determine the amount of itemized deduction for medical expenses Taxpayer may deduct after all applicable limitations. $7,000 $7,130 $8,250 $9,000 $11,000

determine the amount of itemized deduction for medical expenses Taxpayer may deduct after all applicable limitations. $7,000 $7,130 $8,250 $9,000 $11,000

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 37P

Related questions

Question

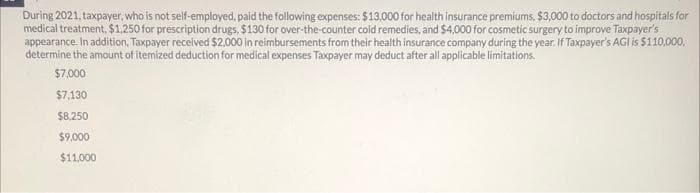

Transcribed Image Text:During 2021, taxpayer, who is not self-employed, paid the following expenses: $13,000 for health insurance premiums, $3,000 to doctors and hospitals for

medical treatment. $1,250 for prescription drugs, $130 for over-the-counter cold remedies, and $4,000 for cosmetic surgery to improve Taxpayer's

appearance. In addition, Taxpayer received $2,000 in reimbursements from their health insurance company during the year. If Taxpayer's AGI is $110,000,

determine the amount of itemized deduction for medical expenses Taxpayer may deduct after all applicable limitations.

$7,000

$7,130

$8,250

$9,000

$11,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT