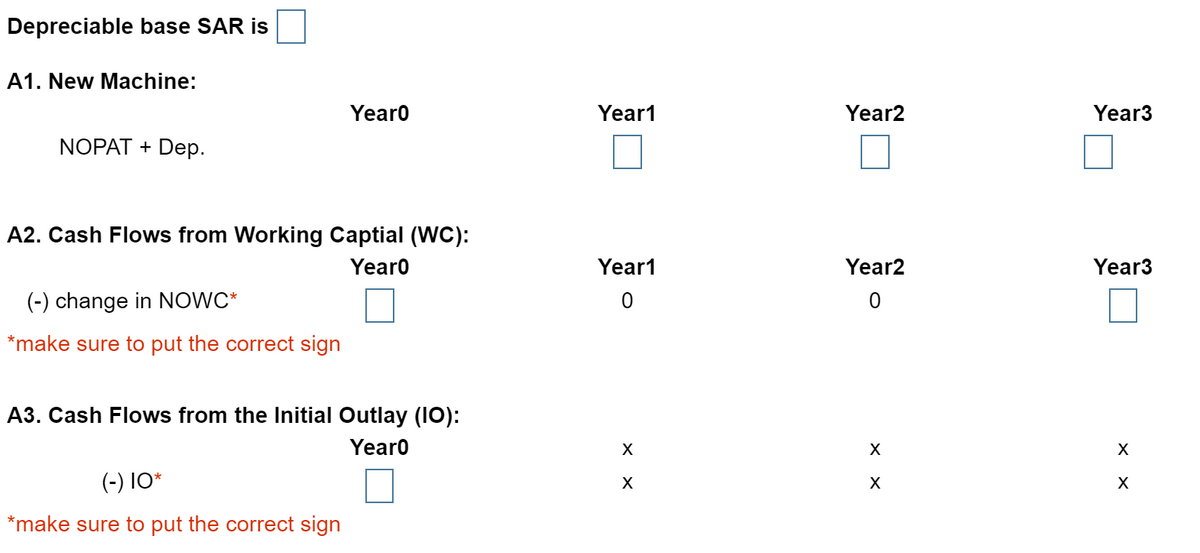

Depreciable base SAR is A1. New Machine: Yearo Year1 Year2 Year3 NOPAT + Dep. A2. Cash Flows from Working Captial (WC): Yearo Year1 Year2 Year3 (-) change in NOWC* *make sure to put the correct sign A3. Cash Flows from the Initial Outlay (IO):

Depreciable base SAR is A1. New Machine: Yearo Year1 Year2 Year3 NOPAT + Dep. A2. Cash Flows from Working Captial (WC): Yearo Year1 Year2 Year3 (-) change in NOWC* *make sure to put the correct sign A3. Cash Flows from the Initial Outlay (IO):

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 64.1C

Related questions

Question

Explansion Project:

ABC is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a life of 3 years.

New Machine:

Life of machine: 3 years

The cost of the new machine is SAR 1,134

The machine will increase the gross profit every year by SAR 314

The market value of the machine when sold at the end of its life is SAR 191

If replaced, then the net working capital (NOWC) will increase every year by SAR 22

ABC will recover all investments in working capital at the end of the new machine's life (after 3 years).

WACC is

9.49%

Tax rate is 40%

ABC uses straight-line Depreciation.

Calculate the follwoing:

Notes:

1. Use 2 Decimals

Transcribed Image Text:Depreciable base SAR is

A1. New Machine:

Yearo

Year1

Year2

Year3

NOPAT + Dep.

A2. Cash Flows from Working Captial (WC):

Yearo

Year1

Year2

Year3

(-) change in NOWC*

*make sure to put the correct sign

A3. Cash Flows from the Initial Outlay (10):

Yearo

(-) 1O*

*make sure to put the correct sign

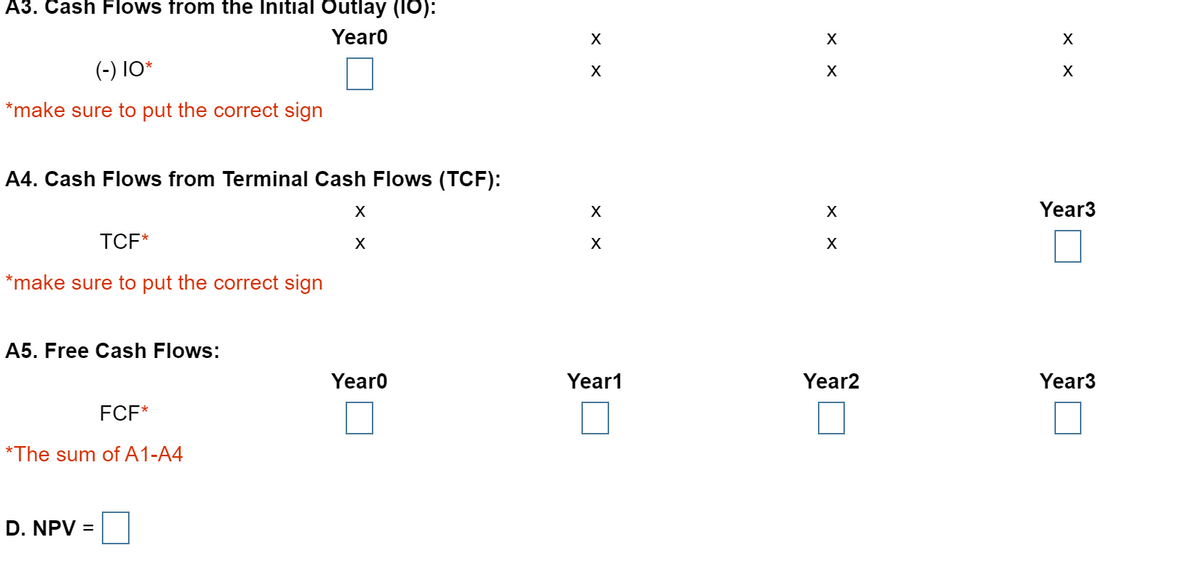

Transcribed Image Text:A3. Cash Flows from the Initial Outlay (I0):

Yearo

X

X

(-) 1O*

*make sure to put the correct sign

A4. Cash Flows from Terminal Cash Flows (TCF):

X

X

Year3

TCF*

X

*make sure to put the correct sign

A5. Free Cash Flows:

Yearo

Year1

Year2

Year3

FCF*

*The sum of A1-A4

D. NPV =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning