Demopoulos Company acquired $145,800 of Marimar Co., 8% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Demopoulos Company sold $43,800 of the bonds for 95. Journalize the entries to record the following: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. May 1 b. The semiannual interest received on November 1. Nov. 1 c. The sale.of the bonds on November 1. Nov. 1

Demopoulos Company acquired $145,800 of Marimar Co., 8% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Demopoulos Company sold $43,800 of the bonds for 95. Journalize the entries to record the following: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. May 1 b. The semiannual interest received on November 1. Nov. 1 c. The sale.of the bonds on November 1. Nov. 1

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter22: Corporations: Bonds

Section: Chapter Questions

Problem 10SPA

Related questions

Question

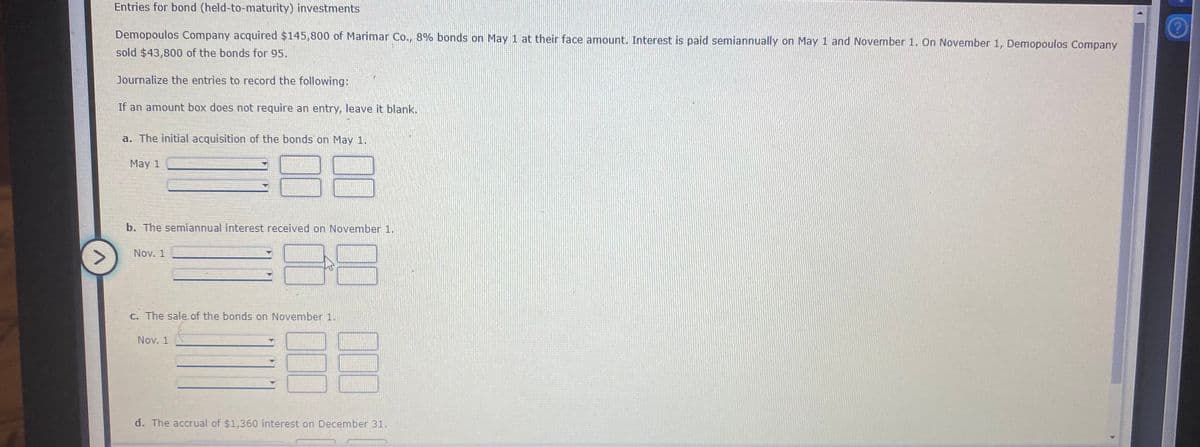

Transcribed Image Text:Entries for bond (held-to-maturity) investments

Demopoulos Company acquired $145,800 of Marimar Co., 8% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Demopoulos Company

sold $43,800 of the bonds for 95.

Journalize the entries to record the following:

If an amount box does not require an entry, leave it blank.

a. The initial acquisition of the bonds on May 1.

May 1

b. The semiannual interest received on November 1.

Nov. 1

C. The sale of the bonds on November 1.

Nov. 1

d. The accrual of $1,360 interest on December 31.

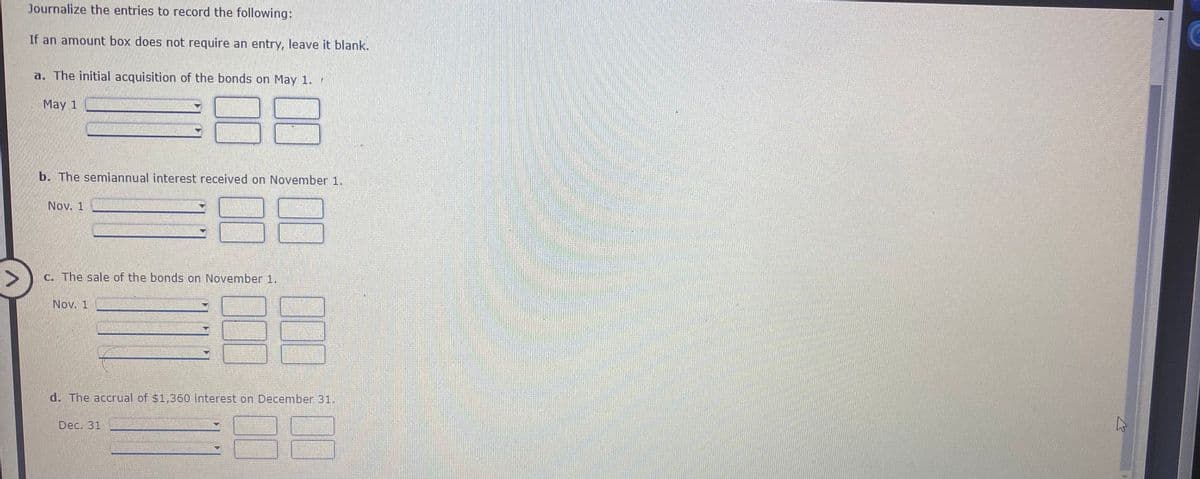

Transcribed Image Text:Journalize the entries to record the following:

If an amount box does not require an entry, leave it blank.

a. The initial acquisition of the bonds on May 1.

May 1

b. The semiannual interest received on November 1.

Nov. 1

c. The sale of the bonds on November 1.

Nov. 1

d. The accrual of $1,360 interest on December 31.

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning