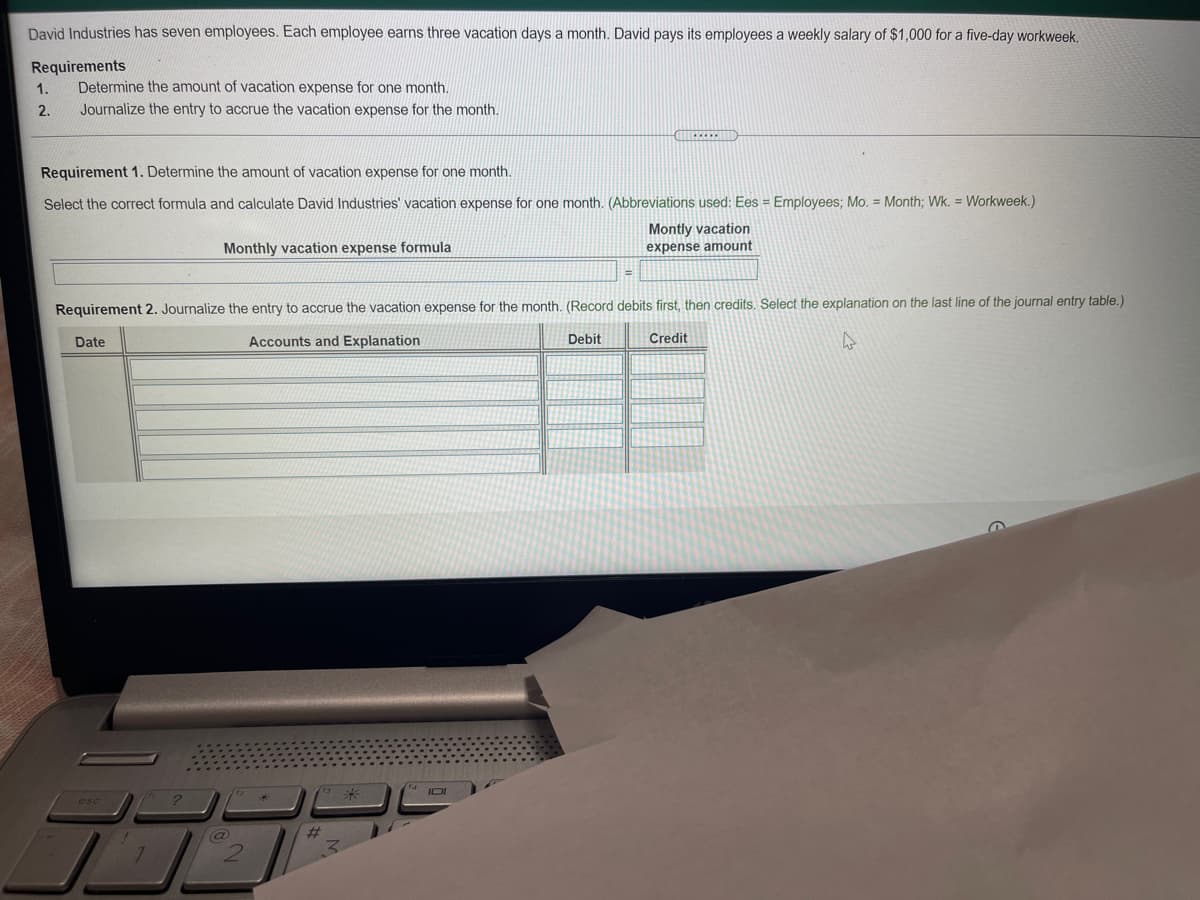

David Industries has seven employees. Each employee earns three vacation days a month. David pays its employees a weekly salary of $1,000 for a five-day workweek. Requirements 1. Determine the amount of vacation expense for one month. 2. Journalize the entry to accrue the vacation expense for the month. Requirement 1. Determine the amount of vacation expense for one month. Select the correct formula and calculate David Industries' vacation expense for one month. (Abbreviations used: Ees = Employees; Mo. = Month; Wk. = Workweek.) Montly vacation Monthly vacation expense formula expense amount Requirement 2. Journalize the entry to accrue the vacation expense for the month. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit 共

David Industries has seven employees. Each employee earns three vacation days a month. David pays its employees a weekly salary of $1,000 for a five-day workweek. Requirements 1. Determine the amount of vacation expense for one month. 2. Journalize the entry to accrue the vacation expense for the month. Requirement 1. Determine the amount of vacation expense for one month. Select the correct formula and calculate David Industries' vacation expense for one month. (Abbreviations used: Ees = Employees; Mo. = Month; Wk. = Workweek.) Montly vacation Monthly vacation expense formula expense amount Requirement 2. Journalize the entry to accrue the vacation expense for the month. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit 共

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for...

Related questions

Question

Transcribed Image Text:David Industries has seven employees. Each employee earns three vacation days a month. David pays its employees a weekly salary of $1,000 for a five-day workweek.

Requirements

1.

Determine the amount of vacation expense for one month.

2.

Journalize the entry to accrue the vacation expense for the month.

Requirement 1. Determine the amount of vacation expense for one month.

Select the correct formula and calculate David Industries' vacation expense for one month. (Abbreviations used: Ees = Employees; Mo. = Month; Wk. = Workweek.)

Montly vacation

Monthly vacation expense formula

expense amount

Requirement 2. Journalize the entry to accrue the vacation expense for the month. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

IDI

%23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning