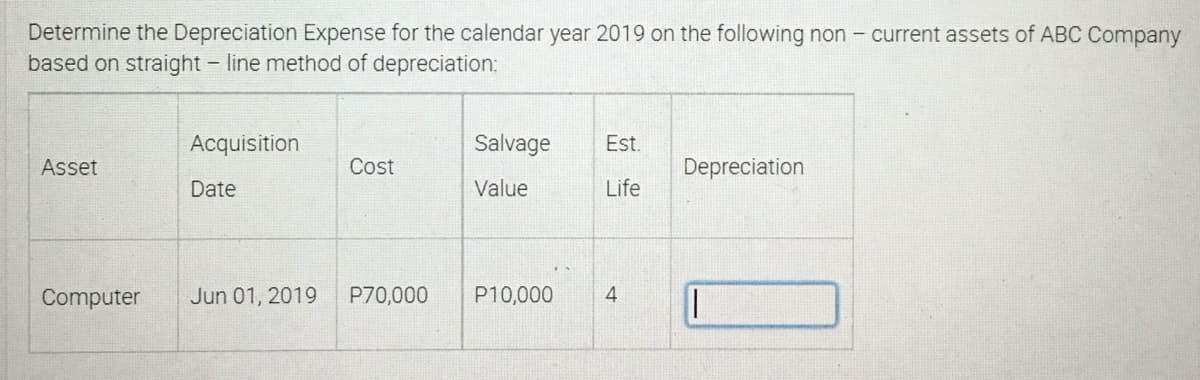

Determine the Depreciation Expense for the calendar year 2019 on the following non - current assets of ABC based on straight-line method of depreciation: Acquisition Salvage Est. Asset Cost Depreciation Date Value Life Computer Jun 01, 2019 P70,000 P10,000 4 ||

Q: Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $20 per unit.…

A: Contribution margin income statement is the statement of income in which it is clearly shown about…

Q: Instructions In not less than five sentences, choose ONE FS item and explain what kind of audit…

A: The risk of material misstatement at the assertion level for the class of transactions account…

Q: December 31 Accounts Payable P500,000 P700,000 Inventory P300,000 P450,000 Accounts Receivable…

A:

Q: what are the pro and cons for traditional budgeting?

A: Traditional Budgeting Traditional budgeting which provides the budgetary requirement of the business…

Q: a. Determine the standard unit materials cost per pound for a standard batch. Round the per unit…

A: Solution:- a)Determine the standard unit materials cost per pound for a standard batch as follows…

Q: The bank statement opposite shows transactions over a one-month period for a savings account that…

A: Interest on savings account is calculated on daily balance in the account.

Q: CERISE Company uses accrual basis of accounting. Wages expense account had a balance of $255,000 at…

A: Cash paid for the wages will be calculated by the following formula: Cash paid for wages during the…

Q: PAGE 5 Estimated selling price 6,000,000 Cost to complete 700,000 Cost to sell 800,000 Normal profit…

A: Measurement of inventory is should be based on following:- 1) If net realisable value of finished…

Q: During the year ended 30 June 2021, a parent entity rents a warehouse from a subsidiary entity for…

A: Eliminating entries adjust the totals of the individual account balances of the separate…

Q: 2. Determine the share of income for each partner in 2013 and 2014 under each of the following…

A: Partners agreed to share income equally, so ratio would be = 1:1

Q: A plant bought a new equipment for P220,000and used it for 10 years, the life span of the equipment.…

A: Depreciation is a method of reducing the capitalized cost of long-lived operating assets or plant…

Q: SCARLET Corporation has an authorized capital of 10,000 shares of 100 par, 8% cumulative preference…

A: Formula: Book value per ordinary share = Total Equity available to Ordinary shareholders / No. of…

Q: gear involves many complex and specialized activities that, before now, have lacked of organization…

A: As the company manufactures Gear which involves complex, difficult and specialized activities,…

Q: On January 1, 2006, Wolf Company issued its 10% bonds in the face amount of P5,000,000, which mature…

A: The bonds are issued at premium when market rate is lower than the coupon rate of bonds payable.

Q: At the beginning of current year, BLACKPINK Company had 480,000 $60 par value ordinary shares and…

A: Formula: Basic earnings per share = (Net income - Preferred dividend)/ Weighted average number of…

Q: The management of Kunkel Company is considering the purchase of a $38,000 machine that would reduce…

A: Net Present value is present value of cash flow minus initial investment

Q: Assuming net income for 20x1 of P132,000, how much profit should be allocated to each partner? a.…

A: Total Month Marie Pez Weighted capital of marie Weighted capital of Pez Jan-Mar…

Q: What is the net effect of the above errors in the 2021 net income? (If understated, put a negative…

A: The accrued expense are those expenses that are due but the payment of these expenses are not made…

Q: ed as one level item. sts. om variable manufacturing

A: Contribution income statement shows the contribution margin by deducting variable cost from sales…

Q: At the beginning of current year, BLACKPINK Company had 480,000 $60 par value ordinary shares and…

A: Diluted earnings per share (Diluted EPS) : Diluted EPS is the company's earnings per share if all…

Q: Business transaction Jan 1 started business with RM 12000 cash. 2 Purchased furniture worth RM 5000…

A: Journal- Journalizing is the process by which businesses record their transactions in a systematic…

Q: d. The partners agreed to share income by allowing interest of 12 percent on their original…

A:

Q: Answer the following Questions Question 1: (B1& C2&D3) The following items were taken from the…

A: Balance sheet is one of the statement of financial position which shows all assets, all liabilities…

Q: The shareholders' equity of Laguz Inc. as of January 1, 2021, is as follows: Share Capital Ordinary…

A: The shareholder's equity is the sum total of all the types of shares (including equity shares, share…

Q: On December 30, 2021, CHERRY Company paid $2,000,000 for land. On December 31, 2021, the current…

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued…

Q: BLACK JACK Company purchased an automotive equipment on June 30, 2018 for $3,000,000. At the date of…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: Mercedes Corporation produces and sells coffee. It currently roasts coffee using a manual operation…

A: NPV means PV of net benefits which will be received from the project over the life of the project.…

Q: charges depreciation at 5% p.a. on a straight-line basis. (f) In May 2019, a SYD sold…

A: Basic Information The question is related to Consolidated Financial Statements. The MEL Ltd. is…

Q: General Mills is authorized to issue 13 million, $1 par common shares. During 2021, its first year…

A: Introduction: Common shares normally provide shareholders the right to vote at shareholder meetings.…

Q: Below are the Statement of Financial Position of Malibu Finance Inc for the year 2020. Statement of…

A: Formulas: Debt ratio = Total liabilities / Total assets Equity ratio = Total shareholders equity /…

Q: Included in Witt Company’s liability account balance at December 31, 2021 were the following: 14%…

A: Current liabilities It is the debts a company owes that must be paid within one year.

Q: The partners of the 3E Partnership have decided to liquidate their partnership. The partnership…

A: Case (a): All partners are in good financial standing, and additional goods are sold for P300,000.…

Q: adjusted Accounts Receivable on December 31, 2021?

A: Person from whom amounts are due for goods sold or services rendered or in respect of contractual…

Q: Chancellor Limited provided a loan of $1 500 000 to its subsidiary Park Limited. On consolidation,…

A: In consolidated financial statements the intra group receivable and payable are to be eliminated,…

Q: Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following…

A: At the end of each budget period, the budget for terminating completed products inventory computes…

Q: * 2. What is the diluted earnings per share? (Present answer in 2 decimal places, example: x.xx) At…

A: Basic earnings per share is the income attributable per share based on the weighted average number…

Q: QUESTION 1 On 1 January 2016, the management of ZAIDY granted an option for 3,000 shares employee on…

A: Employees Stock option Plan: It is an employees compensation scheme of employees stock option plan…

Q: A restriction on retained earnings a. Reduces retained earnings available for the declaration of…

A: Introduction:- Retained earnings means the accumulated or total amount of earnings that the…

Q: Income Statement The revenues and expenses of Paradise Travel Service for the year ended Fees earned…

A: Net income = Fees earned - Total Expenses

Q: Explain the components of the balance sheet.

A: The balance sheet is also known as "position statement" of the business, as it tells…

Q: Discuss the relationship between Management Accounting and Financial Accounting

A: Accounting comprises of processes that allow access to critical information that aids in…

Q: A purely self-employed individual’s gross sales/receipts and other non-operating income do not…

A: VAT Special Rate applicability to Self Employed Individuals: The 8% tax is applicable only to…

Q: Separate income statement for ABC and XYZ for the year ended, 2022 are summarized as follows:…

A:

Q: 2. What should be reported in a hyper-inflationary statement of financial position prepared on…

A: The carrying value of the assets is inflated as per the inflation index to be shown in the…

Q: Gil wants to have $9,625 in 8 years. Use the present value formula to calculate how much he should…

A: Present value (PV) is the current value of a future cash flows given a specified rate of return

Q: A company plans to tighten its credit policy. The new policy will decrease the average number of…

A: In a credit policy if the collection period is reduced, the turnover of the business and accounts…

Q: BLACK JACK Company purchased an automotive equipment on June 30, 2018 for $3,000,000. At the date of…

A: Depreciation formula as per straight line method = (Cost- residual value)/useful life

Q: What is the 2021 pension expense?

A: Pension expense (PE) refers to those expenses which are charged by the company in relation to pay…

Q: ears and would have a useful life of 5 years and would have a salvage value of P7,000. For tax…

A: Net present value is the difference between the present value of cash flow and initial investment…

Step by step

Solved in 3 steps

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000An extract of the Asset Register of Ace Pty Ltd (“Ace”) for the 2018 - 2019 Income year isshown as follows:Asset Cost OpeningAdjustableValueMethod EffectiveLifeDecline inValue forThis PeriodClosingAdjustableValuePrinter 1,200 1,200 DiminishingValue3 years 400 800Desks 3,000 2,400 Prime Cost 10 years 300 2,100Appliances 2,600 1,040 Prime Cost 5 years 520 520All depreciable assets are 100% for business use and Ace uses a low-value pool for all eligibleassets. The closing value of the low-value pool at 30 June 2019 was $8,000. Ace purchased a camera on 20 Jan 2020 for $840.Advise Ace of the Income Tax consequences arising out of the above information for the 2019 - 2020 Income year assuming Ace is not a small business entity.An entity accounts for non-current assets using the revaluation model. On 30 June 2020, the entity classified two items of non-current assets as held for sale in accordance with PFRS5. The following information relates to these assets: Asset 1 Asset 2 Carrying amount before classification as held for sale P400,000 P300,000 Revaluation surplus before classification as held for sale 60,000 30,000 Fair value, 30 June 2020 450,000 260,000 Estimated costs to sell 20,000 12,000 The balance of revaluation surplus as of 30 June 2020 after classification of the assets as held for sale is

- An entity accounts for non-current assets using the revaluation model. On 30 June 2020, the entity classified two items of non-current assets as held for sale in accordance with PFRS5. The following information relates to these assets: Asset 1 Asset 2 Carrying amount before classification as held for sale P400,000 P300,000 Revaluation surplus before classification as held for sale 60,000 30,000 Fair value, 30 June 2020 450,000 260,000 Estimated costs to sell 20,000 12,000 The total expense to be recognized in profit or loss related to these assets isPrepare an ECOBV amortization schedule at the date of acquisition What is the amount of gross profit to be deferred in 2021? What consolidation entries are needed at the end of 2021?An entity accounted for noncurrent assets using the cost model. On July 1, 2019, the entity classified an equipment as held for sale. At the date, the carrying amount was P5,000,000, the fair value was estimated at P3,500,000 and the cost of disposal at P100,000. On December 31, 2019, the equipment was sold for net proceeds of P2,500,000. What amount should be reported as an impairment loss for 2019? a. 1,600,000 b. 2,500,000 c. 1,500,000 d. 900,000 2. What amount should be reported as loss on disposal for 2019? a. 1,500,000 b. 2,500,000 c. 1,600,000 d. 900,000

- Required: Compute for the following: Gain or loss on sale of Asset P Total depreciation expense for 2021 Adjusted cost of PPE as of Dec. 31, 2021 Carrying amount of PPE as of Dec. 31, 2021Surreal Company accounted for non-current assets using the revaluation model. On October 1, 2021, the entity classified a land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At same date, the fair value of the land was estimated at P5,500,000 and the cost of disposal at P100,000. On December 31,2021, the fair value less cost of disposal of the land did not change. The land was sold on January 31,2022 for P6,000,000. Required: 1. What amount should be reported as impairment loss for 2021? a. 100,000 b. 400,000 c. 500,000 d. 0 2. What amount should be reported as revaluation surplus on December 31,2021? a. 1,500,000 b. 2,000,000 c. 1,000,000 d. 1,900,000Surreal Company accounted for non-current assets using the revaluation model. On October 1, 2021, the entity classified a land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At same date, the fair value of the land was estimated at P5,500,000 and the cost of disposal at P100,000. On December 31,2021, the fair value less cost of disposal of the land did not change. The land was sold on January 31,2022 for P6,000,000. REQUIRED: 1. What amount should be reported as gain on disposal of land in 2022? a. 1,000,000 b. 2,600,000 c. 500,000 d. 600,000

- Surreal Company accounted for non-current assets using the revaluation model. On October 1, 2021, the entity classified a land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At same date, the fair value of the land was estimated at P5,500,000 and the cost of disposal at P100,000. On December 31,2021, the fair value less cost of disposal of the land did not change. The land was sold on January 31,2022 for P6,000,000. Required: 1. What is the adjusted carrying amount of the land on December 31,2021? a. 5,000,000 b. 5,500,000 c. 5,400,000 d. 3,500,000Surreal Company accounted for non-current assets using the revaluation model. On October 1, 2021, the entity classified a land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At same date, the fair value of the land was estimated at P5,500,000 and the cost of disposal at P100,000. On December 31,2021, the fair value less cost of disposal of the land did not change. The land was sold on January 31,2022 for P6,000,000. Required: 1. What is the adjusted carrying amount of the land on December 31,2021? a. 5,000,000 b. 5,500,000 c. 5,400,000 d. 3,500,000 2. What amount should be reported as impairment loss for 2021? a. 100,000 b. 400,000 c. 500,000 d. 0 3. What amount should be reported as revaluation surplus on December 31,2021? a. 1,500,000 b. 2,000,000 c. 1,000,000 d. 1,900,000 4. What amount should be reported as gain on disposal of land in 2022? a. 1,000,000 b. 2,600,000 c. 500,000 c. 600,000Barnum Company acquired several small companies at the end of 2018, and based On the acquisitions, reported the following intangible assets on its December 31, 2018, balance sheet.How much amortization expense should the company recognize on each intangible asset in 2019?