Describe any 4 (Four) substantive procedures the auditor should perform to obtain sufficient and appropriate audit evidence in relation to the matters identified regarding the inventory valuation of Polobalancing Dog products.

Describe any 4 (Four) substantive procedures the auditor should perform to obtain sufficient and appropriate audit evidence in relation to the matters identified regarding the inventory valuation of Polobalancing Dog products.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 50P

Related questions

Question

Describe any 4 (Four) substantive procedures the auditor should perform to obtain sufficient and appropriate audit evidence in relation to the matters identified regarding the

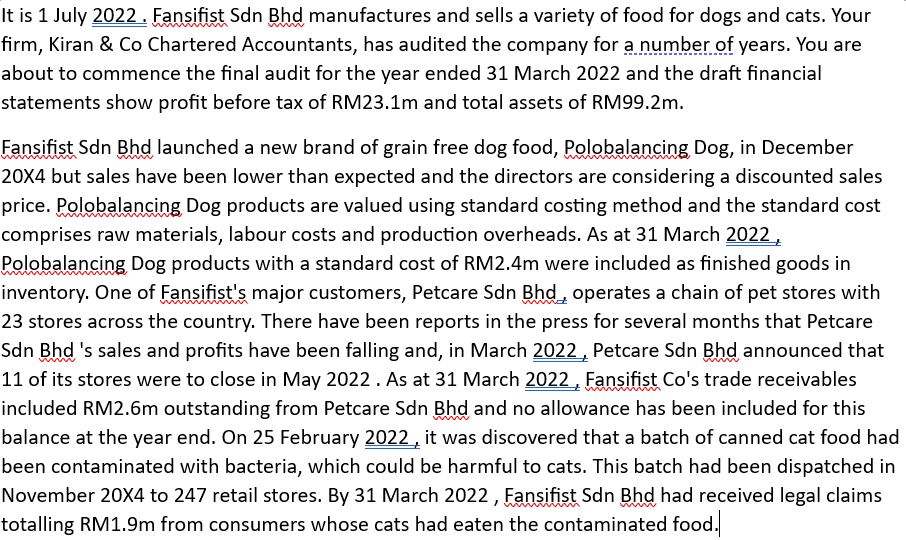

Transcribed Image Text:It is 1 July 2022. Fansifist Sdn Bhd manufactures and sells a variety of food for dogs and cats. Your

firm, Kiran & Co Chartered Accountants, has audited the company for a number of years. You are

about to commence the final audit for the year ended 31 March 2022 and the draft financial

statements show profit before tax of RM23.1m and total assets of RM99.2m.

Fansifist Sdn Bhd launched a new brand of grain free dog food, Polobalancing Dog, in December

20X4 but sales have been lower than expected and the directors are considering a discounted sales

price. Polobalancing Dog products are valued using standard costing method and the standard cost

comprises raw materials, labour costs and production overheads. As at 31 March 2022,

Polobalancing Dog products with a standard cost of RM2.4m were included as finished goods in

inventory. One of Fansifist's major customers, Petcare Sdn Bhd, operates a chain of pet stores with

23 stores across the country. There have been reports in the press for several months that Petcare

Sdn Bhd 's sales and profits have been falling and, in March 2022, Petcare Sdn Bhd announced that

11 of its stores were to close in May 2022. As at 31 March 2022, Fansifist Co's trade receivables

included RM2.6m outstanding from Petcare Sdn Bhd and no allowance has been included for this

balance at the year end. On 25 February 2022, it was discovered that a batch of canned cat food had

been contaminated with bacteria, which could be harmful to cats. This batch had been dispatched in

November 20X4 to 247 retail stores. By 31 March 2022, Fansifist Sdn Bhd had received legal claims

totalling RM1.9m from consumers whose cats had eaten the contaminated food.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning