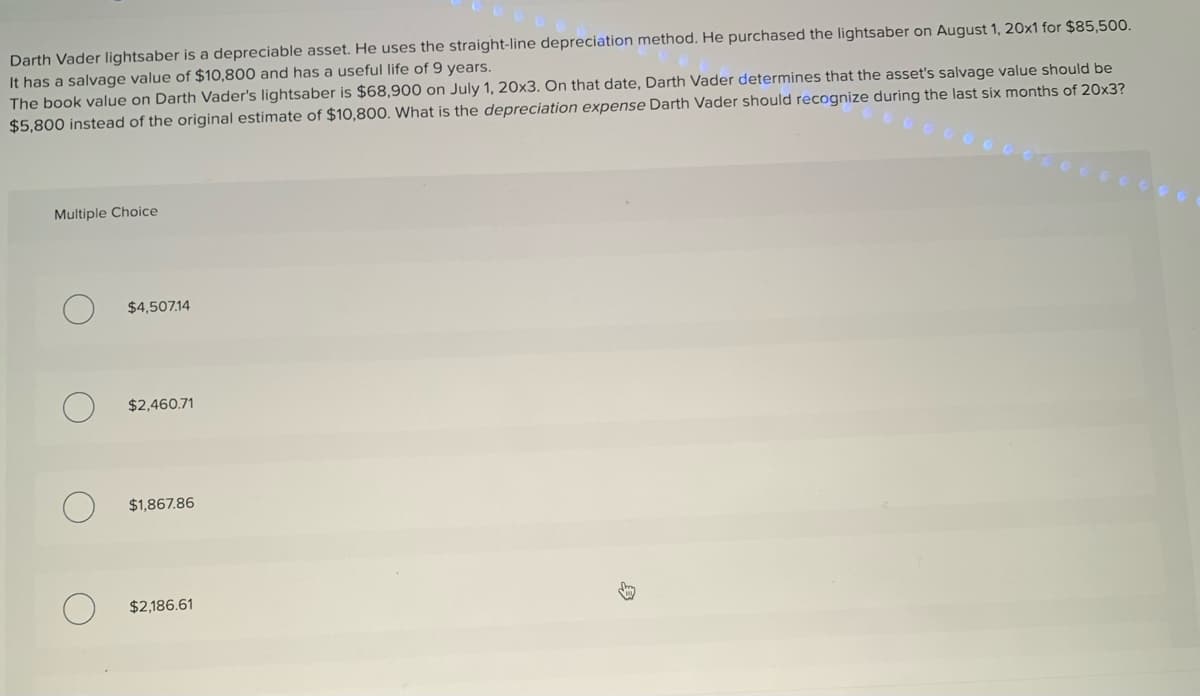

Darth Vader lightsaber is a depreciable asset. He uses the straight-line depreciation method. He purchased the lightsaber on August 1, 20x1 for $85,500. It has a salvage value of $10,800 and has a useful life of 9 years. The book value on Darth Vader's lightsaber is $68,900 on July 1, 20x3. On that date, Darth Vader determines that the asset's salvage value should be $5,800 instead of the original estimate of $10,800. What is the depreciation expense Darth Vader should recognize during the last six months of 20x3? Multiple Choice $4,507.14 $2,460.71 $1,867.86

Darth Vader lightsaber is a depreciable asset. He uses the straight-line depreciation method. He purchased the lightsaber on August 1, 20x1 for $85,500. It has a salvage value of $10,800 and has a useful life of 9 years. The book value on Darth Vader's lightsaber is $68,900 on July 1, 20x3. On that date, Darth Vader determines that the asset's salvage value should be $5,800 instead of the original estimate of $10,800. What is the depreciation expense Darth Vader should recognize during the last six months of 20x3? Multiple Choice $4,507.14 $2,460.71 $1,867.86

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 1AFE

Related questions

Question

Transcribed Image Text:Darth Vader lightsaber is a depreciable asset. He uses the straight-line depreciation method. He purchased the lightsaber on August 1, 20x1 for $85,500.

It has a salvage value of $10,800 and has a useful life of 9 years.

The book value on Darth Vader's lightsaber is $68,900 on July 1, 20x3. On that date, Darth Vader determines that the asset's salvage value should be

$5,800 instead of the original estimate of $10,800. What is the depreciation expense Darth Vader should recognize during the last six months of 20x3?

Multiple Choice

$4,507.14

$2,460.71

$1,867.86

$2,186.61

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning