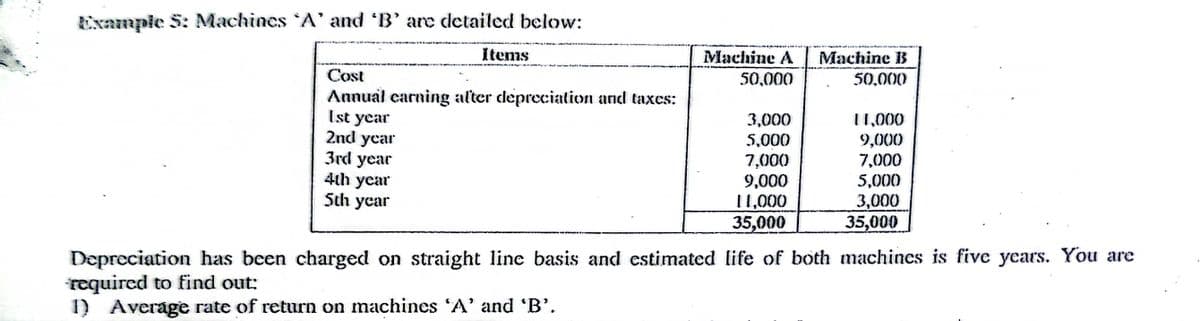

Depreciation has bcen charged on straight line basis and cstimated life of both machincs is five years. You are required to find out: 1) Average rate of return on machines 'A' and 'B'.

Depreciation has bcen charged on straight line basis and cstimated life of both machincs is five years. You are required to find out: 1) Average rate of return on machines 'A' and 'B'.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 23EQ:

23. Consider a simple economy with just two industries: farming and manufacturing. Farming consumes...

Related questions

Question

Transcribed Image Text:Example S: Machines A' and B' are detailed below:

Items

Machine A

Machine B

50,000

Cost

50,000

Annual carning alter depreciation and taxes:

Ist year

2nd year

3rd year

4th year

Sth year

3,000

11,000

5,000

7,000

9,000

11,000

35,000

9,000

7,000

5,000

3,000

35,000

Depreciation has been charged on straight line basis and estimated life of both machines is five years. You are

required to find out:

I) Average rate of return on machines 'A' and 'B'.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage