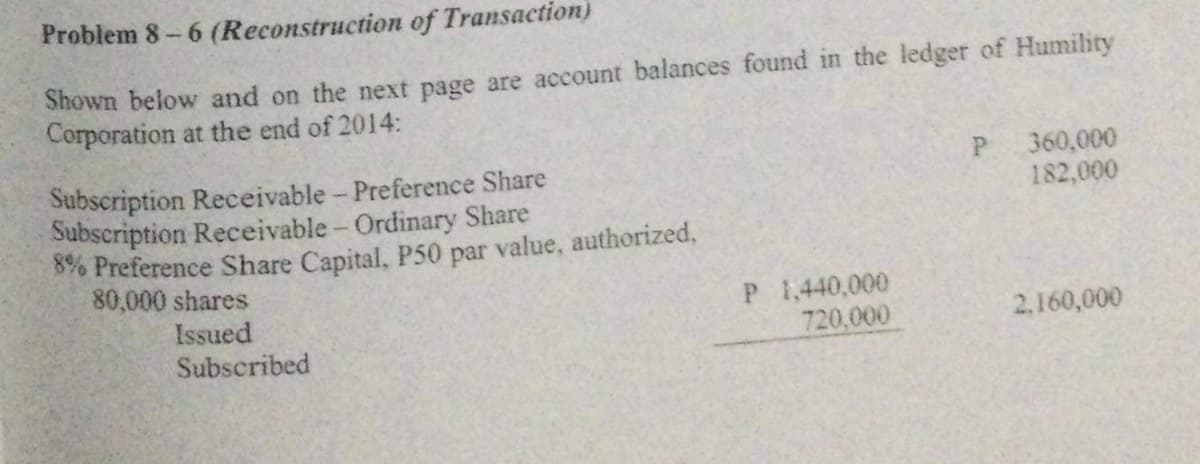

Problem 8-6 (Reconstruction of Shown below and on the next page are account balances found in the ledger of Humility Corporation at the end of 2014: P 360,000 182,000 Subscription Receivable - Preference Share Subscription Receivable - Ordinary Share 8% Preference Share Capital, P50 par value, authorized, 80,000 shares Issued P 1,440,000 720,000 2,160,000 Subscribed

Problem 8-6 (Reconstruction of Shown below and on the next page are account balances found in the ledger of Humility Corporation at the end of 2014: P 360,000 182,000 Subscription Receivable - Preference Share Subscription Receivable - Ordinary Share 8% Preference Share Capital, P50 par value, authorized, 80,000 shares Issued P 1,440,000 720,000 2,160,000 Subscribed

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.23E

Related questions

Question

Answer 4 to 6

Transcribed Image Text:Problem 8-6 (Reconstruction of Transaction)

Shown below and on the next page are account balances found in the ledger of Humility

Corporation at the end of 2014:

P

360,000

182,000

Subscription Receivable - Preference Share

Subscription Receivable - Ordinary Share

8% Preference Share Capital, P50 par value, authorized,

80,000 shares

Issued

P 1,440,000

720,000

2,160,000

Subscribed

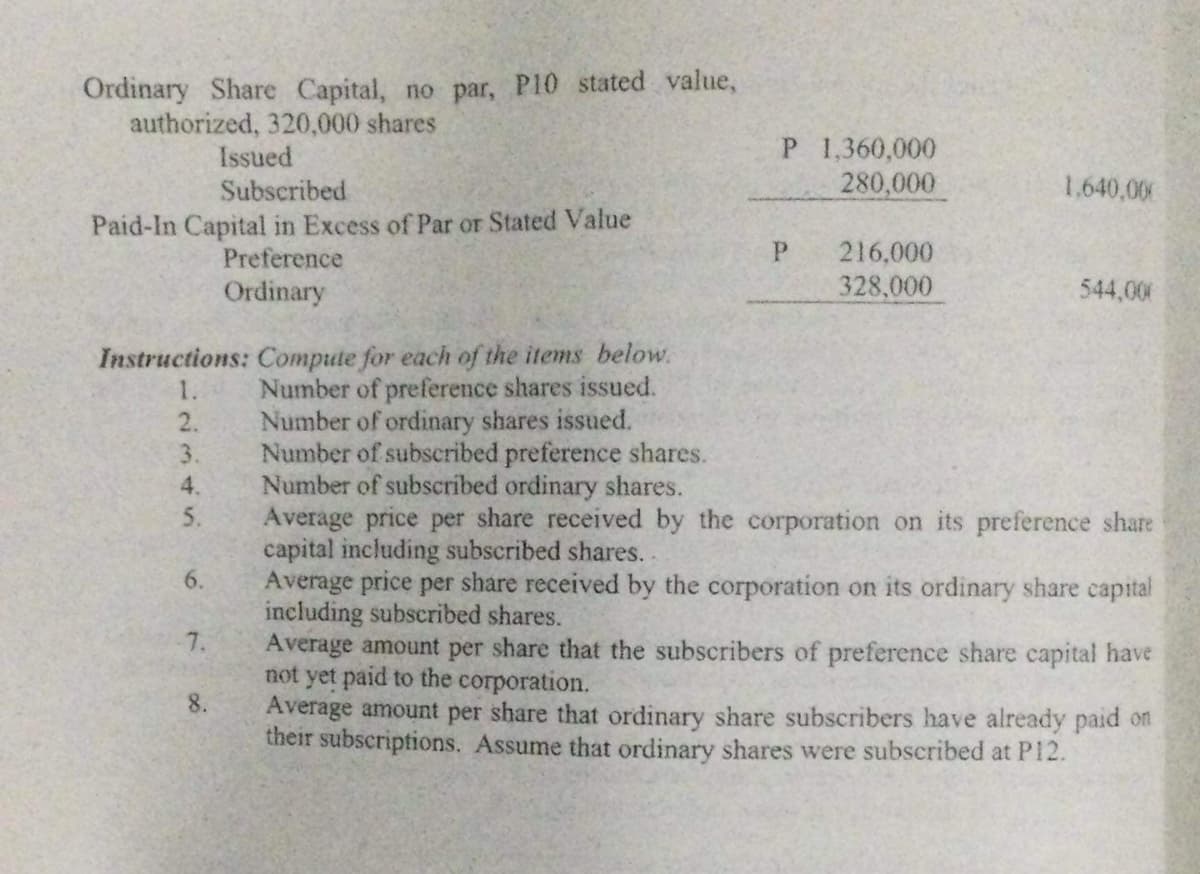

Transcribed Image Text:Ordinary Share Capital, no par, P10 stated value,

authorized, 320,000 shares

P 1,360,000

Issued

280,000

Subscribed

1.640,000

Paid-In Capital in Excess of Par or Stated Value

Р

216,000

Preference

328,000

Ordinary

544,000

Instructions: Compute for each of the items below.

Number of preference shares issued.

Number of ordinary shares issued.

1.

3.

Number of subscribed preference shares.

Number of subscribed ordinary shares.

Average price per share received by the corporation on its preference share

capital including subscribed shares..

6.

Average price per share received by the corporation on its ordinary share capital

including subscribed shares.

7.

Average amount per share that the subscribers of preference share capital have

not yet paid to the corporation.

8.

Average amount per share that ordinary share subscribers have already paid on

their subscriptions. Assume that ordinary shares were subscribed at P12.

2345

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning