Using the information in the above table answer the following questions: a. What is the expected return of a portfolio with 40% in FUSTA and 60% in FANSA? b. What are the portfolio’s variance and standard deviation using the same asset weights from part (c)?

Using the information in the above table answer the following questions: a. What is the expected return of a portfolio with 40% in FUSTA and 60% in FANSA? b. What are the portfolio’s variance and standard deviation using the same asset weights from part (c)?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

Using the information in the above table answer the following questions:

a. What is the expected return of a portfolio with 40% in FUSTA and 60% in

FANSA?

b. What are the portfolio’s variance and standard deviation using the same asset

weights from part (c)?

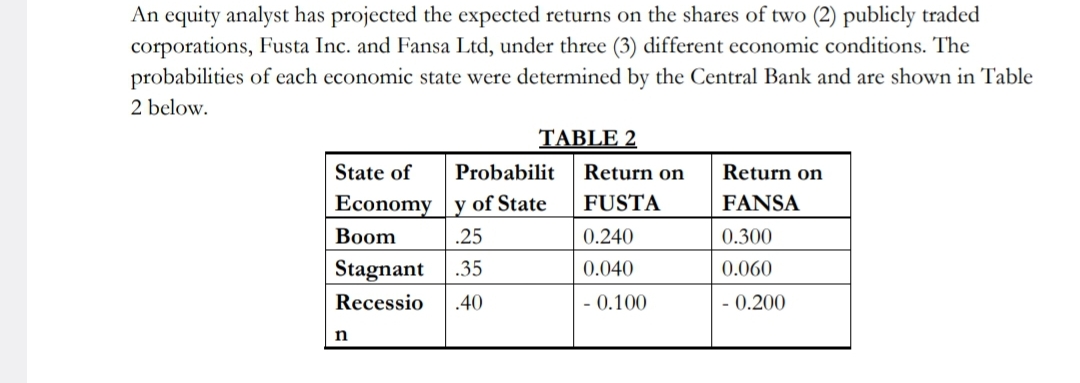

Transcribed Image Text:An equity analyst has projected the expected returns on the shares of two (2) publicly traded

corporations, Fusta Inc. and Fansa Ltd, under three (3) different economic conditions. The

probabilities of each economic state were determined by the Central Bank and are shown in Table

2 below.

TABLE 2

State of

Probabilit

Return on

Return on

Economy y of State

FUSTA

FANSA

Boom

.25

0.240

0.300

Stagnant .35

0.040

0.060

Recessio .40

-0.100

-0.200

n

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT