December 2022 Fraser Ltd's statement of financial positi motor vehicles at a cost price of $400 000 less accumulated dep $100 000. Fraser Ltd uses the cost model to value its assets. On December 2022 an estimate is made that the recoverable amour vehicles is $270 000. Under AASB 136, Impairment of Assets, the accounting entry to record the write down of the motor vehicles recoverable amount is which of the following?

December 2022 Fraser Ltd's statement of financial positi motor vehicles at a cost price of $400 000 less accumulated dep $100 000. Fraser Ltd uses the cost model to value its assets. On December 2022 an estimate is made that the recoverable amour vehicles is $270 000. Under AASB 136, Impairment of Assets, the accounting entry to record the write down of the motor vehicles recoverable amount is which of the following?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.6E

Related questions

Question

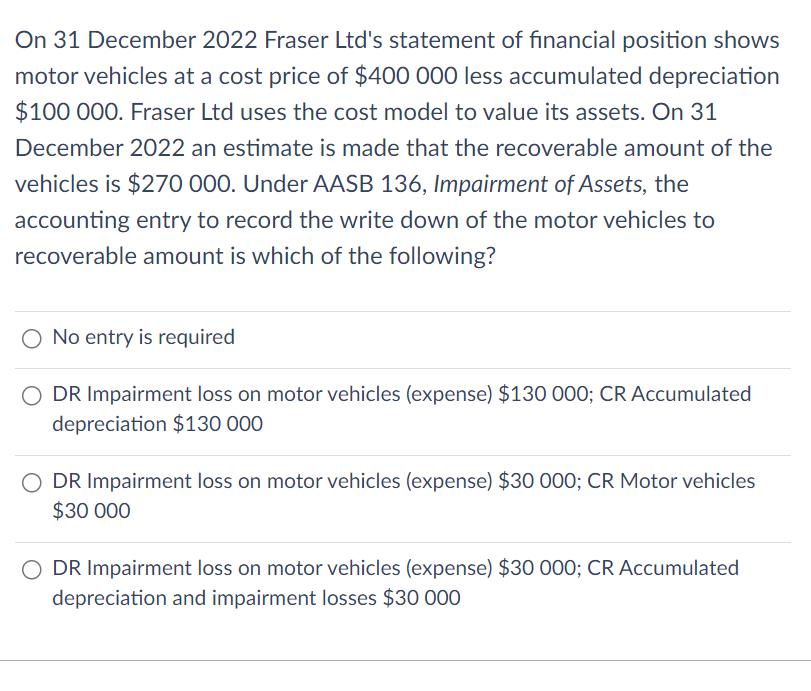

Transcribed Image Text:On 31 December 2022 Fraser Ltd's statement of financial position shows

motor vehicles at a cost price of $400 000 less accumulated depreciation

$100 000. Fraser Ltd uses the cost model to value its assets. On 31

December 2022 an estimate is made that the recoverable amount of the

vehicles is $270 000. Under AASB 136, Impairment of Assets, the

accounting entry to record the write down of the motor vehicles to

recoverable amount is which of the following?

O No entry is required

DR Impairment loss on motor vehicles (expense) $130 000; CR Accumulated

depreciation $130 000

DR Impairment loss on motor vehicles (expense) $30 000; CR Motor vehicles

$30 000

DR Impairment loss on motor vehicles (expense) $30 000; CR Accumulated

depreciation and impairment losses $30 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College