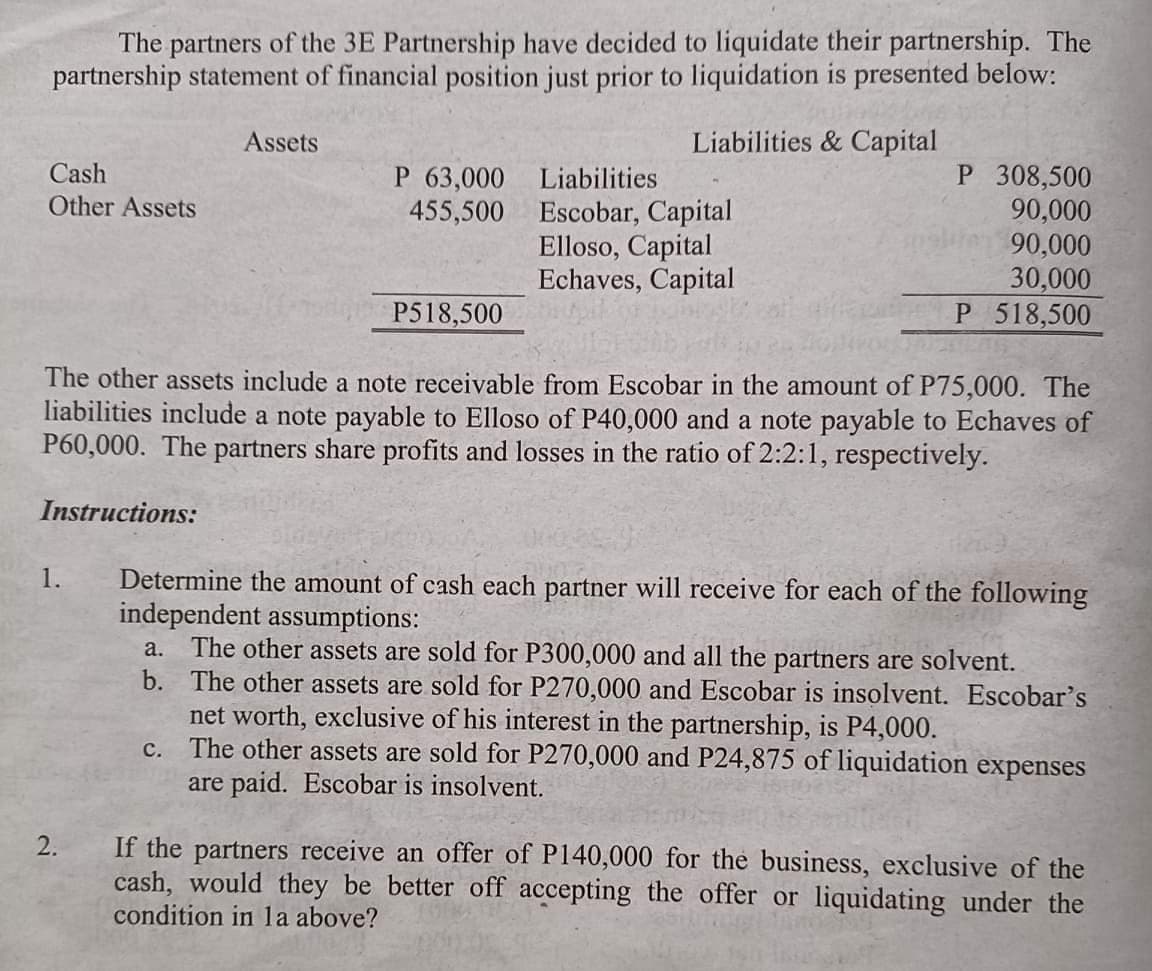

The partners of the 3E Partnership have decided to liquidate their partnership. The partnership statement of financial position just prior to liquidation is presented below: Assets Liabilities & Capital P 308,500 Cash P 63,000 455,500 Other Assets 90,000 Liabilities Escobar, Capital Elloso, Capital Echaves, Capital 90,000 30,000 P518,500 P 518,500 The other assets include a note receivable from Escobar in the amount of P75,000. The liabilities include a note payable to Elloso of P40,000 and a note payable to Echaves of P60,000. The partners share profits and losses in the ratio of 2:2:1, respectively. Instructions: 1. Determine the amount of cash each partner will receive for each of the following independent assumptions: a. The other assets are sold for P300,000 and all the partners are solvent. b. The other assets are sold for P270,000 and Escobar is insolvent. Escobar's net worth, exclusive of his interest in the partnership, is P4,000. C. The other assets are sold for P270,000 and P24,875 of liquidation expenses are paid. Escobar is insolvent.

The partners of the 3E Partnership have decided to liquidate their partnership. The partnership statement of financial position just prior to liquidation is presented below: Assets Liabilities & Capital P 308,500 Cash P 63,000 455,500 Other Assets 90,000 Liabilities Escobar, Capital Elloso, Capital Echaves, Capital 90,000 30,000 P518,500 P 518,500 The other assets include a note receivable from Escobar in the amount of P75,000. The liabilities include a note payable to Elloso of P40,000 and a note payable to Echaves of P60,000. The partners share profits and losses in the ratio of 2:2:1, respectively. Instructions: 1. Determine the amount of cash each partner will receive for each of the following independent assumptions: a. The other assets are sold for P300,000 and all the partners are solvent. b. The other assets are sold for P270,000 and Escobar is insolvent. Escobar's net worth, exclusive of his interest in the partnership, is P4,000. C. The other assets are sold for P270,000 and P24,875 of liquidation expenses are paid. Escobar is insolvent.

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

100%

Transcribed Image Text:The partners of the 3E Partnership have decided to liquidate their partnership. The

partnership statement of financial position just prior to liquidation is presented below:

Assets

Liabilities & Capital

Cash

P 63,000

Liabilities

P 308,500

Other Assets

455,500

Escobar, Capital

90,000

Elloso, Capital

90,000

Echaves, Capital

30,000

P518,500

P 518,500

The other assets include a note receivable from Escobar in the amount of P75,000. The

liabilities include a note payable to Elloso of P40,000 and a note payable to Echaves of

P60,000. The partners share profits and losses in the ratio of 2:2:1, respectively.

Instructions:

1.

Determine the amount of cash each partner will receive for each of the following

independent assumptions:

a. The other assets are sold for P300,000 and all the partners are solvent.

b. The other assets are sold for P270,000 and Escobar is insolvent. Escobar's

net worth, exclusive of his interest in the partnership, is P4,000.

C.

The other assets are sold for P270,000 and P24,875 of liquidation expenses

are paid. Escobar is insolvent.

2.

If the partners receive an offer of P140,000 for the business, exclusive of the

cash, would they be better off accepting the offer or liquidating under the

condition in la above?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,