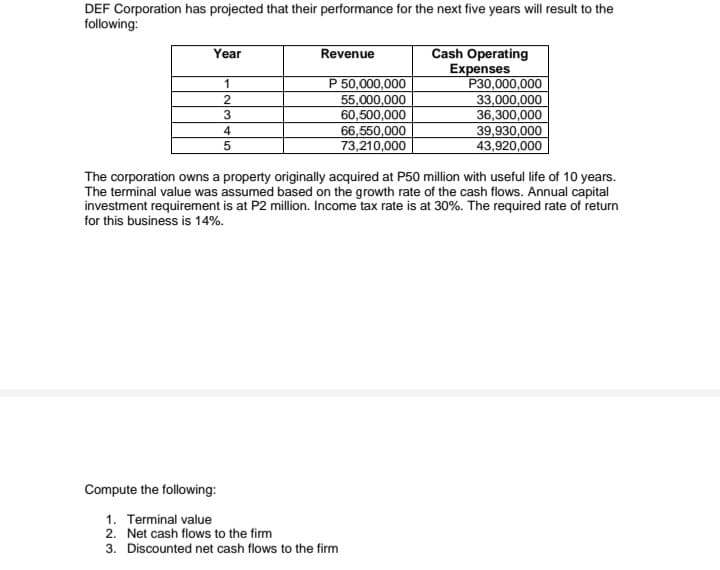

DEF Corporation has projected that their performance for the next five years will result to the following: Cash Operating Expenses P30,000,000 33,000,000 36,300,000 39,930,000 43,920,000 Year Revenue P 50,000,000 55,000,000 60,500,000 66,550,000 73,210,000 1 3 5 The corporation owns a property originally acquired at P50 million with useful life of 10 years. The terminal value was assumed based on the growth rate of the cash flows. Annual capital investment requirement is at P2 million. Income tax rate is at 30%. The required rate of return for this business is 14%.

DEF Corporation has projected that their performance for the next five years will result to the following: Cash Operating Expenses P30,000,000 33,000,000 36,300,000 39,930,000 43,920,000 Year Revenue P 50,000,000 55,000,000 60,500,000 66,550,000 73,210,000 1 3 5 The corporation owns a property originally acquired at P50 million with useful life of 10 years. The terminal value was assumed based on the growth rate of the cash flows. Annual capital investment requirement is at P2 million. Income tax rate is at 30%. The required rate of return for this business is 14%.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Transcribed Image Text:DEF Corporation has projected that their performance for the next five years will result to the

following:

Cash Operating

Expenses

P30,000,000

33,000,000

36,300,000

39,930,000

43,920,000

Year

Revenue

P 50,000,000

55,000,000

60,500,000

66,550,000

73,210,000

1

3

4

The corporation owns a property originally acquired at P50 million with useful life of 10 years.

The terminal value was assumed based on the growth rate of the cash flows. Annual capital

investment requirement is at P2 million. Income tax rate is at 30%. The required rate of return

for this business is 14%.

Compute the following:

1. Terminal value

2. Net cash flows to the firm

3. Discounted net cash flows to the firm

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning