1. Calculate the profit per package and the total profitability of each of the three corporate packages. 2. Compare the profitability of the three corporate packages. 3. Do you consider that the allocation of the corporate department overhead to packages using actual sales revenue is appropriate? Can you suggest a better method? 4. Suggest what actions the company could take in regard to the three corporate packages.

1. Calculate the profit per package and the total profitability of each of the three corporate packages. 2. Compare the profitability of the three corporate packages. 3. Do you consider that the allocation of the corporate department overhead to packages using actual sales revenue is appropriate? Can you suggest a better method? 4. Suggest what actions the company could take in regard to the three corporate packages.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter10: Accounting Systems For Manufacturing Operations

Section: Chapter Questions

Problem 10.4.2C: Factory overhead rate Fabricator Inc., a specialized equipment manufacturer, uses a job order cost...

Related questions

Question

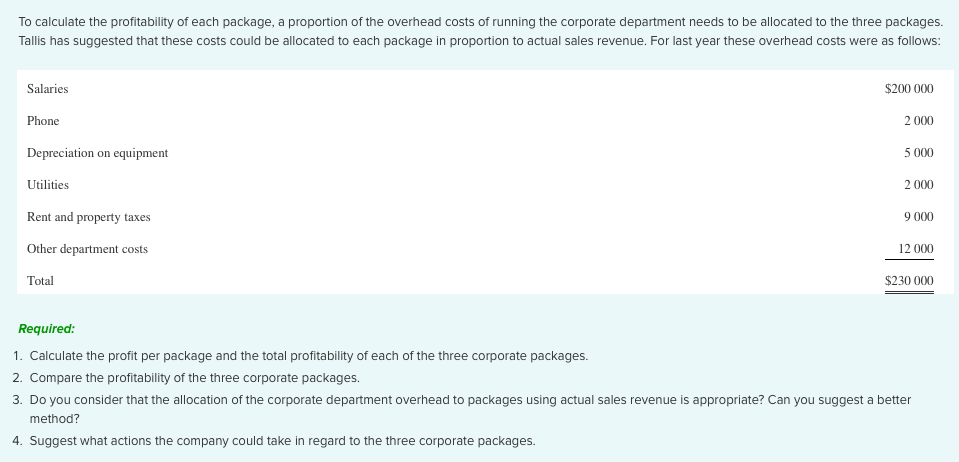

Transcribed Image Text:To calculate the profitability of each package, a proportion of the overhead costs of running the corporate department needs to be allocated to the three packages.

Tallis has suggested that these costs could be allocated to each package in proportion to actual sales revenue. For last year these overhead costs were as follows:

Salaries

$200 000

Phone

2 000

Depreciation on equipment

5 000

Utilities

2 000

Rent and property taxes

9 000

Other department costs

12 000

Total

$230 000

Required:

1. Calculate the profit per package and the total profitability of each of the three corporate packages.

2. Compare the profitability of the three corporate packages.

3. Do you consider that the allocation of the corporate department overhead to packages using actual sales revenue is appropriate? Can you suggest a better

method?

4. Suggest what actions the company could take in regard to the three corporate packages.

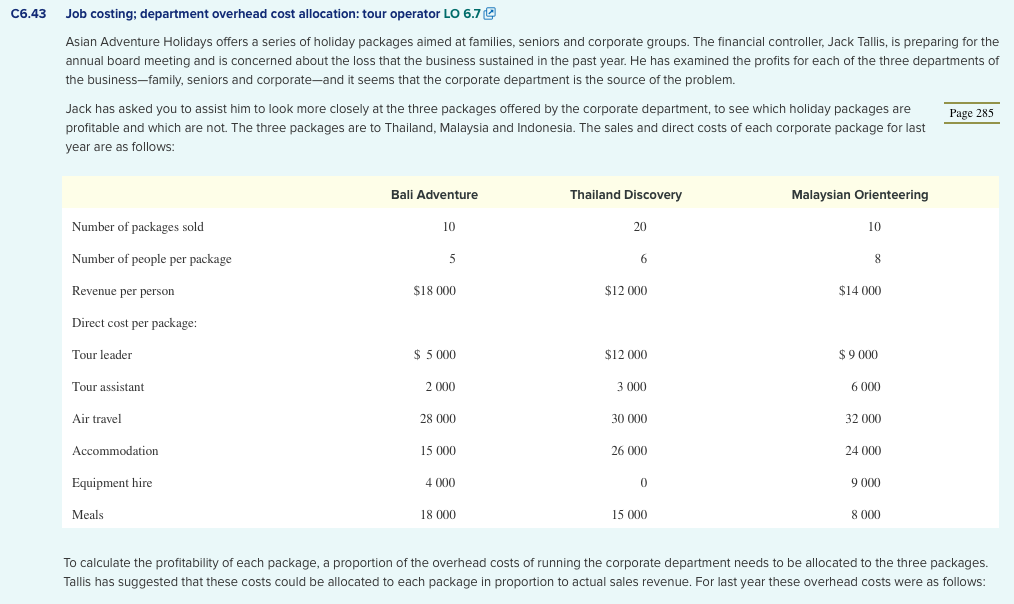

Transcribed Image Text:C6.43 Job costing; department overhead cost allocation: tour operator LO 6.72

Asian Adventure Holidays offers a series of holiday packages aimed at families, seniors and corporate groups. The financial controller, Jack Tallis, is preparing for the

annual board meeting and is concerned about the loss that the business sustained in the past year. He has examined the profits for each of the three departments of

the business-family, seniors and corporate-and it seems that the corporate department is the source of the problem.

Jack has asked you to assist him to look more closely at the three packages offered by the corporate department, to see which holiday packages are

Page 285

profitable and which are not. The three packages are to Thailand, Malaysia and Indonesia. The sales and direct costs of each corporate package for last

year are as follows:

Bali Adventure

Thailand Discovery

Malaysian Orienteering

Number of packages sold

10

20

10

Number of people per package

5

6

8

Revenue per person

$18 000

$12 000

$14 000

Direct cost per package:

Tour leader

$ 5 000

$12 000

$9 000

Tour assistant

2 000

3 000

6 000

Air travel

28 000

30 000

32 000

Accommodation

15 000

26 000

24 000

Equipment hire

4 000

9 000

Meals

18 000

15 000

8 000

To calculate the profitability of each package, a proportion of the overhead costs of running the corporate department needs to be allocated to the three packages.

Tallis has suggested that these costs could be allocated to each package in proportion to actual sales revenue. For last year these overhead costs were as follows:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning