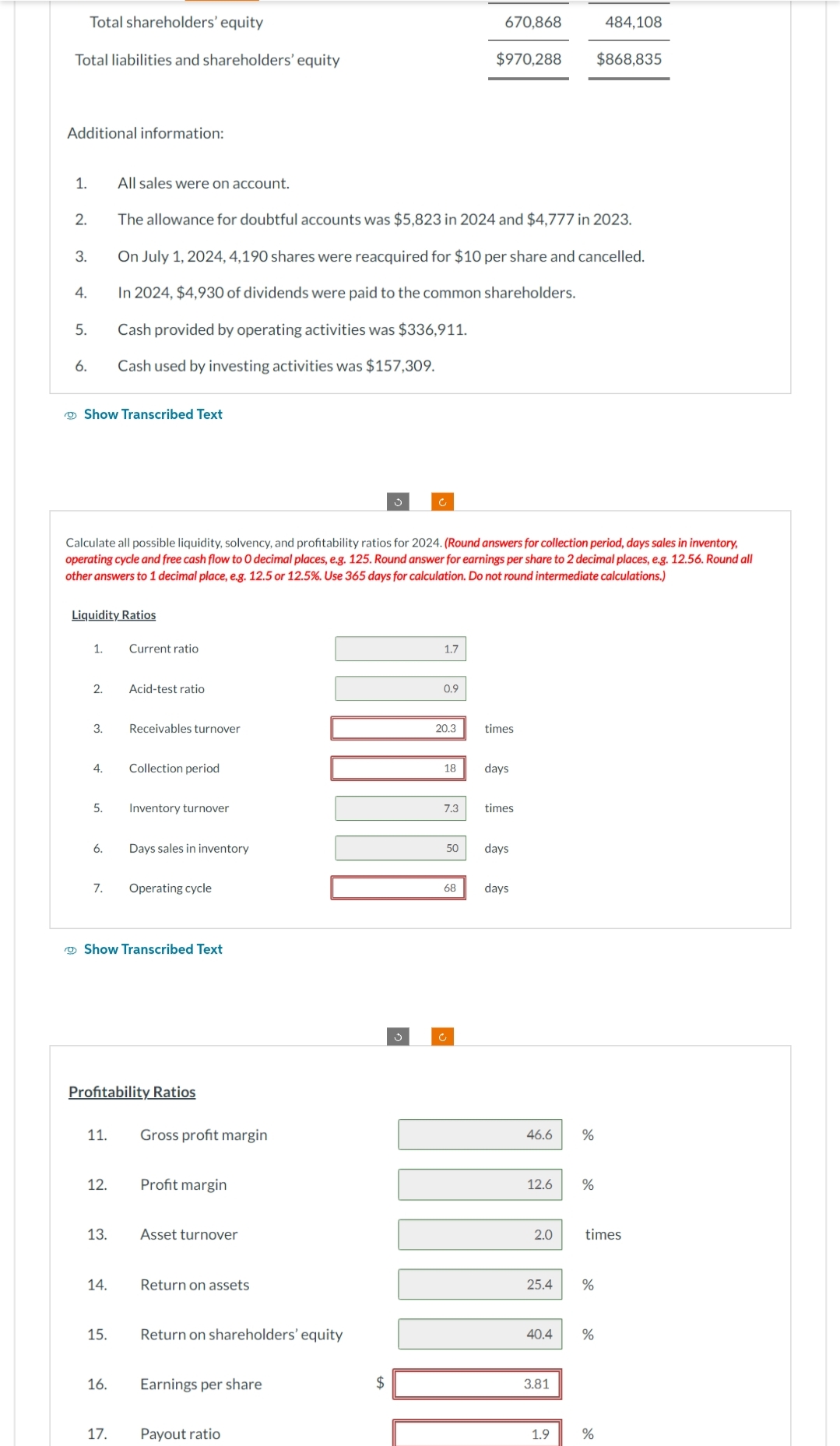

Net sales Cost of goods sold Gross profit Operating expenses Profit from operations Interest expense Profit before income tax Income tax expense Profit for the year Show Transcribed Text Assets Current assets Cash Accounts receivable Inventory Total current assets Total assets Property, plant, and equipment Show Transcribed Text 2024 $1,854,990 Total current liabilities Mortgage payable Total liabilities 990,790 864,200 504,050 360,150 26,450 333,700 100,110 $233,590 Liabilities and Shareholders' Equity Current liabilities Accounts payable Income tax payable Current portion of mortgage payable Total current liabilities 2023 $1,868,180 876,350 991,830 468,340 523,490 20,770 502,720 THE ORIOLE COMPANY LTD. Balance Sheet December 31 150,816 $351,904 3 Shareholders' equity Common shares (50,300 issued in 2024; 54,490 in 2023) Retained earnings 2024 $79,606 103,011 150,890 43,970 10,870 194,740 333,507 636,781 $970,288 $868,835 194,740 $139,900 $114,897 104,680 299,420 2023 150,900 $63,742 519,968 107,557 119,310 290,609 578,226 38,500 20,430 173,827 173,827 210,900 384,727 163,470 320,638

Net sales Cost of goods sold Gross profit Operating expenses Profit from operations Interest expense Profit before income tax Income tax expense Profit for the year Show Transcribed Text Assets Current assets Cash Accounts receivable Inventory Total current assets Total assets Property, plant, and equipment Show Transcribed Text 2024 $1,854,990 Total current liabilities Mortgage payable Total liabilities 990,790 864,200 504,050 360,150 26,450 333,700 100,110 $233,590 Liabilities and Shareholders' Equity Current liabilities Accounts payable Income tax payable Current portion of mortgage payable Total current liabilities 2023 $1,868,180 876,350 991,830 468,340 523,490 20,770 502,720 THE ORIOLE COMPANY LTD. Balance Sheet December 31 150,816 $351,904 3 Shareholders' equity Common shares (50,300 issued in 2024; 54,490 in 2023) Retained earnings 2024 $79,606 103,011 150,890 43,970 10,870 194,740 333,507 636,781 $970,288 $868,835 194,740 $139,900 $114,897 104,680 299,420 2023 150,900 $63,742 519,968 107,557 119,310 290,609 578,226 38,500 20,430 173,827 173,827 210,900 384,727 163,470 320,638

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.16E

Related questions

Question

Complete all Requirement

Do not give solution in images format

Transcribed Image Text:Total shareholders' equity

Total liabilities and shareholders' equity

Additional information:

1.

2.

3.

4.

5.

6.

Show Transcribed Text

1.

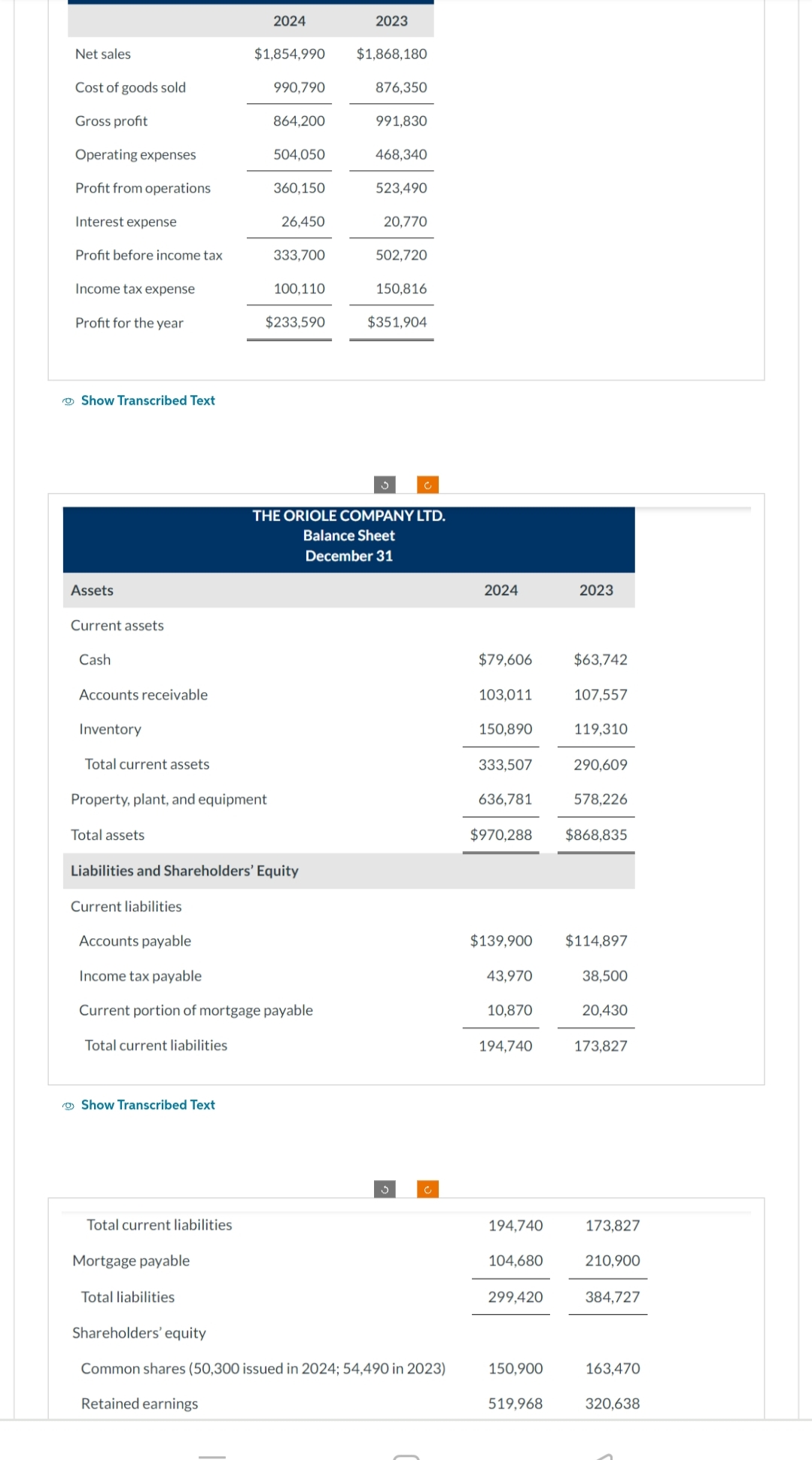

Liquidity Ratios

2.

3.

4.

Calculate all possible liquidity, solvency, and profitability ratios for 2024. (Round answers for collection period, days sales in inventory,

operating cycle and free cash flow to 0 decimal places, e.g. 125. Round answer for earnings per share to 2 decimal places, e.g. 12.56. Round all

other answers to 1 decimal place, e.g. 12.5 or 12.5%. Use 365 days for calculation. Do not round intermediate calculations.)

5.

6.

7.

11.

12.

All sales were on account.

13.

14.

15.

16.

17.

The allowance for doubtful accounts was $5,823 in 2024 and $4,777 in 2023.

On July 1, 2024, 4,190 shares were reacquired for $10 per share and cancelled.

In 2024, $4,930 of dividends were paid to the common shareholders.

Cash provided by operating activities was $336,911.

Cash used by investing activities was $157,309.

Current ratio

Show Transcribed Text

Acid-test ratio

Profitability Ratios

Receivables turnover

Collection period

Inventory turnover

Days sales in inventory

Operating cycle

Gross profit margin

Profit margin

Asset turnover

Return on assets

Return on shareholders' equity

Earnings per share

Payout ratio

1.7

$

0.9

VOTU

670,868

$970,288

20.3 times

18

68

days

7.3 times

50 days

days

46.6 %

12.6 %

2.0

25.4 %

40.4

3.81

1.9

484,108

$868,835

times

%

%

Transcribed Image Text:Net sales

Cost of goods sold

Gross profit

Operating expenses

Profit from operations

Interest expense

Profit before income tax

Income tax expense

Profit for the year

Show Transcribed Text

Assets

Current assets

Cash

Accounts receivable

Inventory

Total current assets

Total assets

Property, plant, and equipment

Total current liabilities

Show Transcribed Text

Total current liabilities

2024

$1,854,990

Mortgage payable

Total liabilities

990,790

864,200

504,050

360,150

26,450

Liabilities and Shareholders' Equity

Current liabilities

333,700

Accounts payable

Income tax payable

Current portion of mortgage payable

100,110

$233,590

2023

$1,868,180

876,350

991,830

468,340

523,490

20,770

502,720

150,816

THE ORIOLE COMPANY LTD.

Balance Sheet

December 31

$351,904

3

Shareholders' equity

Common shares (50,300 issued in 2024; 54,490 in 2023)

Retained earnings

2024

$79,606

103,011

150,890

333,507

636,781

43,970

10,870

194,740

194,740

$970,288 $868,835

104,680

$139,900 $114,897

299,420

2023

150,900

$63,742

107,557

519,968

119,310

290,609

578,226

38,500

20,430

173,827

173,827

210,900

384,727

163,470

320,638

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning