Describe possible sources of random and systematic errors in the given measurement. The annual incomes of 200 people obtained from their tax returns. Choose the correct answer below. O A. Random errors could occur when taxpayers are given the wrong forms from their employers, but systematic errors could not occur OB. Random errors could occur when taxpayers make honest mistakes or when the income accounts are recorded incorrectly. Systematic errors could occur when dishonest taxpayers report income amounts that are lower than their true amounts. OC. Random errors could not occur, but systematic errors could occur when the taxpayer accidently uses last year's tax forms instead of the current year's tax forms. O D. Random errors could occur when taxpayers forget to file their taxes. Systematic errors could occur when dishonest taxpayers report income amounts that are greater than their true amounts. Next

Describe possible sources of random and systematic errors in the given measurement. The annual incomes of 200 people obtained from their tax returns. Choose the correct answer below. O A. Random errors could occur when taxpayers are given the wrong forms from their employers, but systematic errors could not occur OB. Random errors could occur when taxpayers make honest mistakes or when the income accounts are recorded incorrectly. Systematic errors could occur when dishonest taxpayers report income amounts that are lower than their true amounts. OC. Random errors could not occur, but systematic errors could occur when the taxpayer accidently uses last year's tax forms instead of the current year's tax forms. O D. Random errors could occur when taxpayers forget to file their taxes. Systematic errors could occur when dishonest taxpayers report income amounts that are greater than their true amounts. Next

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.3: Measures Of Spread

Problem 4GP

Related questions

Question

Please need it asap

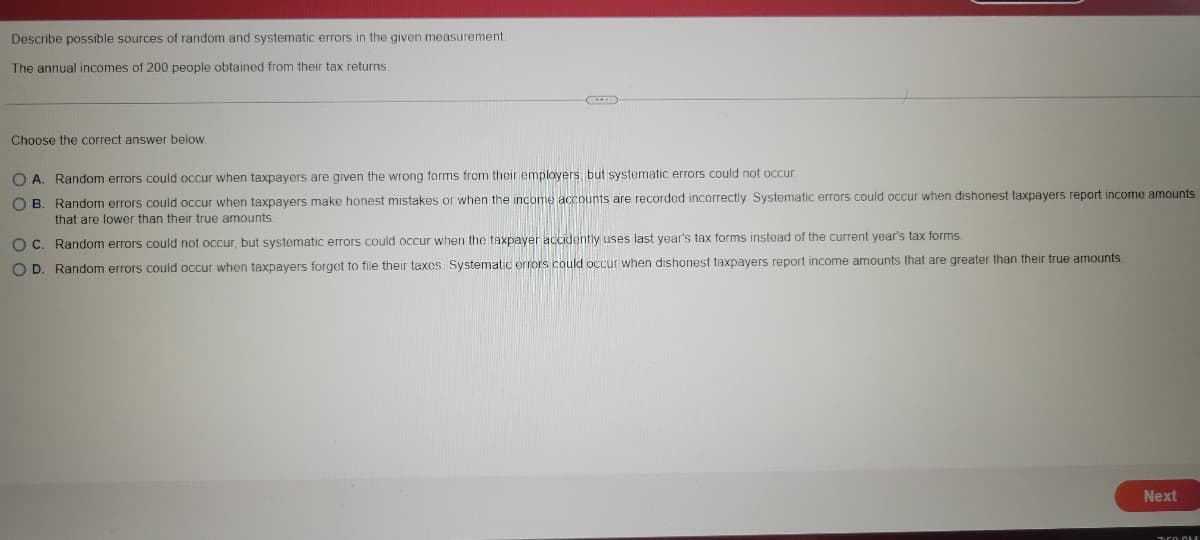

Transcribed Image Text:Describe possible sources of random and systematic errors in the given measurement.

The annual incomes of 200 people obtained from their tax returns.

Choose the correct answer below.

O A. Random errors could occur when taxpayers are given the wrong forms from their employers, but systematic errors could not occur.

OB. Random errors could occur when taxpayers make honest mistakes or when the income accounts are recorded incorrectly. Systematic errors could occur when dishonest taxpayers report income amounts

that are lower than their true amounts.

OC. Random errors could not occur, but systematic errors could occur when the taxpayer accidently uses last year's tax forms instead of the current year's tax forms.

O D. Random errors could occur when taxpayers forget to file their taxes. Systematic orrors could occur when dishonest taxpayers report income amounts that are greater than their true amounts.

Next

750 D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill