Decision makers and analysts look deeply into profitability ratios to identify trends in a company’s profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. If a company has a profit margin of 10%, it means that the company earned a net income of $0.10 for each dollar of sales. If a company’s operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. An increase in the return on assets ratio implies an increase in the assets a firm owns. If a company issues new common shares but its net income does not increase, return on common equity will increase.

Decision makers and analysts look deeply into profitability ratios to identify trends in a company’s profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. If a company has a profit margin of 10%, it means that the company earned a net income of $0.10 for each dollar of sales. If a company’s operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. An increase in the return on assets ratio implies an increase in the assets a firm owns. If a company issues new common shares but its net income does not increase, return on common equity will increase.

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

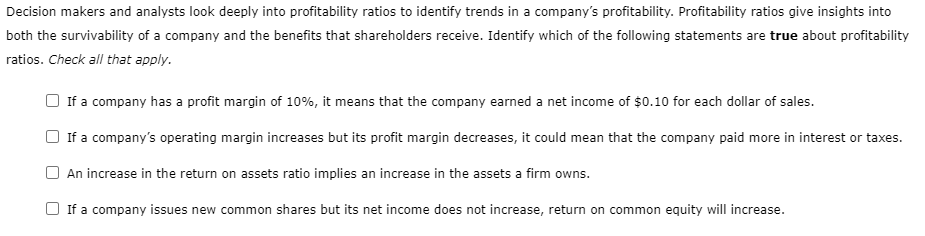

Decision makers and analysts look deeply into profitability ratios to identify trends in a company’s profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply.

If a company has a profit margin of 10%, it means that the company earned a net income of $0.10 for each dollar of sales.

If a company’s operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes.

An increase in the return on assets ratio implies an increase in the assets a firm owns.

If a company issues new common shares but its net income does not increase, return on common equity will increase.

Transcribed Image Text:Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratios give insights into

both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability

ratios. Check all that apply.

If a company has a profit margin of 10%, it means that the company earned a net income of $0.10 for each dollar of sales.

If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes.

An increase in the return on assets ratio implies an increase in the assets a firm owns.

If a company issues new common shares but its net income does not increase, return on common equity will increase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON