Delores has an investment account (Account # 1) with a current balance of $160,000. Delores plans to contribute approximately $1,550 to the account each month until she retires. The account has averaged a return of about 9.25% (APR), compounded monthly, and that is expected to continue. Delores also has an IRA (Account #2). It has a current balance of $32,800. She plans to contribute an additional $5,000 to that account each year until she retires. The IRA has averaged a return of about 5.50% annually, compounded annually, and this is also expected to continue. Delores plans to retire in about 28 years. (a) What will be the balance in Account #1 when Delores retires? (b) What will be the balance in the IRA (Account #2) when Delores retires? (c) How much will Delores have in total when she retires if she combines the balances of both accounts into one (1) account?

Delores has an investment account (Account # 1) with a current balance of $160,000. Delores plans to contribute approximately $1,550 to the account each month until she retires. The account has averaged a return of about 9.25% (APR), compounded monthly, and that is expected to continue. Delores also has an IRA (Account #2). It has a current balance of $32,800. She plans to contribute an additional $5,000 to that account each year until she retires. The IRA has averaged a return of about 5.50% annually, compounded annually, and this is also expected to continue. Delores plans to retire in about 28 years. (a) What will be the balance in Account #1 when Delores retires? (b) What will be the balance in the IRA (Account #2) when Delores retires? (c) How much will Delores have in total when she retires if she combines the balances of both accounts into one (1) account?

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 3FPE

Related questions

Question

i need the answer quickly

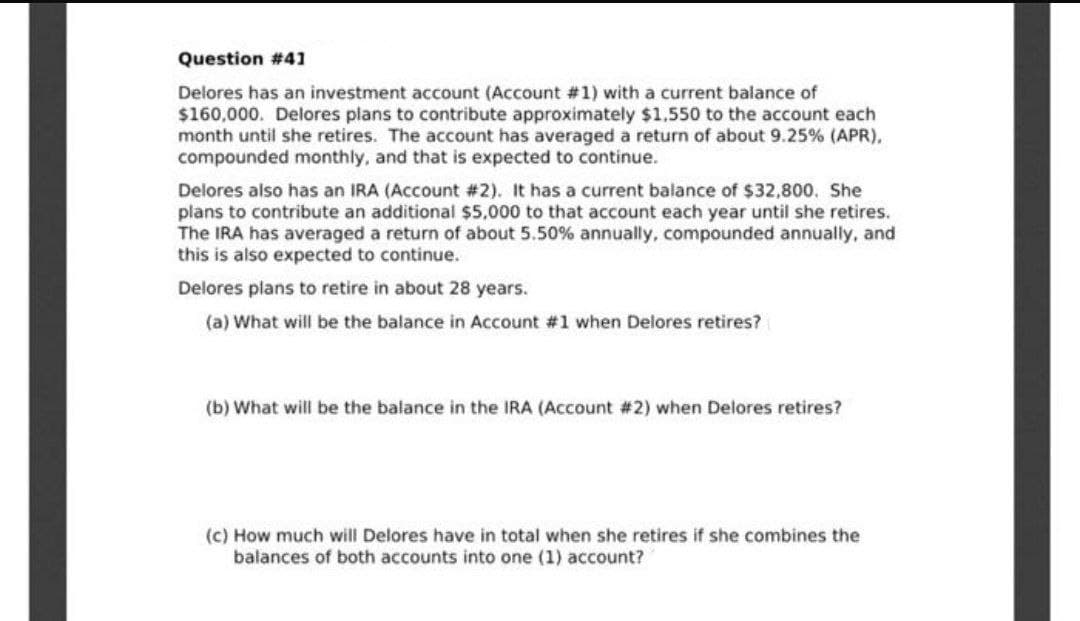

Transcribed Image Text:Question #41

Delores has an investment account (Account #1) with a current balance of

$160,000. Delores plans to contribute approximately $1,550 to the account each

month until she retires. The account has averaged a return of about 9.25 % (APR),

compounded monthly, and that is expected to continue.

Delores also has an IRA (Account # 2). It has a current balance of $32,800. She

plans to contribute an additional $5,000 to that account each year until she retires.

The IRA has averaged a return of about 5.50% annually, compounded annually, and

this is also expected to continue.

Delores plans to retire in about 28 years.

(a) What will be the balance in Account #1 when Delores retires?

(b) What will be the balance in the IRA (Account #2) when Delores retires?

(c) How much will Delores have in total when she retires if she combines the

balances of both accounts into one (1) account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning