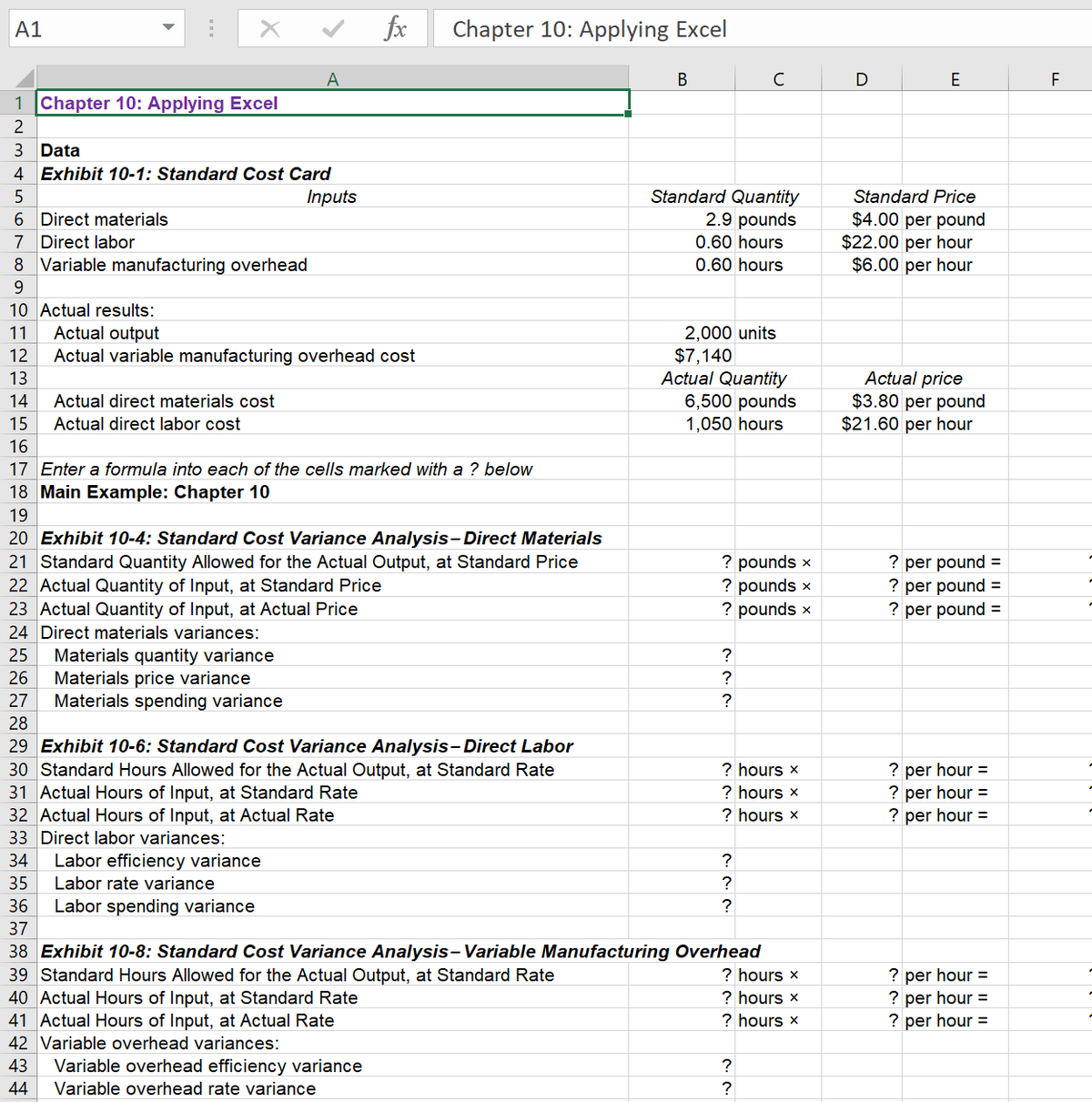

Data Exhibit 10-1: Standard Cost Card Standard Quantity 2.9 pounds Inputs Standard Price $4.00 per pound $22.00 per hour $6.00 per hour Direct materials Direct labor 0.60 hours Variable manufacturing overhead 0.60 hours Actual results: Actual output Actual variable manufacturing overhead cost 2,000 units $7,140 Actual Quantity 6,500 pounds 1,050 hours Actual price $3.80 per pound $21.60 per hour Actual direct materials cost Actual direct labor cost Enter a formula into each of the cells marked with a ? below Main Example: Chapter 10 Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials Standard Quantity Allowed for the Actual Output, at Standard Price Actual Quantity of Input, at Standard Price Actual Quantity of Input, at Actual Price Direct materials variances: ? pounds × ? pounds x ? pounds x ? per pound = ? per pound = ? per pound = Materials quantity variance Materials price variance Materials spending variance ? Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor Standard Hours Allowed for the Actual Output, at Standard Rate Actual Hours of Input, at Standard Rate Actual Hours of Input, at Actual Rate ? per hour = ? per hour = ? per hour = ? hours x ? hours x ? hours x Direct labor variances: Labor efficiency variance ? Labor rate variance ? Labor spending variance ? Exhibit 10-8: Standard Cost Variance Analysis- Variable Manufacturing Overhead Standard Hours Allowed for the Actual Output, at Standard Rate Actual Hours of Input, at Standard Rate ? per hour = ? per hour = ? per hour = ? hours x ? hours x Actual Hours of Input, at Actual Rate Variable overhead variances: ? hours x Variable overhead efficiency variance ? Variable overhead rate variance ?

Data Exhibit 10-1: Standard Cost Card Standard Quantity 2.9 pounds Inputs Standard Price $4.00 per pound $22.00 per hour $6.00 per hour Direct materials Direct labor 0.60 hours Variable manufacturing overhead 0.60 hours Actual results: Actual output Actual variable manufacturing overhead cost 2,000 units $7,140 Actual Quantity 6,500 pounds 1,050 hours Actual price $3.80 per pound $21.60 per hour Actual direct materials cost Actual direct labor cost Enter a formula into each of the cells marked with a ? below Main Example: Chapter 10 Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials Standard Quantity Allowed for the Actual Output, at Standard Price Actual Quantity of Input, at Standard Price Actual Quantity of Input, at Actual Price Direct materials variances: ? pounds × ? pounds x ? pounds x ? per pound = ? per pound = ? per pound = Materials quantity variance Materials price variance Materials spending variance ? Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor Standard Hours Allowed for the Actual Output, at Standard Rate Actual Hours of Input, at Standard Rate Actual Hours of Input, at Actual Rate ? per hour = ? per hour = ? per hour = ? hours x ? hours x ? hours x Direct labor variances: Labor efficiency variance ? Labor rate variance ? Labor spending variance ? Exhibit 10-8: Standard Cost Variance Analysis- Variable Manufacturing Overhead Standard Hours Allowed for the Actual Output, at Standard Rate Actual Hours of Input, at Standard Rate ? per hour = ? per hour = ? per hour = ? hours x ? hours x Actual Hours of Input, at Actual Rate Variable overhead variances: ? hours x Variable overhead efficiency variance ? Variable overhead rate variance ?

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter15: Integrated Production Processes (ipps)

Section: Chapter Questions

Problem 3P

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

100%

Transcribed Image Text:A1

fr

Chapter 10: Applying Excel

A

В

D

E

F

1 Chapter 10: Applying Excel

3 Data

4 Exhibit 10-1: Standard Cost Card

Standard Quantity

2.9 pounds

5

Inputs

Standard Price

6 Direct materials

7 Direct labor

8 Variable manufacturing overhead

$4.00 per pound

$22.00 per hour

$6.00 per hour

0.60 hours

0.60 hours

9.

