Triad Children's Center (TCC), a non-profit organization, uses relevant cost analysis to determine whether new services are desirable. TCC is looking at adding a new educational program for grade school children who are having difficulty with their reading and math skills. The following relevant costs are expected if the program is accepted: Costs (per year) Program Director salary Part-time Assistants Variable cost per child $ 49,000 $ 27,000 $1,200 TCC estimates that a maximum of 40 children will participate in this program in the first year. If TCC decides to implement this program, funding will be received from the City Chamber of Commerce ($48,000) and a local Private University Endowment Fund ($30,000). Calculate the expected surplus or deficit from operations given the above information.

Triad Children's Center (TCC), a non-profit organization, uses relevant cost analysis to determine whether new services are desirable. TCC is looking at adding a new educational program for grade school children who are having difficulty with their reading and math skills. The following relevant costs are expected if the program is accepted: Costs (per year) Program Director salary Part-time Assistants Variable cost per child $ 49,000 $ 27,000 $1,200 TCC estimates that a maximum of 40 children will participate in this program in the first year. If TCC decides to implement this program, funding will be received from the City Chamber of Commerce ($48,000) and a local Private University Endowment Fund ($30,000). Calculate the expected surplus or deficit from operations given the above information.

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 71P

Related questions

Question

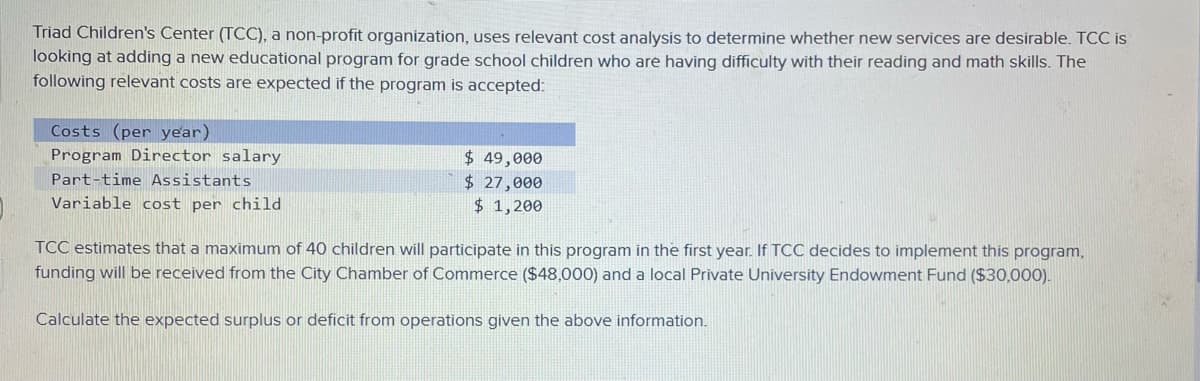

Triad Children's Center(TCC), a non-profit organization, uses relevant cost analysis to determine whether new services are desirable. TCC is looking at adding a new education program for grade school children who are having difficulty with the reading and math skills. The following relevant cost are expected if the program is accepted:

Transcribed Image Text:Triad Children's Center (TCC), a non-profit organization, uses relevant cost analysis to determine whether new services are desirable. TCC is

looking at adding a new educational program for grade school children who are having difficulty with their reading and math skills. The

following relevant costs are expected if the program is accepted:

Costs (per year)

Program Director salary

Part-time Assistants

Variable cost per child

$ 49,000

$ 27,000

$ 1,200

TCC estimates that a maximum of 40 children will participate in this program in the first year. If TCC decides to implement this program,

funding will be received from the City Chamber of Commerce ($48,000) and a local Private University Endowment Fund ($30,000).

Calculate the expected surplus or deficit from operations given the above information.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning