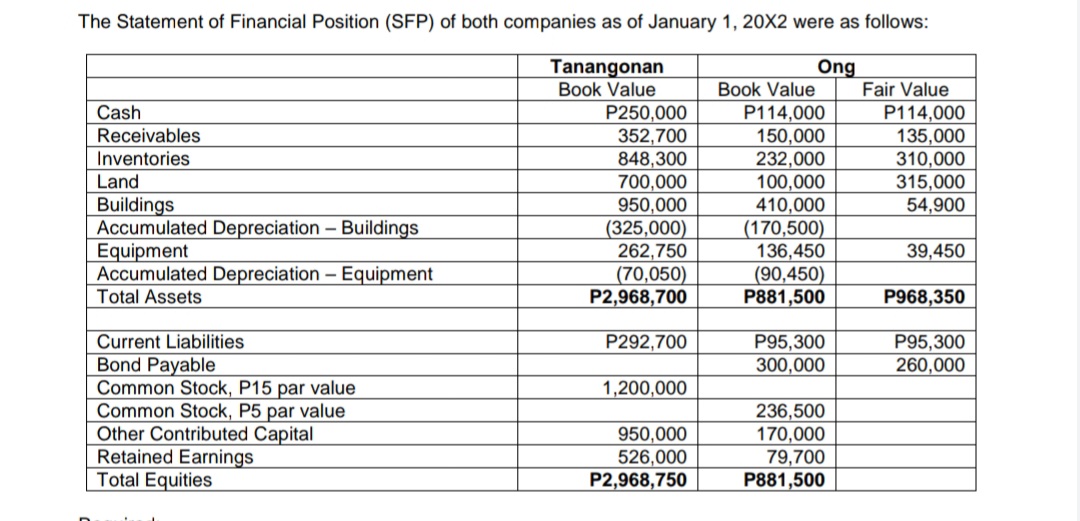

Determine the goodwill or gain on bargain purchase from the above acquisition. 2. Give the adjusting entries that will be made on the book of Tanangonan. 3. Prepare the Statement of Financial Position (SFP) of Tanangonan after the merger. see the given picture for The Statement of Financial Position (SFP) of both companies as of January 1, 20X2 were as follows:

On January 1, 20X2, Tanangonan Company acquired all the assets and assumed all the liabilities of Ong

Company. In exchange for the net assets of Ong, Tanangonan gave its bond payable with a maturity value of P600,000 with a stated rate of 10% interest payable semiannually on June 30 and December 31. The said bond will also mature on January 1, 20X2, and has a yield rate of 12%.

Required:

1. Determine the

2. Give the

3. Prepare the

see the given picture for The Statement of Financial Position (SFP) of both companies as of January 1, 20X2 were as follows:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images