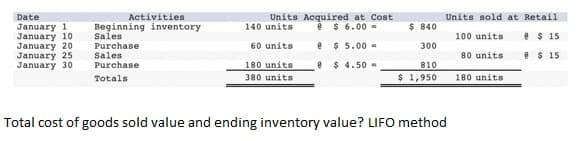

Date Activities Units Acquired at Cost e$ 6.00 - Unita sold at Retail $ 840 Beginning inventory Sales Purchase Sales 140 units January 1 January 10 January 20 January 25 January 30 100 units e$ 15 60 units e $ 5.00 - 300 80 units e$ 15 180 unita 380 units Purchane e$ 4.50 B10 $1,950 180 units Totals Total cost of goods sold value and ending inventory value? LIFO method

Q: Using the lower of cost or market, what should the total inventory value be for the following items:…

A: inventory management is considered to be an important part for business. The inventory in accounting…

Q: Preferred shares, $4.55 non-cumulative, 52,000 shares authorized and issued* $ 3,328,000…

A: Cumulative Preference Shares: In the case of missing dividend payments in the past, cumulative…

Q: Internal balances Multiple Choice Represent activity between the governmental funds and enterprise…

A: The internal balance can be defined as the situation where real output is equal to or near its…

Q: The management accountant at Genus Manufacturing Company, Karen Cranston, is in the process of…

A: The question is related to Budgetary control. The details are given.

Q: 12/31/2018 12/31/2019 Accounts payable $2,500 $6,400 Accounts receivable 3,500 8,500 Cash 4,700…

A: Formulas: Working Capital = Total Current assets - Total Current liabilities Current ratio = Total…

Q: An installment note payable for a principal amount of $48,000 at 6% interest requires Lawson Company…

A: preparation of an amortization table amount borrowed = 48,000 rate of interest = 6%annually annual…

Q: On January 1, 2022 Hideki Matsuyama provides services in exchange for a $10,000 zero-interest…

A: Solution: Present value of note on Jan 1, 2022 = $10,000 * PV of 1 at 15% for 4 periods = $10,000 *…

Q: Consider a poor country with an under-developed economy which could invest trillions into…

A: different country in the world have different level of economy according to their level of GDP and…

Q: company audio division produces a speaker that is used by manufactureers of various audio products…

A: Transfer price is the price charged when one segment of a company provides goods and services to…

Q: $125,000. The book values and fair values of except for buildings and equipment, which were worth…

A: Elimination entries are defined as those entries that re recorded to present the account balances of…

Q: The following figures have been extracted from the department P of Q Ltd. Direct material used $…

A: Overhead allocation is based on a predetermined overhead rate. It can be on the basis of the…

Q: M10-6 (Algo) Recording Notes Payable [LO 10-2] Part 2 Skip to question [The following information…

A: Solution:- Preparation of the journal entries related for the above transactions as follows under:

Q: Prepare Job-Order Cost Sheets, Predetermined OverheadRate, Ending Balance of WIP, Finished Goods,…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Flora Inc. reported the following information: Net income: $640,000 Depreciation expense: $79,000…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements.…

Q: ten empty packs returned to Brownie, customer will receive an attractive food container. The company…

A: Estimated liability (EL) refers to the obligation against which there is no definitive amount but…

Q: The manager of a division that produces add-on products for the automobile industry has just been…

A: Answer - First three subparts are solved here. Part 1 - Computation of the ROI for each…

Q: From the French Instrument Corporation second-quarter report ended 2018, do a vertical analysis for…

A: Vertical analysis: It implies to a method of analyzing or evaluating the financial statements of a…

Q: Gentleness Company issued P5,000,000 10% bonds on January 1, 2017 with a tenor of 10 years. Interest…

A: You have posted multiple parts, so as per Bartleby policy only the first three parts are answered.…

Q: Table 1. Raw Data COUNTRY Number of Number of Workers Workers needed to needed to produce 1,000…

A: international trade, that takes place in whole world across the border of the country this trade…

Q: Unit v question 15

A: Journal entry is a process of recording and classifying business transactions into books of accounts…

Q: What is Sales Mix and why is it used in retail operations?

A: Sales mix is the proportion of each product sold by a company as a percentage of its total sales.…

Q: E12.1B (L0 1,2) (Classification Issues—Intangibles) Presented below is a list of items that could be…

A: Intangible assets are assets that do not have physical appearance. Financial statements include…

Q: On July 31, 202O, Teal Company engaged Minsk Tooling Company to construct a special-purpose piece of…

A: The question is based on the concept of Financial Accounting.

Q: For the calculation of weighted average number of shares where does the (4) come from when you are…

A: The number of shares will be given weight as per the number of period they have been remained…

Q: Brian Company provided the following selected account balances on December 31. 2021 Cash P60,000…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity. The…

Q: The following example illustrates how traditional cost accounting techniques could result in a…

A: Traditional costing: Under traditional costing The cost is allocated on a single basis say direct…

Q: 1. What is the total effect of the errors on the 2020 net income?

A: As per our protocol we provide solution to the one question only but you have asked three multiple…

Q: Question 2 please see the following financial information for Company A and B respectively.…

A: ROE = Return on equity Return on equity is a measure of company's profitability (Net income) with…

Q: Unit VI question 7

A: Break-even point in units = Total fixed costs / (Unit selling price - Variable cost per unit)…

Q: During 2019, Latte Inc., spent P5,000,000 developing its new "Hyperion" software package. Of this…

A: The question is related to Accounting for Intangible Assets. In developing an Intangible Assets…

Q: Which of the following statements is incorrect? For each business combination, one of the combining…

A: In this question, we will explain that which of the following statement is incorrect.

Q: When the cost of capital is jı = 10%, the two machines have the same capitalized cost. What is the…

A: Machine A Machine B Overall Cost $C $C Scrap Value $0 $5000 Lifetime 10 years 8 years…

Q: Beagle Corporation has 28,000 shares of $10 par common stock outstanding and 15,000 shares of $100…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,900 cases of Oktoberfest style…

A: Given: It is purchased 1,900 cases of Oktoberfest-style beer from a German supplier for 570,000…

Q: come Statement accounts are closed at which stage of the accounting process? Multiple Cholce At the…

A: Solution: Income statements accounts are temporary accounts that are closed to income statement at…

Q: Kitt Company borrows $800,000 from Neville Capital by issuing an 8-year (96-month), 12% note…

A: GIVEN Kitt Company borrows $800,000 from Neville Capital by issuing an 8-year (96-month), 12% note…

Q: Provide the missing data in the following table for a distributor of martial arts products: (Enter…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: On April 1, 2017, the directors of ABC Ltd issued 1,00,000 equity shares of BDT 10 each at BDT 12…

A: given On April 1, 2017, the directors of ABC Ltd issued 1,00,000 equity shares of BDT 10 each at…

Q: ,000)$, its e: vage value is

A: Explanation - 1. Depreciation Expenses - This is an expense booked on the income statement debit…

Q: The amount available under the line of credit is Prepare the appropriate journal entries through th-…

A: A journal entry is an accounting entry that is used to document a business transaction in the…

Q: following items are reported on a company's balance sheet: $365,600 rketable securities 285,700…

A: The current ratio is a liquidity ratio that evaluates a company's ability to pay one-year or…

Q: May Made cash sales of $6,300; the cost of the inventory was $3,700. 1 5 Purchased $2,000 of…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: You discovered the following errors in connection with your examination of the financial statements…

A: Non-Counterbalancing errors are those errors that do not get adjusted with the next year's figures…

Q: Teslum Inc. has a number of divisions, including the Machina Division, a producer of…

A: Transfer pricing is a tax and accounting approach that allows businesses to price transactions both…

Q: orth Company ,000 for P1,000,00 00 and signed a r :eh is

A: Accounts Payable: Accounts payable is recognized in the accounting books of a company to indicate…

Q: How much must Deon pay in income tax for last year?

A: Tax refers to the amount charged by the government on individuals, partnership firms, HUF’s or any…

Q: Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $30,000 $29,200 Inventory 75,800 76,500 Accounts…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements.…

Q: What is a financial assets held for trading?It is measurement still applicable? explain

A: Meaning of Financial assets held for trading: A financial asset is held for trading if the entity…

Q: David is interested in a rental apartment that would supply him with $60,000 at the end of year 1,…

A: The amount that David should pay for this investment should be equal to the NPV of all cash flows.…

Q: Compute the standard cost of the ingredients for one gallon of the nutrition drink. (Round…

A: Actual Input Material Required for 100 Gallon Batch Price ounce of lime kool drink 2000 $…

Step by step

Solved in 2 steps with 1 images

- Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 110 units @ $51.20 per unit March 5 Purchase 230 units @ $56.20 per unit March 9 Sales 270 units @ $86.20 per unit March 18 Purchase 90 units @ $61.20 per unit March 25 Purchase 160 units @ $63.20 per unit March 29 Sales 140 units @ $96.20 per unit Totals 590 units 410 units rev: 05_26_2021_QC_CS-265380, 07_10_2021_QC_CDR-376 Required:1. Compute cost of goods available for sale and the number of units available for sale.Entity A has a beginning inventory of ₱280,000. During the period Entity A purchased inventories costing ₱890,000. Freight paid on the purchase totaled ₱30,000. If the ending inventory is ₱220,000, how much is the cost of goods sold? 980,000920,000950,0001,360,000BeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofgoods sold $81,000 $111,000 $ (a) $ (b) $121,000 $50,000 $ (c) $115,000 $34,000 $ (d) $ (e) $101,000 $161,000

- An item of inventory was purchased by company X for £500. Company X expects to sell the inventory for£700 and has to date incurred conversion costs of £130. A further £60 is expected to be incurred. Salesstaff will receive a commission of 4% from the sale.Compute the value at which this inventory item will be measured in company X’s statement of financialposition.May Company has ending finished goods inventory of P40,000.00, beginning finished goods inventory P55,000.00 and cost of goods manufactured of P120,000.00. What is the cost of goods sold of May Company? P 105,000.00 P 135,000.00 P 140,000.00 P 120,000.00Chicago Company has two products in the inventory. Selling price 2,000,000 3,000,000 Materials and conversion costs 1,500,000 1,800,000 General administration costs 300,000 800,000 Estimated selling costs 600,000 700,000 Required:a. What amount should be reported as inventory using the LCNRV individual approach?b. What amount should be reported as inventory using the LCNRV total approach?

- Given the following: Numberpurchased Costper unit Total January 1 inventory 39 $ 5 $ 195 April 1 59 8 472 June 1 49 9 441 November 1 54 10 540 201 $ 1,648 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 60 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 60 units).The products of ABC can be grouped into two major categories: products A1 and A2 are in Category A, while products B1 and B2 are in category B. Assume the following information regarding ABC's inventories for year 2021: Product A1 Transaction Number of Units Unit Cost Unit Price Beginning inventory 400 €5 Purchase No. 1 400 €5 Sale No.1 600 €10 Sale No.2 100 €12 Purchase No. 2 1,000 €7 Sale No.3 700 €10 Purchase No. 3 1,000 €7 Sale No.4 600 €15 Sale No.5 600 €15 Purchase No. 4 1,200 €9 Selling price as at December 31, 2021 €14 Product A2 Transaction Beginning inventory Number of Units 500 Unit Cost €8 Unit Price Sale No.1 400 €12 Purchase No. 1 600 €8 Purchase No. 2 500 €7 Sale No.2 650 €12 Purchase No. 3 150 €9 Purchase No. 4 200 €8 Selling priceas at December 31, €11 2021…Extreme Company shows the following information:Units Unit cost Total costJanuary 1 Beginning 10,000 40 400,00031 Sale 5,000April 1 Purchase 15,000 50 750,000July 31 Sale 18,000October 1 Purchase 25,000 60 1,500,000December 31 Sale 12,000Required:Compute the cost of the ending inventory and cost of sales using:1. FIFO – periodic2. Weighted average3. Moving average

- 22.Presented below is the list of inventory items of ABC Corp at Dec 31, 20X1:a. Goods sold on installment basis, P100,000 b. Goods in transit sold at FOB shipping point, P120,000c. Freight charges on goods purchased, P50,000d. Freight charges on goods sold, P46,000e. Raw materials purchased, P60,000f. Goods in transit purchased at FOB shipping point, P34,000g. Raw materials placed in the production, P45,000h. Unsold finished goods in the warehouse and store, P80,000 How much cost of goods would be usually reported as inventory?489,000369,000269,000186,000E8.12 (LO 3) (FIFO, LIFO, Average-Cost Inventory) Shania Twain Company was formed onDecember 1, 2019. The following information is available from Twain’s inventory records for Product BAP. Units Unit CostJanuary 1, 2020 (beginning inventory) 600 $ 8.00Purchases:January 5, 2020 1,200 9.00January 25, 2020 1,300 10.00February 16, 2020 800 11.00March 26, 2020 600 12.00 A physical inventory on March 31, 2020, shows 1,600 units on hand.InstructionsPrepare schedules to compute the ending inventory at March 31, 2020, under each of the following inventory methods.a. FIFO b. LIFO. c. Weighted-average (round unit costs to two decimal places)Anna Company included the following items in its ending inventory: Merchandise out on consignment, at sales price, Including 40% markup on selling price P500,000 Goods purchased in transit, FOB shipping point 300,000 Goods held on consignment by Anna Company 400,000 By what amount should ending inventory be reduced? Choices: P900,000 P600,000 P1,200,000 P400,000