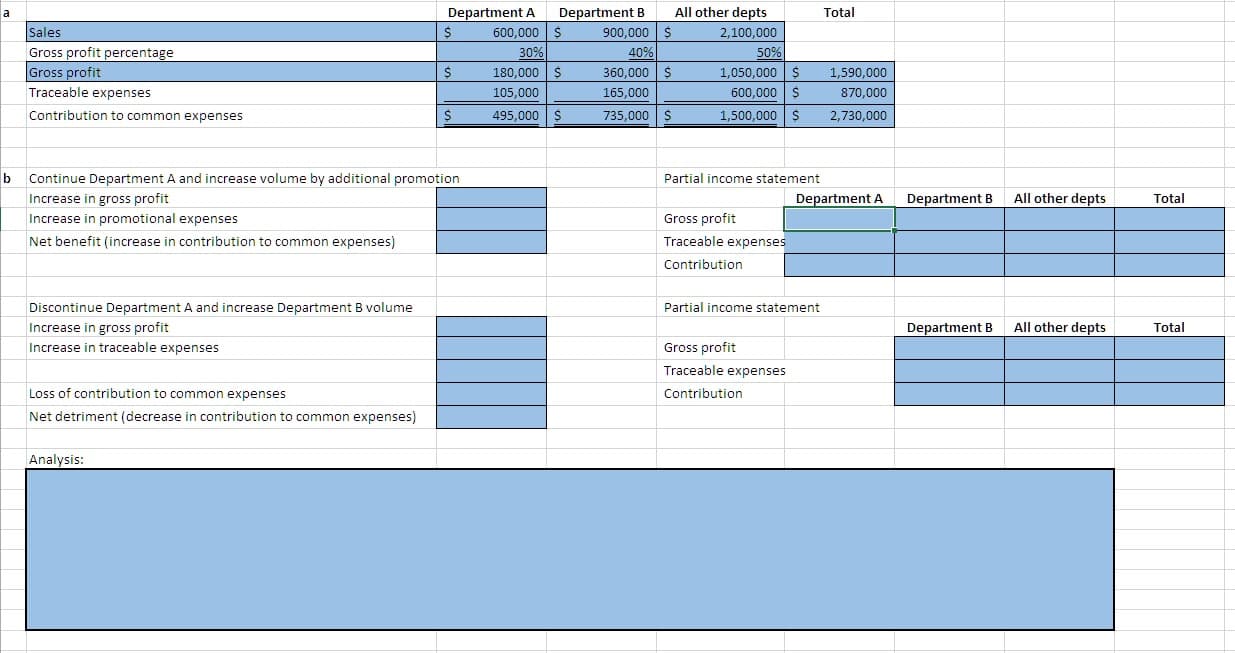

Department A 600,000 $ Department B All other depts Total Sales Gross profit percentage Gross profit $ 900,000 $ 2,100,000 30% 40% 50% 180,000 $ 360,000 $ 1,050,000 $ 1,590,000 Traceable expenses 165,000 105,000 S 600,000 870,000 735,000 $ 1,500,000 $ Contribution to common expenses 495,000 $ 2,730,000 Continue Department A and increase volume by additional promotion Increase in gross profit Increase in promotional expenses Partial income statement Department A All other depts Department B Total Gross profit Traceable expenses Net benefit (increase in contribution to common expenses) Contribution Discontinue Department A and increase Department B volume Partial income statement All other depts Increase in gross profit Increase in traceable expenses Total Department B Gross profit Traceable expenses Loss of contribution to common expenses Contribution Net detriment (decrease in contribution to common expenses) Analysis:

I filled in some of the work for part "a" and was wondering if somebody could check to make sure it's correct. I also don't know what to put in part "b" so assistance there is needed too. See attached spreadsheet for what I mean. Thanks!

Certain operating information is shown below for Palmer Department Store:

| Department A | Department B | All Other Departments | |

| Sales | $600,000 | $900,000 | $2,100,000 |

| Traceable expenses | 105,000 | 165,000 | 600,000 |

| Common expenses | 90,000 | 120,000 | 300,000 |

| Gross profit percentage | 30% | 40% | 50% |

The managers are disappointed with the operating results of department A. They do not believe that competition will permit raising prices; however, they believe that spending $21,000 more for promoting this department's products will increase the physical volume of products sold by 20%.

An alternative is to discontinue department A and use the space to expand department B. It is believed that department B's physical volume of products sold can thus be increased 37.5%. Special sales personnel are needed, however, and department B's traceable expenses would increase by $90,000. Neither alternative would appreciably affect the total common department expense.

Required

a) Calculate the contribution now being made to common expenses by department A, by department B, and by the combination of other departments.

b) Which of the two alternatives should management choose: increase promotional outlays for department A or discontinue department A and expand department B? Support your answer with calculations.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images