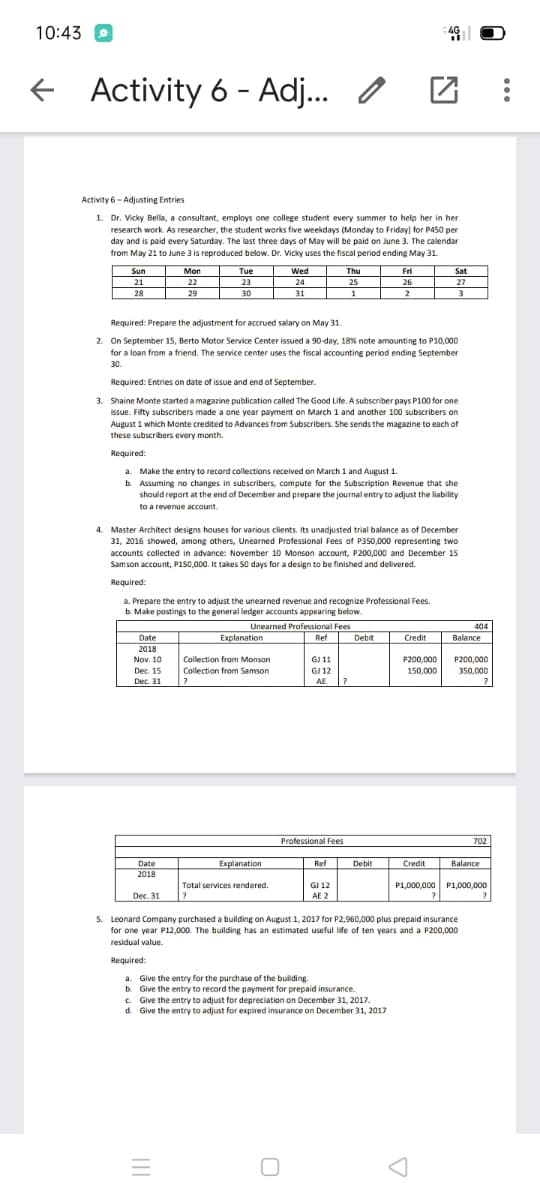

1. Dr. Vicky Bella, a consultant, employs one college student every summer to help her in her research work. As researcher, the student works five weekdays (Monday to Friday) for P450 per day and is paid every Saturday. The last three days of May will be paid on June 3. The calendar from May 21 to June 3 is reproduced below. Dr. Vicky uses the fiscal period ending May 31. Wed 24 31 Thu Fri Sun 21 28 Mon 22 29 Tue 23 30 Sat 27 25 26 2 3 Required: Prepare the adjustment for accrued salary on May 31.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images