data related to Shunda Enterprises Inc.'s factory overhead cost for the production of 40,000 units of product are as follows: ual: Variable factory overhead $138,900 Fixed factory overhead 101,000 ndard: 61,000 hrs. at $4.00 ($2.30 for variable factory overhead) 244,000 đuctive capacity at 100% of normal was 59,900 hours, and the factory overhead cost budgeted at the level of 61,000 standard hours was $242,500. Based on these data, the chief cost accountant prepared the following variance analysis: iable factory overhead controllable variance: actual variable factory overhead cost incurred $138,900 Budgeted variable factory overhead for 61,000 hours 140,300 Variance-favorable $(1,400) ed factory overhead volume variance: Normal productive capacity at 100% 59,900 hrs. Standard for amount produced 61,000 Productive capacity not used 1,100 hrs. Standard variable factory overhead rate x $4.00 Variance-unfavorable 4,400 al factory overhead cost variance-unfavorable $3,000 mpute the following to assist you in identifying the errors in the factory overhead cost variance analysis. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your inter putations to the nearest cent, if required. riance Favorable/Unfavorable Amount iable Factory Overhead Controllable Variance -1,400 Favorable ed Factory Overhead Volume Variance Favorable al Factory Overhead Cost Variance 3,000 Favorable

data related to Shunda Enterprises Inc.'s factory overhead cost for the production of 40,000 units of product are as follows: ual: Variable factory overhead $138,900 Fixed factory overhead 101,000 ndard: 61,000 hrs. at $4.00 ($2.30 for variable factory overhead) 244,000 đuctive capacity at 100% of normal was 59,900 hours, and the factory overhead cost budgeted at the level of 61,000 standard hours was $242,500. Based on these data, the chief cost accountant prepared the following variance analysis: iable factory overhead controllable variance: actual variable factory overhead cost incurred $138,900 Budgeted variable factory overhead for 61,000 hours 140,300 Variance-favorable $(1,400) ed factory overhead volume variance: Normal productive capacity at 100% 59,900 hrs. Standard for amount produced 61,000 Productive capacity not used 1,100 hrs. Standard variable factory overhead rate x $4.00 Variance-unfavorable 4,400 al factory overhead cost variance-unfavorable $3,000 mpute the following to assist you in identifying the errors in the factory overhead cost variance analysis. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your inter putations to the nearest cent, if required. riance Favorable/Unfavorable Amount iable Factory Overhead Controllable Variance -1,400 Favorable ed Factory Overhead Volume Variance Favorable al Factory Overhead Cost Variance 3,000 Favorable

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 15E: Factory overhead cost variances The following data relate to factory overhead cost for the...

Related questions

Question

.

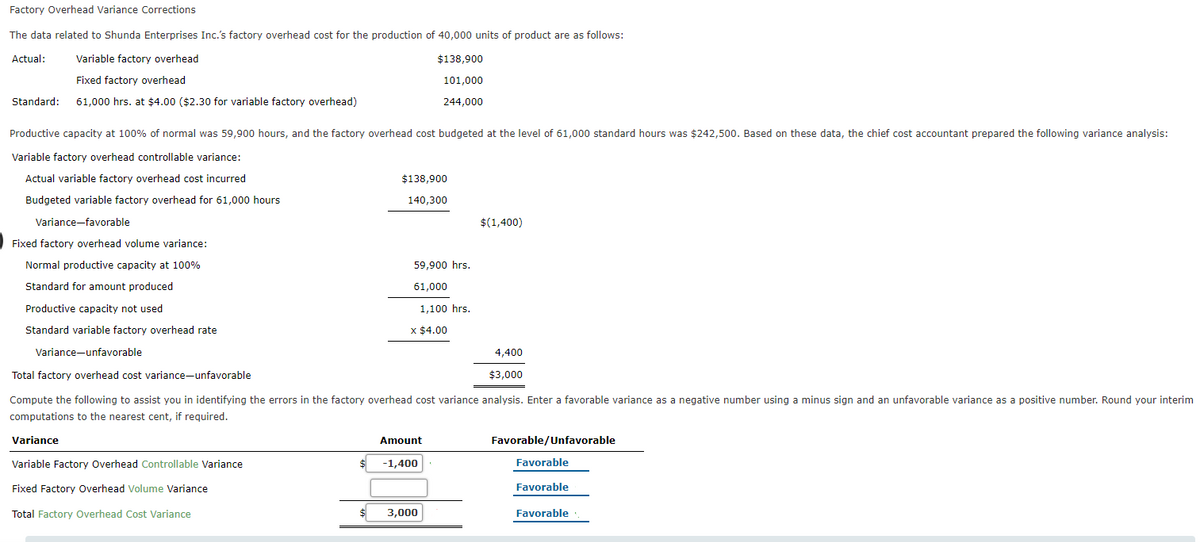

Transcribed Image Text:Factory Overhead Variance Corrections

The data related to Shunda Enterprises Inc.'s factory overhead cost for the production of 40,000 units of product are as follows:

Actual:

Variable factory overhead

$138,900

Fixed factory overhead

101,000

Standard:

61,000 hrs. at $4.00 ($2.30 for variable factory overhead)

244,000

Productive capacity at 100% of normal was 59,900 hours, and the factory overhead cost budgeted at the level of 61,000 standard hours was $242,500. Based on these data, the chief cost accountant prepared the following variance analysis:

Variable factory overhead controllable variance:

Actual variable factory overhead cost incurred

$138,900

Budgeted variable factory overhead for 61,000 hours

140,300

Variance-favorable

$(1,400)

Fixed factory overhead volume variance:

Normal productive capacity at 100%

59,900 hrs.

Standard for amount produced

61,000

Productive capacity not used

1,100 hrs.

Standard variable factory overhead rate

x $4.00

Variance-unfavorable

4,400

Total factory overhead cost variance-unfavorable

$3,000

Compute the following to assist you in identifying the errors in the factory overhead cost variance analysis. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your interim

computations to the nearest cent, if required.

Variance

Amount

Favorable/Unfavorable

Variable Factory Overhead Controllable Variance

-1,400

Favorable

Fixed Factory Overhead Volume Variance

Favorable

Total Factory Overhead Cost Variance

3,000

Favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College