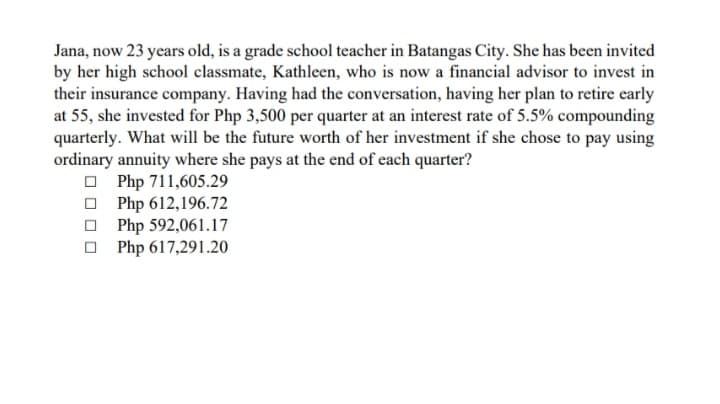

Jana, now 23 years old, is a grade school teacher in Batangas City. She has been invited by her high school classmate, Kathleen, who is now a financial advisor to invest in their insurance company. Having had the conversation, having her plan to retire early at 55, she invested for Php 3,500 per quarter at an interest rate of 5.5% compounding quarterly. What will be the future worth of her investment if she chose to pay using ordinary annuity where she pays at the end of each quarter?

Jana, now 23 years old, is a grade school teacher in Batangas City. She has been invited by her high school classmate, Kathleen, who is now a financial advisor to invest in their insurance company. Having had the conversation, having her plan to retire early at 55, she invested for Php 3,500 per quarter at an interest rate of 5.5% compounding quarterly. What will be the future worth of her investment if she chose to pay using ordinary annuity where she pays at the end of each quarter?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 9FPE

Related questions

Question

M5

Transcribed Image Text:Jana, now 23 years old, is a grade school teacher in Batangas City. She has been invited

by her high school classmate, Kathleen, who is now a financial advisor to invest in

their insurance company. Having had the conversation, having her plan to retire early

at 55, she invested for Php 3,500 per quarter at an interest rate of 5.5% compounding

quarterly. What will be the future worth of her investment if she chose to pay using

ordinary annuity where she pays at the end of each quarter?

O Php 711,605.29

Php 612,196.72

Php 592,061.17

Php 617,291.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning