date the book at the time of values except c Inventory Land Equipment The remaining useful life. Durin P100,000. What sophisticated ex P 42,00 b. P 70,00 2. The equipment depreciation of P320,000 at the what is the works a. a. P20,000 de b. P20,000 cre 73. The equipment depreciation of the

date the book at the time of values except c Inventory Land Equipment The remaining useful life. Durin P100,000. What sophisticated ex P 42,00 b. P 70,00 2. The equipment depreciation of P320,000 at the what is the works a. a. P20,000 de b. P20,000 cre 73. The equipment depreciation of the

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Subject: AFAR

Transcribed Image Text:P72,000.

b.

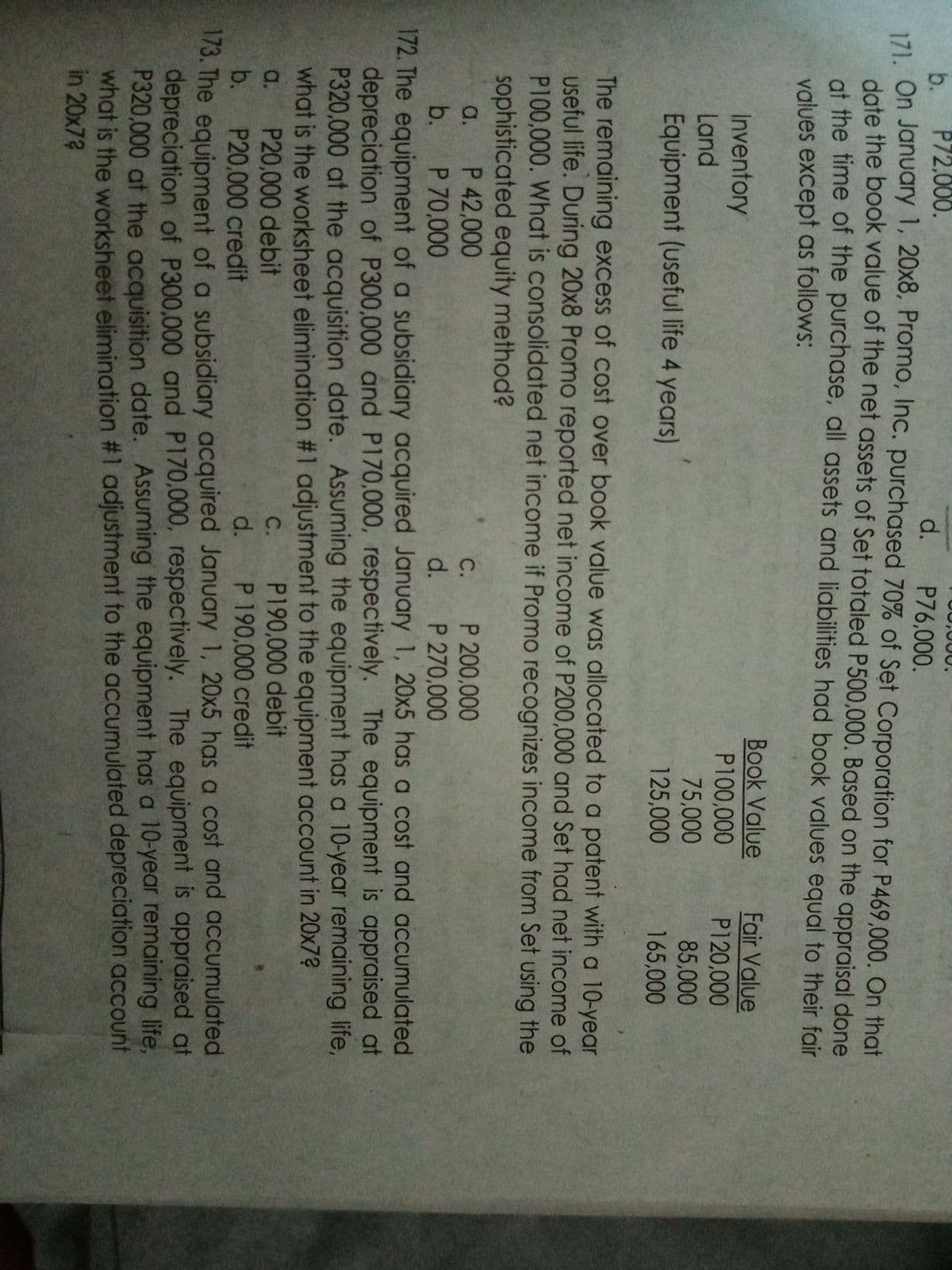

171 On January 1, 20x8, Promo, Inc. purchased 70% of Set Corporation for P469,000. On that

date the book value of the net assets of Set totaled P500,000. Based on the appraisal done

at the time of the purchase, all assets and liabilities had book values equal to their fair

d.

P76,000.

values except as follows:

Book Value

Fair Value

Inventory

Land

P100,000

P120,000

Equipment (useful life 4 years)

75,000

125,000

85,000

165,000

The remaining excess of cost over book value was allocated to a patent with a 10-year

useful life. During 20x8 Promo reported net income of P200,000 and Set had net income of

P100,000. What is consolidated net income if Promo recognizes income from Set using the

sophisticated equity method?

P 42,000

P 70,000

P 200,000

P 270,000

a.

C.

b.

d.

172. The equipment of a subsidiary acquired January 1, 20x5 has a cost and accumulated

depreciation of P300,000 and P170,000, respectively. The equipment is appraised at

P320,000 at the acquisition date. Assuming the equipment has a 10-year remaining life,

what is the worksheet elimination #1 adjustment to the equipment account in 20x7?

a. P20,000 debit

b. P20,000 credit

С.

P190,000 debit

d. P 190,000 credit

173. The equipment of a subsidiary acquired January 1, 20x5 has a cost and accumulated

depreciation of P300,000 and P170,000, respectively. The equipment is appraised at

P320,000 at the acquisition date. Assuming the equipment has a 10-year remaining life,

what is the worksheet elimination #1 adjustment to the accumulated depreciation account

in 20x7?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning