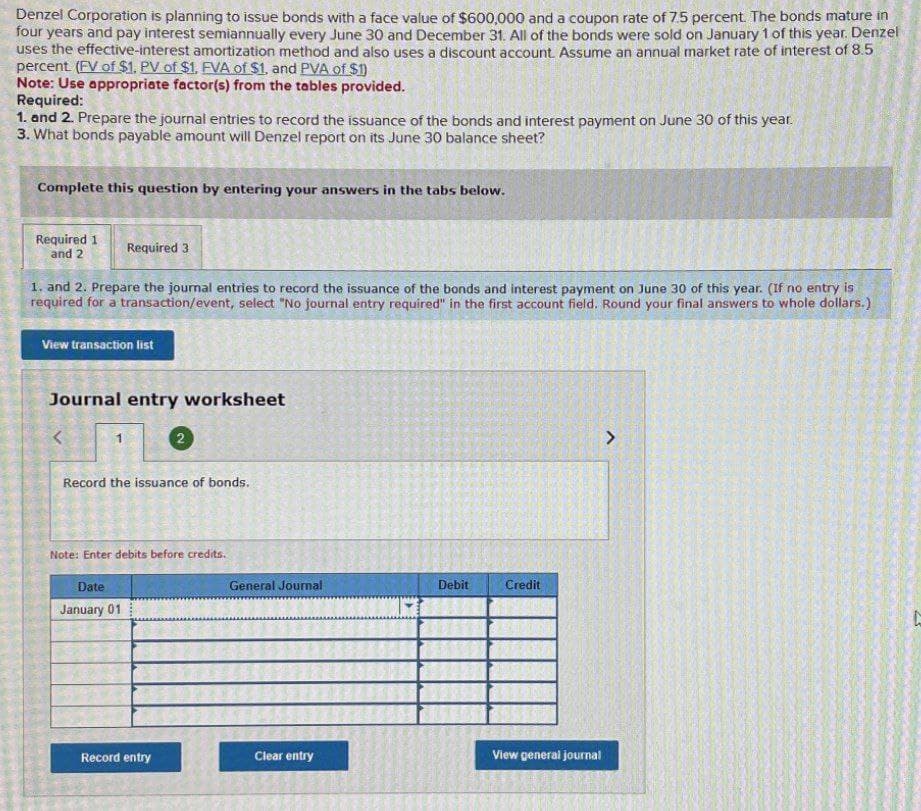

Denzel Corporation is planning to issue bonds with a face value of $600,000 and a coupon rate of 7.5 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Denzel uses the effective-interest amortization method and also uses a discount account. Assume an annual market rate of interest of 8.5 percent (FV of $1. PV of $1. FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required: 1. and 2. Prepare the journal entries to record the issuance of the bonds and interest payment on June 30 of this year. 3. What bonds payable amount will Denzel report on its June 30 balance sheet? Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 1. and 2. Prepare the journal entries to record the issuance of the bonds and interest payment on June 30 of this year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to whole dollars.) View transaction list

Debenture Valuation

A debenture is a private and long-term debt instrument issued by financial, non-financial institutions, governments, or corporations. A debenture is classified as a type of bond, where the instrument carries a fixed rate of interest, commonly known as the ‘coupon rate.’ Debentures are documented in an indenture, clearly specifying the type of debenture, the rate and method of interest computation, and maturity date.

Note Valuation

It is the process to determine the value or worth of an asset, liability, debt of the company. It can be determined by many processes or techniques. Many factors can impact the valuation of an asset, liability, or the company, like:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images