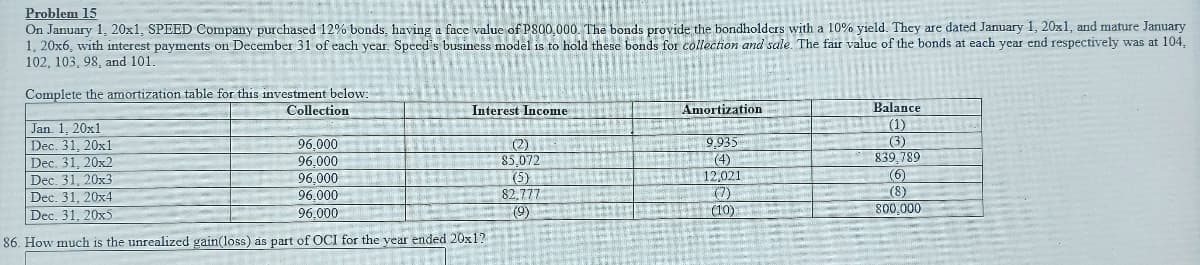

On January 1, 20x1, SPEED Company purchased 12% bonds, having a face value of P800,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 20x1, and mature January 1, 20x6, with interest payments on December 31 of each year. Speed's business model is to hold these bonds for collection and sale. The fair value of the bonds at each ycar end respectively was at 104, 102, 103, 98, and 101. Complete the amortization table for this investment below: Collection Interest Income Amortization Balance (1) (3) 839,789 (6) (8) 800,000 Jan. 1, 20x1 Dec. 31, 20x1 9,935 (4) 12,021 (7) (10) 96,000 96.000 (2) 85.072 Dec. 31, 20x2 Dec. 31, 20x3 Dec. 31, 20x4 Dec. 31, 20x5 96,000 96,000 96.000 (5) 82,777 (9) How much is the unrealized gain(loss) as part of OCI for the year ended 20x1?

On January 1, 20x1, SPEED Company purchased 12% bonds, having a face value of P800,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 20x1, and mature January 1, 20x6, with interest payments on December 31 of each year. Speed's business model is to hold these bonds for collection and sale. The fair value of the bonds at each ycar end respectively was at 104, 102, 103, 98, and 101. Complete the amortization table for this investment below: Collection Interest Income Amortization Balance (1) (3) 839,789 (6) (8) 800,000 Jan. 1, 20x1 Dec. 31, 20x1 9,935 (4) 12,021 (7) (10) 96,000 96.000 (2) 85.072 Dec. 31, 20x2 Dec. 31, 20x3 Dec. 31, 20x4 Dec. 31, 20x5 96,000 96,000 96.000 (5) 82,777 (9) How much is the unrealized gain(loss) as part of OCI for the year ended 20x1?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 18E

Related questions

Question

Q1: How much is the unrealized gain (loss) as part of OCI for the year ended 20x1?

Q2: How much is the unrealized gain (loss) as component of equity as of December 31, 20x2?

Transcribed Image Text:Problem 15

On January 1, 20x1, SPEED Company purchased 12% bonds, having a face value of P800,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 20x1, and mature January

1, 20x6, with interest payments on December 31 of each year. Speed's business model is to hold these bonds for collection and sale. The fair value of the bonds at each year end respectively was at 104,

102, 103, 98, and 101.

Complete the amortization table for this investment below:

Collection

Interest Income

Amortization

Balance

(1)

(3)

839 789

Jan. 1. 20x1

Dec. 31, 20x1

Dec. 31, 20x2

Dec. 31, 20x3

Dec. 31, 20x4

Dec. 31, 20x5

96.000

96,000

96.000

96,000

9,935

(4)

12,021

(7)

(10)

(2)

85.072

(5)

82,777

(6)

(8)

800,000

96.000

(9)

86. How much is the unrealized gain(loss) as part of OCI for the year ended 20x1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,