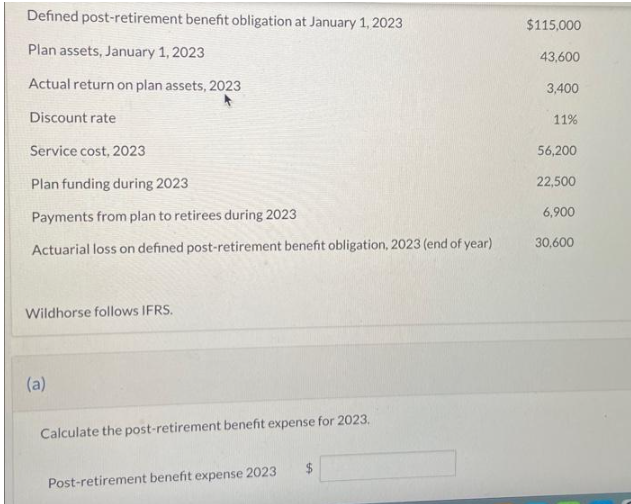

Defined Plan assets, January 1, 2023 Actual return on plan assets, 2023 Discount rate Service cost, 2023 Plan funding during 2023 Payments from plan to retirees during 2023 Actuarial loss on defined post-retirement benefit obligation, 2023 (end of year) post-retirement benefit obligation at January 1, 2023 $115,000 43,600 3,400 11% 56,200 22,500 6,900 30,600

Q: Royall Company purchased factory equipment by signing a 5-year zero interest bearing note which…

A: Seller is the drawer of bill of exchange Royall company is drawee Note is of Zero interest

Q: arplus Limited is well known for its focus on customer satisfaction and this is highlighted in the…

A: The statement of financial position also known as balance sheet shows the assets, liabilities and…

Q: Mark Ting desperately wants his proposed new product, DNA-diamond, to be accepted by top management.…

A: Mark Ting's actions are not ethical. He is knowingly misrepresenting the estimated fixed costs of…

Q: Kubin Company’s relevant range of production is 20,000 to 23,000 units. When it produces and sells…

A: calculation of direct manufacturing cost , indirect manufacturing cost and direct selling expenses…

Q: The Vizzini Shop (TVS) specializes in making fraternity and sorority tote bags for the college…

A: Since the question has multiple sub-parts, as per the guidelines only the first three sub-parts will…

Q: The following is list of accounts each represented by letter(s). A Accounts Payable U Loss from…

A: Interest expense refers to the cost of borrowing money from creditors or lenders. It is an expense…

Q: BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it…

A: Introduction:- Net present value method : It is defined as the difference between the present value…

Q: TB EX Qu. 6-211 (Algo) During 2024, a company sells... During 2024, a company sells 20 units of…

A: Weighted average cost per unit = Total cost/Number of units

Q: Net sales Cost of goods sold Gross profit Operating expenses Profit from operations Interest expense…

A: Since the question has multiple sub-parts, as per the guidelines only the first three sub-parts will…

Q: worksheet d adjusting entry to record bad debts expense under the Allowance for Doubtful Accounts…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Williams Incorporated produces a single product, a part used in the manufacture of automobile…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: please Answer these questions part 1 Use the data below to compute and allocate Single Department…

A: Factory overhead is defined as those support costs that assist in the production of the products.…

Q: Factory Overhead Cost Variances The following data relate to factory overhead cost for the…

A: Variance :— It is the difference between standard cost and actual cost. Budgeted variable…

Q: uired: repare the adjusting entry to record bad debts under each separate assumption. a. Bad debts…

A: Introduction: - Journal entry is the first stage of accounting process. Journal entry used to record…

Q: Equipment purchased on 06/01/22 for $560K (U/L = 5 years, S/V = 0, Straight-line depreciation). Sold…

A: Gain or loss on non-current asset means the amount earned or incurred on the sale of the asset.…

Q: Record the journal entry: Jack has $90,000 two-year note payable to first USA Bank and Trust, dated…

A: Here USA bank is the drawer and Jack is the drawee

Q: A company uses a weighted-average perpetual inventory system. The following transactions took place…

A: Ending inventory in units = Beginning inventory + Purchases - Ending inventory

Q: On January 1, Year 1, Marino Moving Company paid $48,000 cash to purchase a truck. The truck was…

A: Depreciation Expense: Depreciation Expense is a expense charged to assets of the company. It is…

Q: Required: 1. Determine the company's cost of technical support per customer service call. 2. During…

A: Introduction:- ABC costing means Activity based costing. It is used to allocation of manufacturing…

Q: Minden Company is a wholesale distributor of premium European chocolates. The company's balance…

A: Expected Cash Collection for May (Amounts in $) Particulars Amount Cash Sales…

Q: Jackson Company engaged in the following investment transactions during the current year. February…

A: INFORMATION:- This is a question that requires the preparation of journal entries for investment…

Q: [The following information applies to the questions displayed below.] Warnerwoods Company uses a…

A: Perpetual inventory system: The system of material control on a continuous basis is while the…

Q: When Income Summary has a credit balance and the account is closed: OA. Capital is decreased. OB.…

A: Preparation of closing entries is a method used by the business entity to close its temporary…

Q: (17,500 units, 10% complete with respect to Refining costs) Transferred-in costs (from Mixing) $…

A: Equivalent units of production arises in case of process costing . In most cases,not all units are…

Q: Jaffre Enterprises distributes a single product whose selling price is $13 per unit and whose…

A: Break even point in unit sales are the number of units required to cover the fixed expenses of the…

Q: Great American Oilchange (GAO) sells a combined oil change service and parts package for $40. A…

A: Journal entries are the primary reporting of the business transactions in the books of accounts.…

Q: NOVA BOOKS sells books, backpacks, and shirts. The following information is presented as of December…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Assume that Raghad company has decided to recall its' bond. The recall cost was BD 10,000. The…

A: The bonds may be called before maturity if the company have provisions to do that and company may…

Q: Mauro Products distributes a single product, a woven basket whose selling price is $22 per unit and…

A: BREAKEVEN POINT Break Even means the volume of production or sales where there is no profit or loss.…

Q: REQUIRED (a) Explain the tax treatment of rental income, royalties and management consultancy fees.…

A: a) Tax Treatment of Rental Income, Royalties, and Management Consultancy Fees: Rental…

Q: Rockland Shoe Company, prides itself as being the "world's leading marketer of U.S. branded non-…

A: Income statement is one of the financial statements which is prepared to depict the profitability of…

Q: 4. Now, let's assume the company wants to consider producing both products. Assume that, considering…

A: Lets understand the basics. Break even point is a point at which no profit no loss condition arise.…

Q: The inventory records for Radford Company reflected the following Beginning inventory on May 1 1,600…

A: Cost of goods sold is the amount of cost which is incurred on the making of the goods. It includes…

Q: Prepare an incremental analysis of Twilight Hospital. (In the first two columns, enter costs and…

A: The company has some assets to run the business, before buying the assets company should compare the…

Q: Betty DeRose, Inc. borrowed $170,000 on January 1, 2024. The terms of the loan require Betty DeRose…

A: A note payable is a written promise by a borrower to pay a certain amount of money to a lender at a…

Q: 2. Prepare a direct materials purchases budget for jars for the months of January and February.…

A: Lets understand the basics. Management prepare budget in order to estimate future profit and loss…

Q: Sam purchased a five-year insurance policy for $4,320. The adjusting entry for one month would…

A: When Sam purchased the five-year insurance policy for $4,320, he paid upfront for the entire policy…

Q: Which of the following are prohibited when accounting for inventory under U.S. GAAP? a. FIFO method…

A: 1. The correct answer is: (C) recovery of written down inventory. Under U.S. GAAP, the lower of cost…

Q: If a firm has tangible fixed assets of $52 million, accumulated depreciation of $40 million, and…

A: (i) The estimated remaining asset life can be calculated as follows: Estimated Remaining Asset Life…

Q: Audit Committee Responsibilities A company's audit committee performs duties that are essen- tial to…

A: An audit committee is a sub-committee of a company's board of directors that is responsible for…

Q: This information relates to Sheridan Supply Co. 1. 2. 3. 4. 5. On April 5 purchased merchandise from…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction is…

Q: Amina is a 30 percent partner in the AOM Partnership when she sells her entire interest to Hope for…

A: Calculation of gain or loss recognized on sale of share in AOM are as follows. A partnership is an…

Q: The Central Valley Company is a manufacturing firm that produces and sells a single product. The…

A: The break even sales are the sales where business earns no profit no loss during the period. The…

Q: 6. Calculate the number of units of finished goods to be manufactured in January 20x1. 7. Calculate…

A: The cash budget is prepared to estimate the financing requirements for the period. The production…

Q: You are a management accountant of EON and Brothers Ltd., a manufacturing company that produces two…

A: Activity-based costing (ABC) is a costing technique that allocates costs based on the activities…

Q: Exercise 8-18 (Algo) Partial-year depreciation; disposal of plant asset LO P2 Rayya Company…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Grouper Company lost most of its inventory in a fire in December just before the year-end physical…

A: Lets understand the basics. When inventory gets damaged due to fire then loss due to fire needs to…

Q: Equivalent Units of Production The Converting Department of Toren Company had 1,160 units in work in…

A: Conversion cost refers to the expenses incurred by a manufacturing company to convert raw materials…

Q: Assuming costs vary with sales and a 20 percent increase in sales is projected, create the pro forma…

A: Due to our protocol only first three sub-parts are solved as there are four sub-parts. The plug…

Q: Hiking boots and Fashion boots income statement data for the most recent year follow Total $490.000…

A: Given The fixed cost remains same and additional rental revenue of $27000.

solve with working

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- a. Compute pension expense for 2020. Amortize the full pension gain/loss over the average service life of 15 years using the straight-line method. b. Compute PBO at December 31st, 2020. c. Compute the fair value of plan assets at December 31st, 2020. Please don't provide solution in an image based thankuComputing Pension Expense, Gain/Loss Amortization, PBO, and Plan Asset Balances The following data relate to a defined benefit pension plan for Hollistir Co. Fair value of plan assets, Jan. 1, 2020 $9,600 PBO Jan. 1, 2020, not including any items below 12,000 PSC from amendment dated Jan. 1, 2020, (10 years is the amortization period) 6,000 Gain from change in actuarial assumptions, computed as of Jan. 1, 2020 1,800 Actual return on plan assets, 2020 1,200 Contributions to plan assets in 2020 2,400 Benefits paid to retirees in 2020 3,000 Service cost for 2020 5,400 Discount rate 8% Expected rate of return on plan assets 10% Required a. Compute pension expense for 2020. Hollistir amortizes the full pension gain/loss over average service life of 15 years, using the straight-line method. Pension expense, 2020 b. Compute PBO at December 31, 2020. PBO, Dec. 31, 2020 c. Compute fair value of plan assets at December 31, 2020. Fair…Amortizing Pension Gain/Loss On June 1, 2018, West Corporation established a defined benefit pension plan for its employees. The following information was available in 2020: Balance Jan. 1, 2020 Projected Benefit Obligation $5,075,000 Cr. Plan Assets 5,250,000 Dr. Accumulated OCI—Pension Gain/Loss 892,500 Cr. For 2021, compute the amortization of the account, Accumulated OCI—Pension Gain/Loss, assuming that the company uses the corridor approach in determining the minimum amortization to recognize. Assume that the average remaining service life of employees is 10 years.Note: Do not use a negative sign with your answer. Amortization of Pension Gain/Loss

- Pension data for Sterling Properties include the following: ($ in thousands) Service cost, 2021 $ 116 Projected benefit obligation, January 1, 2021 550 Plan assets (fair value), January 1, 2021 600 Prior service cost—AOCI (2021 amortization, $7) 86 Net loss—AOCI (2021 amortization, $2) 107 Interest rate, 6% Expected return on plan assets, 10% Actual return on plan assets, 11% Required:Determine pension expense for 2021. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.)Recording Pension Expense, Plan Funding, Benefit Payments LetsGo Inc. sponsors a defined benefit plan and determined that for the current year of 2020, service cost was $400,000, amortization of prior service cost was $2,880, interest cost was $33,760, and the expected (and actual) return on plan assets was $28,800. LetsGo will contribute $72,000 to the plan for 2020 and payments to retirees totaled $24,000 in 2020. Record the journal entries for pension expense, to fund the plan, and to pay benefits for 2020. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Date Account Name Dr. Cr. Dec. 31, 2020 CashPlan AssetsAccrued Pension LiabilityProjected Benefit ObligationOCI—Pension Gain/LossOCI—Prior Service CostPension Expense CashPlan AssetsAccrued Pension LiabilityProjected Benefit ObligationOCI—Pension Gain/LossOCI—Prior Service CostPension Expense CashPlan AssetsAccrued…Question 16## Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Also please help me answer part B. (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…

- Question 16 Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and…Question 16# Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…The following facts for Storm plc apply to the pension plan for 2019.1. Annual service cost is 18,0002. Discount Rate is 10%3. Actual return on plan assets is $22,0004. Annual funding contributions are $34,0005. Benefits paid to retirees during the year are $20,5006. Changes in actuarial assumptions establish the end of year defined benefit obligation at $285,000 Required:a. Prepare a pension worksheet using the following table and given the following opening balances. b. Prepare the necessary pension journal entries in accordance with IAS 19 pension Benefits for Storm plc for year ending 2019.

- Preparing a Pension Worksheet Levine Co. sponsored a defined benefit plan, which included January 1, 2020, balances of $3,000 and $2,880 in Plan Assets and Projected Benefit Obligation, respectively. During 2020, the company incurred $600 in service cost, made plan contributions of $126, and paid benefits to retirees for $90. The discount rate is 9% and the expected and actual rate of return on plan assets is 10%. Prepare a pension worksheet for 2020.Note: Use a negative sign for credits to accounts. Pension Worksheet Reported Net in Financial Statements Balance Sheet Income Statement PlanAssets PBO Net PensionAsset/Liability CashOutflow PensionExpense Balance, January 1, 2020 Service cost Interest cost Expected return Contributions to fund Benefit payments Balance, December 31, 2020The following information isavailable for the pension plan of Radcliffe Company for the year 2019.Interest revenue on plan assets $ 15,000Benefits paid to retirees 40,000Contributions (funding) 90,000Discount (interest) rate 10%Defined benefit obligation, January 1, 2019 500,000Service cost 60,000Instructionsa. Compute pension expense for the year 2019.b. Prepare the journal entry to record pension expense and the employer'scontribution to the pension plan in 2019.Pension data for Sterling Properties include the following: ($ in thousands)Service cost, 2021 $112Projected benefit obligation, January 1, 2021 850Plan assets (fair value), January 1, 2021 900Prior service cost—AOCI (2021 amortization, $8) 80Net loss—AOCI (2021 amortization, $1) 101Interest rate, 6%Expected return on plan assets, 10%Actual return on plan assets, 11% Required:Determine pension expense for 2021.