10 Actual results:

Actual output

Actual variable manufacturing overhead cost

13

2,000 units

$7,140

Actual Quantity

6,500 pounds

11

12

Actual price

$3.80 per pound

$21.60 per hour

14

Actual direct materials cost

15

Actual direct labor cost

1,050 hours

16

17 Enter a formula into each of the cells marked with a ? below

18 Main Example: Chapter 10

19

20 Exhibit 10-4: Standard Cost Variance Analysis- Direct Materials

21 Standard Quantity Allowed for the Actual Output, at Standard Price

22 Actual Quantity of Input, at Standard Price

23 Actual Quantity of Input, at Actual Price

24 Direct materials variances:

? pounds x

? pounds x

? pounds x

? per pound =

? per pound =

? per pound =

25

Materials quantity variance

Materials price variance

Materials spending variance

26

?

27

28

29 Exhibit 10-6: Standard Cost Variance Analysis- Direct Labor

? hours x

? hours x

? hours x

? per hour =

? per hour =

? per hour =

30 Standard Hours Allowed for the Actual Output, at Standard Rate

31 Actual Hours of Input, at Standard Rate

32 Actual Hours of Input, at Actual Rate

33 Direct labor variances:

34

Labor efficiency variance

Labor rate variance

?

35

?

36

Labor spending variance

37

38 Exhibit 10-8: Standard Cost Variance Analysis- Variable Manufacturing Overhead

? hours x

? hours x

? hours x

? per hour =

? per hour =

? per hour =

39 Standard Hours Allowed for the Actual Output, at Standard Rate

40 Actual Hours of Input, at Standard Rate

41 Actual Hours of Input, at Actual Rate

42 Variable overhead variances:

43

Variable overhead efficiency variance

?

44

Variable overhead rate variance

?

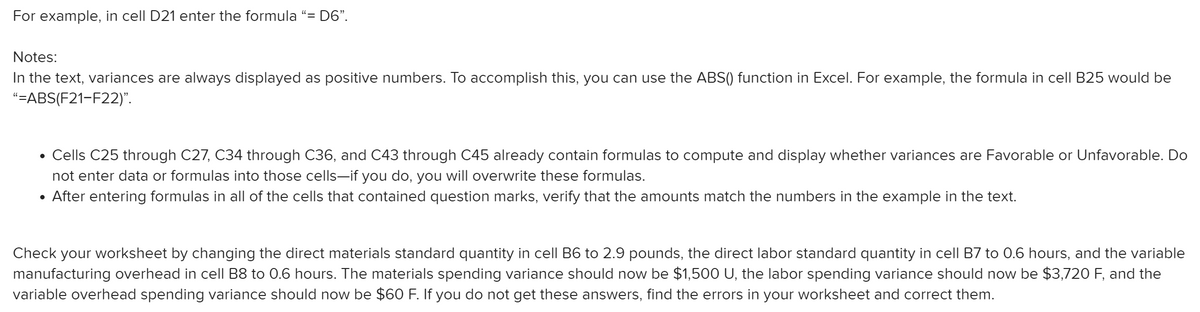

Transcribed Image Text:For example, in cell D21 enter the formula “= D6".

Notes:

In the text, variances are always displayed as positive numbers. To accomplish this, you can use the ABS() function in Excel. For example, the formula in cell B25 would be

"=ABS(F21-F22)".

Cells C25 through C27, C34 through C36, and C43 through C45 already contain formulas to compute and display whether variances are Favorable or Unfavorable. Do

not enter data or formulas into those cells-if you do, you will overwrite these formulas.

After entering formulas in all of the cells that contained question marks, verify that the amounts match the numbers in the example in the text.

Check your worksheet by changing the direct materials standard quantity in cell B6 to 2.9 pounds, the direct labor standard quantity in cell B7 to 0.6 hours, and the variable

manufacturing overhead in cell B8 to 0.6 hours. The materials spending variance should now be $1,500 U, the labor spending variance should now be $3,720 F, and the

variable overhead spending variance should now be $60 F. If you do not get these answers, find the errors in your worksheet and correct them.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning