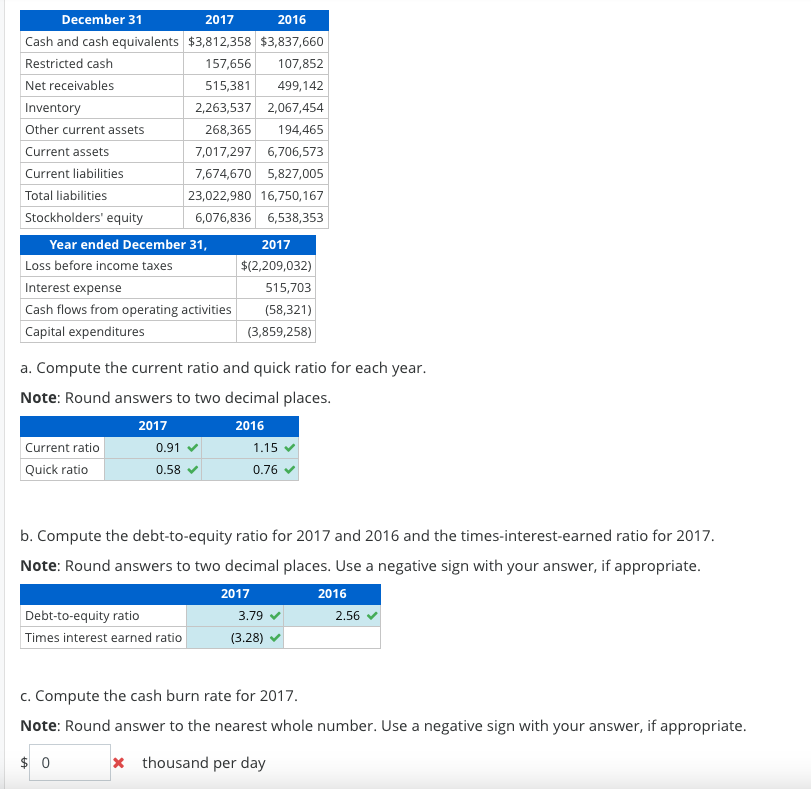

December 31 Cash and cash equivalents Restricted cash Net receivables Inventory Other current assets Current assets Current liabilities Total liabilities Stockholders' equity Year ended December 31, Loss before income taxes Interest expense Cash flows from operating activities Capital expenditures 2017 2016 $3,812,358 $3,837,660 157,656 107,852 515,381 499,142 2,263,537 2,067,454 268,365 194,465 7,017,297 6,706,573 7,674,670 5,827,005 23,022,980 16,750,167 6,076,836 6,538,353 Current ratio Quick ratio 0.91 0.58 a. Compute the current ratio and quick ratio for each year. Note: Round answers to two decimal places. 2017 2016 2017 $(2,209,032) Debt-to-equity ratio Times interest earned ratio 515,703 (58,321) (3,859,258) b. Compute the debt-to-equity ratio for 2017 and 2016 and the times-interest-earned ratio for 2017. Note: Round answers to two decimal places. Use a negative sign with your answer, if appropriate. 1.15 0.76 ✔ 2017 3.79 (3.28)✔ 2016 2.56 c. Compute the cash burn rate for 2017. Note: Round answer to the nearest whole number. Use a negative sign with your answer, if appropria $0 *thousand per day

December 31 Cash and cash equivalents Restricted cash Net receivables Inventory Other current assets Current assets Current liabilities Total liabilities Stockholders' equity Year ended December 31, Loss before income taxes Interest expense Cash flows from operating activities Capital expenditures 2017 2016 $3,812,358 $3,837,660 157,656 107,852 515,381 499,142 2,263,537 2,067,454 268,365 194,465 7,017,297 6,706,573 7,674,670 5,827,005 23,022,980 16,750,167 6,076,836 6,538,353 Current ratio Quick ratio 0.91 0.58 a. Compute the current ratio and quick ratio for each year. Note: Round answers to two decimal places. 2017 2016 2017 $(2,209,032) Debt-to-equity ratio Times interest earned ratio 515,703 (58,321) (3,859,258) b. Compute the debt-to-equity ratio for 2017 and 2016 and the times-interest-earned ratio for 2017. Note: Round answers to two decimal places. Use a negative sign with your answer, if appropriate. 1.15 0.76 ✔ 2017 3.79 (3.28)✔ 2016 2.56 c. Compute the cash burn rate for 2017. Note: Round answer to the nearest whole number. Use a negative sign with your answer, if appropria $0 *thousand per day

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.1APR

Related questions

Question

Do not give solution in image

solve all questions

Transcribed Image Text:December 31

Cash and cash equivalents

Restricted cash

Net receivables

Inventory

Other current assets

Current assets

Current liabilities

Total liabilities

Stockholders' equity

Year ended December 31,

Loss before income taxes

Interest expense

Cash flows from operating activities

Capital expenditures

2017

2016

$3,812,358 $3,837,660

157,656 107,852

515,381

499,142

2,263,537 2,067,454

268,365 194,465

7,017,297 6,706,573

7,674,670 5,827,005

23,022,980 16,750,167

6,076,836 6,538,353

Current ratio

Quick ratio

0.91

0.58

a. Compute the current ratio and quick ratio for each year.

Note: Round answers to two decimal places.

2017

2016

2017

$(2,209,032)

Debt-to-equity ratio

Times interest earned ratio

515,703

(58,321)

(3,859,258)

1.15

0.76 ✓

b. Compute the debt-to-equity ratio for 2017 and 2016 and the times-interest-earned ratio for 2017.

Note: Round answers to two decimal places. Use a negative sign with your answer, if appropriate.

2017

2016

3.79

(3.28)

2.56

c. Compute the cash burn rate for 2017.

Note: Round answer to the nearest whole number. Use a negative sign with your answer, if appropriate.

$0

*thousand per day

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning