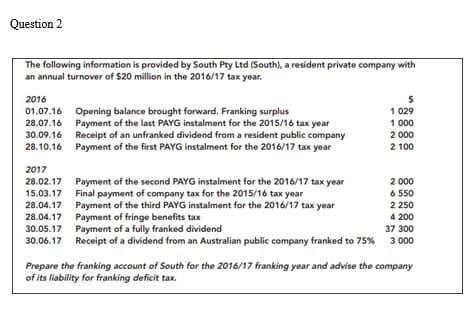

The following information is provided by South Pty Ltd (South), a resident private company with an annual turnover of $20 million in the 2016/17 tax year. 2016 01.07.16 Opening balance brought forward. Franking surplus 28.07.16 Payment of the last PAYG instalment for the 2015/16 tax year 30.09.16 Receipt of an unfranked dividend from a resident public company 28.10.16 Payment of the first PAYG instalment for the 2016/17 tax year 2017 28.02.17 Payment of the second PAYG instalment for the 2016/17 tax year 15.03.17 Final payment of company tax for the 2015/16 tax year 28.04.17 Payment of the third PAYG instalment for the 2016/17 tax year 28.04.17 Payment of fringe benefits tax 30.05.17 Payment of a fully franked dividend 30.06.17 Receipt of a dividend from an Australian public company franked to 75% S 1 029 1 000 2000 2 100 2 000 6550 2 250 4 200 37 300 3 000 Prepare the franking account of South for the 2016/17 franking year and advise the company of its liability for franking deficit tax.

The following information is provided by South Pty Ltd (South), a resident private company with an annual turnover of $20 million in the 2016/17 tax year. 2016 01.07.16 Opening balance brought forward. Franking surplus 28.07.16 Payment of the last PAYG instalment for the 2015/16 tax year 30.09.16 Receipt of an unfranked dividend from a resident public company 28.10.16 Payment of the first PAYG instalment for the 2016/17 tax year 2017 28.02.17 Payment of the second PAYG instalment for the 2016/17 tax year 15.03.17 Final payment of company tax for the 2015/16 tax year 28.04.17 Payment of the third PAYG instalment for the 2016/17 tax year 28.04.17 Payment of fringe benefits tax 30.05.17 Payment of a fully franked dividend 30.06.17 Receipt of a dividend from an Australian public company franked to 75% S 1 029 1 000 2000 2 100 2 000 6550 2 250 4 200 37 300 3 000 Prepare the franking account of South for the 2016/17 franking year and advise the company of its liability for franking deficit tax.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.5APE

Related questions

Question

100%

Transcribed Image Text:Question 2

The following information is provided by South Pty Ltd (South), a resident private company with

an annual turnover of $20 million in the 2016/17 tax year.

2016

01.07.16

Opening balance brought forward. Franking surplus

28.07.16 Payment of the last PAYG instalment for the 2015/16 tax year

30.09.16 Receipt of an unfranked dividend from a resident public company

28.10.16 Payment of the first PAYG instalment for the 2016/17 tax year

2017

28.02.17

15.03.17

Payment of the second PAYG instalment for the 2016/17 tax year

Final payment of company tax for the 2015/16 tax year

Payment of the third PAYG instalment for the 2016/17 tax year

28.04.17 Payment of fringe benefits tax

30.05.17 Payment of a fully franked dividend

30.06.17 Receipt of a dividend from an Australian public company franked to 75%

S

1 029

1 000

2 000

2 100

2 000

6 550

2 250

4 200

300

37

3 000

Prepare the franking account of South for the 2016/17 franking year and advise the company

of its liability for franking deficit tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning