Dyer, Incorporated, completed its first year of operations on December 31, 2021, Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement: Income Statement, 2021 Rent Revenue Expenses Salaries and Wages Expense Repairs and Maintenance Expense Rent Expense Utilities Expense Travel Expense Total Expenses Income $29,500 13,000 9,000 4,000 3,000 $114,000 $1,500 56,500 You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In your audit, you developed additional data as follows: a Wages for the last three days of December amounting to $310 were not recorded or paid. b. The $400 telephone bill for December 2021 has not been recorded or paid c. Depreciation of equipment amounting to $23,000 for 2021 was not recorded. d. Interest of $500 was not recorded on the notes payable by Dyer, Incorporated. e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2022. f Supplies costing $600 were used during 2021, but this has not yet been recorded. g. The income tax expense for 2021 is $7,000, but it won't actually be paid until 2022.

Dyer, Incorporated, completed its first year of operations on December 31, 2021, Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement: Income Statement, 2021 Rent Revenue Expenses Salaries and Wages Expense Repairs and Maintenance Expense Rent Expense Utilities Expense Travel Expense Total Expenses Income $29,500 13,000 9,000 4,000 3,000 $114,000 $1,500 56,500 You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In your audit, you developed additional data as follows: a Wages for the last three days of December amounting to $310 were not recorded or paid. b. The $400 telephone bill for December 2021 has not been recorded or paid c. Depreciation of equipment amounting to $23,000 for 2021 was not recorded. d. Interest of $500 was not recorded on the notes payable by Dyer, Incorporated. e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2022. f Supplies costing $600 were used during 2021, but this has not yet been recorded. g. The income tax expense for 2021 is $7,000, but it won't actually be paid until 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7E: Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December...

Related questions

Question

Please do not give solution in image format thanku

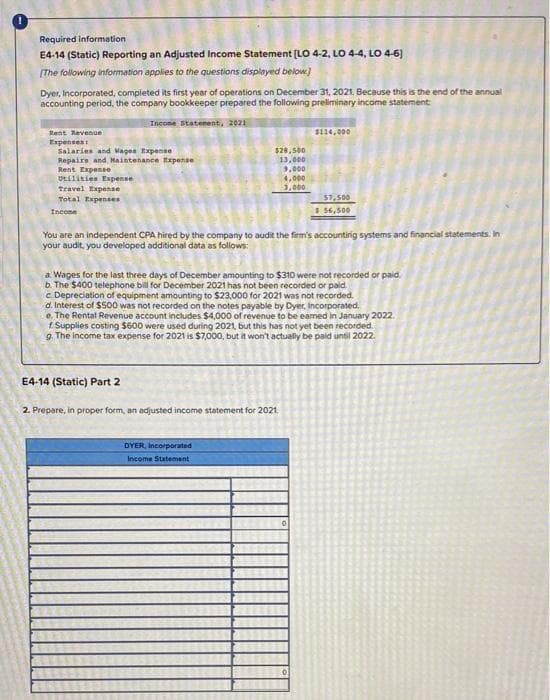

Transcribed Image Text:Required information

E4-14 (Static) Reporting an Adjusted Income Statement [LO 4-2, LO 4-4, LO 4-6)

[The following information applies to the questions displayed below)

Dyer, Incorporated, completed its first year of operations on December 31, 2021, Because this is the end of the annual

accounting period, the company bookkeeper prepared the following preliminary income statement

Income Statement, 2021

Rent Revenue

Expenses

Salaries and Wages Expense

Repairs and Maintenance Expense

Rent Expense

Utilities Expense

Travel Expense

Total Expenses

Income

$28,500

13,000

9,000

4,000

1,000

E4-14 (Static) Part 2

You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In

your audit, you developed additional data as follows:

$114,000

a. Wages for the last three days of December amounting to $310 were not recorded or paid.

b. The $400 telephone bill for December 2021 has not been recorded or paid.

c Depreciation of equipment amounting to $23,000 for 2021 was not recorded.

d. Interest of $500 was not recorded on the notes payable by Dyer, Incorporated.

e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2022.

f Supplies costing $600 were used during 2021, but this has not yet been recorded.

g. The income tax expense for 2021 is $7,000, but it won't actually be paid until 2022

2. Prepare, in proper form, an adjusted income statement for 2021.

DYER, Incorporated

Income Statement

$7,500

$ 56,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning