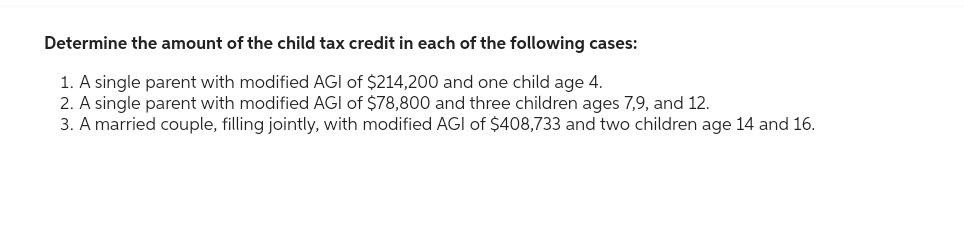

Determine the amount of the child tax credit in each of the following cases: 1. A single parent with modified AGI of $214,200 and one child age 4. 2. A single parent with modified AGI of $78,800 and three children ages 7,9, and 12. 3. A married couple, filling jointly, with modified AGI of $408,733 and two children age 14 and 16.

Determine the amount of the child tax credit in each of the following cases: 1. A single parent with modified AGI of $214,200 and one child age 4. 2. A single parent with modified AGI of $78,800 and three children ages 7,9, and 12. 3. A married couple, filling jointly, with modified AGI of $408,733 and two children age 14 and 16.

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 19CE: Compute the 2019 AMT exemption for the following taxpayers. a. Bristol, who is single, reports AMTI...

Related questions

Question

N4.

Account

Transcribed Image Text:Determine the amount of the child tax credit in each of the following cases:

1. A single parent with modified AGI of $214,200 and one child age 4.

2. A single parent with modified AGI of $78,800 and three children ages 7,9, and 12.

3. A married couple, filling jointly, with modified AGI of $408,733 and two children age 14 and 16.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT