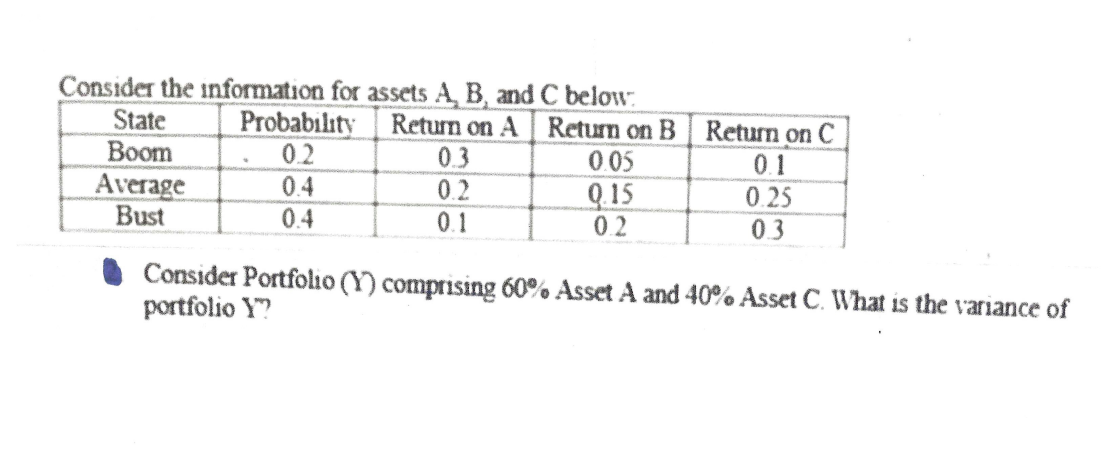

der the information for assets A, B, and C below: State Boom Average Bust Probability 0.2 0.4 0.4 Return on A Return on B Return on C 0.3 0.2 0.1 0.05 Q.15 0.2 0.1 0.25 0.3 Consider Portfolio (Y) comprising 60% Asset A and 40% Asset C. What is the vari portfolio Y?

Q: The common stock of Leaning Tower of Pita, Inc., a restaurant chain, will generate the following…

A:

Q: ). At a certain interest rate the present values of the following two payment patterns are equal:…

A: Present value is the equivalent amount of money today required that is to be paid in future based on…

Q: Q 32 What's the present value, when interest rates are 8.5 percent, of a $225 payment made every…

A: Solution:- When an equal periodic payment is made forever, it is called perpetuity. We know, Present…

Q: A U.S. firm holds an asset in France and faces the following scenario: State 1 State 2 State 3…

A: Probability Spot Rate $/€( State 1 25% 1.28 State 2 25% 1.23 State 3 25% 1.18 State 4 25%…

Q: IRR - Discuss why some investment analysts prefer NPV methods to rank investments while others…

A: NPV and IRR are two main capital budgeting methods that are used quite extensively in the selection…

Q: 1. AA Company issued 5%-preferred stock with a selling price of P50 per share. The cost of issuing…

A: Bartleby honor code states that when multiple questions are asked, the expert is required to solve…

Q: Pujols Lumber Yard has a current accounts receivable balance of $265,038. Credit sales for the year…

A: Days sales in receivables are to be computed by taking account receivables s numerator and credit…

Q: Juliana Cardenas, owner of the Baker Company, was approached by a total local dealer of…

A: In a typical capital budgeting decision, we need to know the annual cost savings that will make the…

Q: selling

A: According to the model S(Spot Price+Put Price P = PV of Strike Price X +Call Price.C S=60,C=5,P=3…

Q: (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is…

A: The internal rate of return is the rate of return at which the net present value is zero. It means…

Q: Payday loans are very short-term loans that charge very high interest rates. You can borrow $400…

A: Rate for 2 weeks (r) = 0.22 or 22% Compound annual rate = ?

Q: Assume the following information (rates are actual 90-day interest rates, not annualized): Spot rate…

A: Given: Particulars Spot rate 1 Canadian Dollar $0.900 Forward rate 1…

Q: A change in the risk premium, E(Rm) - Rf, results in... a) A change in the vertical intercept of…

A: concept. The security market line (SML) gives the market’s expected return at different levels of…

Q: A 5.5% coupon semiannual bond with 9 years remaining until maturity is selling for $935. The face…

A: Given: Particulars Amount Face value (FV) 1000 Years 9 Current price (PV) 935 Coupon rate…

Q: it says its wrong

A: Data given: FV= $60000 n=6 years rate=12% (compounded annually) Required: Amount to be invested at…

Q: A company is considering the purchase of a piece of equipment that will have the following •…

A: Capitalized cost is the today value of all cost that are going to occur in the life of the equipment…

Q: What will be your monthly car payment if you are purchasing a car for $25,000 and you have $2,000…

A: In the mortgage amortization concept, the monthly payments are calculated by taking the monthly…

Q: entory balance was $1.67

A: First of all, find ITOR (Inventory Turnover Ratio) = Cost of Goods Sold COGS/ Average Inventory.…

Q: Explain what is meant by the term 'factoring' for receivables and explain a typical financing…

A: Many small businesses find it difficult to secure funding for new initiatives as they wait for their…

Q: Ariel leased equipment worth $70,000 for 10 years. If the lease rate is 4.75% compounded monthly,…

A: Lease is amount paid to acquire the right to use the equipment during the life of assets. Lease are…

Q: You purchase a vehicle for $25,000 at an 8% APR. Your loan term is 72 months. After one year of…

A: Compute the monthly interest rate, using the equation as shown below: Monthly rate=Annual rate12…

Q: A) Ken deposits #100, and today and another $ 200, mw in Five on years into a fund that pays simple…

A: Future value of a present value is the value of that amount after taking into account the time value…

Q: Afin-Super is the largest superannuation and pension fund in Macquarieland. To promote pension and…

A: Macaulay duration-It can be defined as the weighted average term to maturity of the cash flows from…

Q: or the data set Download data set, perform a 3 month moving average to determine the forecast for…

A: Moving Average Formula= C1+C2+C3+C4+.....CnN C1, C2, C3, C4, ....Cn stands for closing prices,…

Q: When evaluating projects using internal rate of return,? A. projects having lower early-year cash…

A: Internal rate of return is the rate of return at which the net present value is equal to zero.…

Q: n the following information for Sookie’s Cookies Co., calculate the depreciation expense: sales =…

A: The net income is the income earned after doing payment for all expenses that are required for…

Q: What is the NPV for the following project if its cost of capital is 12 percent and its initial…

A: Solution: Net Present Value (NPV) means the net present value of cash inflows from the project after…

Q: What happens to the coupon rate of a $1,000 face value bond that pays $70 annually in interest if…

A: The coupon rate is a fixed-interest rate that attempts to estimate the coupon payment associated…

Q: A sum of money was invested on December 12, 2021 at 3.7% simple interest pa. When the money was…

A: Simple interest is the interest paid on the amount invested without compounding.

Q: the following information to answer the questions. Bond A Bond B Face Value 1000 1000…

A: Price of bond is the present value of coupon payment and present value of par value of bond that is…

Q: To borrow $1,200, you are offered an add-on interest loan at 9 percent. Two loan payments are to be…

A: Borrowed Amount = $1,200 Interest Rate = 9% Time Period = 1 Years

Q: As the current CFO, you are responsible for presenting the dividend policy decisions to the Board of…

A: We need to estimate the impact on the share price due to change in dividend policy.

Q: At December 31, 2020, Albrecht Corporation had outstanding 388,000 shares of common stock and 10,000…

A: Net loss per share = Net loss - Preference dividend/weighted average common shares outstanding

Q: Consider the following information about the various states of economy and the returns of various…

A: State of the Economy Probability T-Bills Philips Pay-up Rubber made Market Index Recession 0.2 7%…

Q: The Hold Up Bank has issued 35,000,000 shares of preferred stock. Each share pays a $4.00 quarterly…

A: Solution: Preference shares are the shares issued by corporations which get fixed dividend payment…

Q: population of a country was approximater million. Use the exponential growth model A = Aet, in which…

A: The growth in the population do not follow any patterns but for simplicity it is assumed that growth…

Q: You invested money in two funds. Last year, the first fund paid a dividend of 9% and the second a…

A: As per Bartleby honor code, when multiple questions are aksed, the expert is required only to solve…

Q: June 4 June 11 June 18 June 25 Units Received 30 80 A. $2.46 C. $2.42 50 40 Unit Cost You sell 100…

A: By using the first-in and first-out concept, the quantity or balance of the stock at the beginning…

Q: Item Beginning Ending Inventory $ 12,435 $ 15,615 Accounts receivable 6,120 6,287 Accounts…

A: The operating cycle represents the number of days takes the company to purchase the goods, sell the…

Q: You are a trader for GreekLetters Ltd. You have sold 100,000 put options on a stock at strike $24.5…

A: We can make the portfolio delta neutral by combining some stocks with the portfolio. Before that we…

Q: Two years ago, you purchased a vehicle for $30,000 at an 8% APR. Your loan term was 60 months. The…

A: Vehicles are easy to buy due to loans available because they can be paid easy monthly payments that…

Q: A call option written on a stock selling for $72 per share with a $72 exercise price. The stock's…

A: Black Scholes Model Particular Value Stock Price S $ 72.00 Strike Price K $ 72.00…

Q: d value : $8,400,000 cash flow :$444,000 Using Information Above what would be the loan amount…

A: Loan to value ratio is very important in the mortgage laons and that decides that how much would be…

Q: Assume that a company issued a bond with $1,000 face value, 10% coupon rate, 20 years maturity, if…

A: Data given: Face value=$1000 Coupon rate=10% N=20 years Yield to maturity=8% Working Note #1…

Q: Is, Inc., has identified an investment project with the following Cash Flow $990 Year

A: Future value of cash include the amount that is being deposited and also the amount of interest…

Q: ABC company has issued a bond that is pays semi-annually at an annual coupon 1.75% and the risk…

A: Bonds are long term source of finance for government and companies and the yield on bond depends on…

Q: * solve

A: is less than fair value will be calculated below-- Given X Strike Price =80, Months of expiration…

Q: When Angela retires in 14 years, he wants to receive $750.00 payments at the start of every month…

A:

Q: Duques Corp. is 100% equity financed. Its cost of equity is 12%. The firm plans to issue bond to…

A: We have to deploy the MM hypothesis and propositions, in the absence of the taxes to answer this…

Q: Sandhill Co. has a capital structure, based on current market values, that consists of 25 percent…

A: Compute the after-tax cost of debt, using the equation as shown below: After tax cost of debt=Cost…

Step by step

Solved in 2 steps

- APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?For minimum variance portfolio,the weight of Asset A1 Ltd in two asset portfolio ,having correlation coefficient of 0 with B2 Ltd , risk of 12 and 15 respectively is a. 0.39 b. 0.61 c. 0.55 d. 0.45Calculate the risk (standard deviation) of a 2-asset portfolio, in which asset A has a variance of return = 0.112, asset B a variance of return = 0.045, and the convariance between the return of 2 assets is = 0.102. asset A comprises 60% ans asset B comprises 40% of the total portfolio. Give your answer 0.000.

- Using the information in the above table answer the following questions: a. What is the expected return of a portfolio with 40% in FUSTA and 60% in FANSA? b. What are the portfolio’s variance and standard deviation using the same asset weights from part (c)?Asset K has an expected return of 10 percent and a standard deviation of 28 percent. Asset L has an expected return of 7 percent and a standard deviation of 18 percent. The correlation between the assets is .40. What are the expected return and standard deviation of the minimum variance portfolio?Asset X has an expected return of 6% and a variance of 0.001. Asset Y has an expected return of 12% and the same variance asX (i.e., 0.001). The returns of assets X and are uncorrelated, and the risk-free rate is 3%. Find the variance of the highestSharpe ratio portfolio that can be formed of the two risky assets X and Y.

- Below are the returns for two assets; State of nature r1 r2 probability Weak growth 15% 15% 1/3 Strong growth 30% 12 1/3 Very strong growth 45% 9 1/3 Expected returns 30% 12 total 1.0 Calculate the two variances and Cov (r1, r2). If assets 1 and 2 are combined 50-50 into a portfolio, what is the variance of this portfolio? Show your calculations.Compute the correlation between assets A and B if you know that the standard deviation of B is 50% of the standard deviation of A and the covarancce between the two assets is 0.5 times the variance of asset A. What is the risk (measured as the variance) of the portfolio created by investing 50% in asset A and 50% in asset B in the previous point? Assume that the variance of the asset A is 4/9.Consider the information below, compute the expected return, variance, and standard deviation. Show the solution. Probability Return of Assets 25% .30 25% .050 25% .100 25% .280

- The following table provides information relating to Omega Ltd, as well as the market portfolio. The risk-free rate of return is 3.4% . Asset Excess Return Variance Beta Omega 12% 0.021904 1.4 M 8.1% 0.010201 1 What is Omega's M2 value? a. 7.41% b. 11.59% c. 8.99% d. 9.27% What is Omega's Sharpe Ratio? a. 0.061 b. 0.811 c. 0.086 d. 0.581 please explain the calculation step by stepUncorrelated assets A and B have standard deviation of return 0.3 and 0.4 respectively. If a denotes the proportion invested in A, which value of a leads to the Minimum Variance Portfolio? A. 0.55 B. 0.64 C. 0.12 D. 0.80 .Expected Return and risk of Hitech Ltd. is 13% and variance 225 % square and Expected Return and risk of Sigma Ltd is 18 % and 400 % Square, the Correlation Coefficient between the two is 0.2. Find the minimum variance portfolio. Also find the return and risk of the minimum variance portfolio. Clearly show the diversification benefit ?