Determine the gross estate under the following property relationships: 1. Conjugal partnership of gains regime: 2. Absolute community of property regime:

Determine the gross estate under the following property relationships: 1. Conjugal partnership of gains regime: 2. Absolute community of property regime:

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 23CE

Related questions

Question

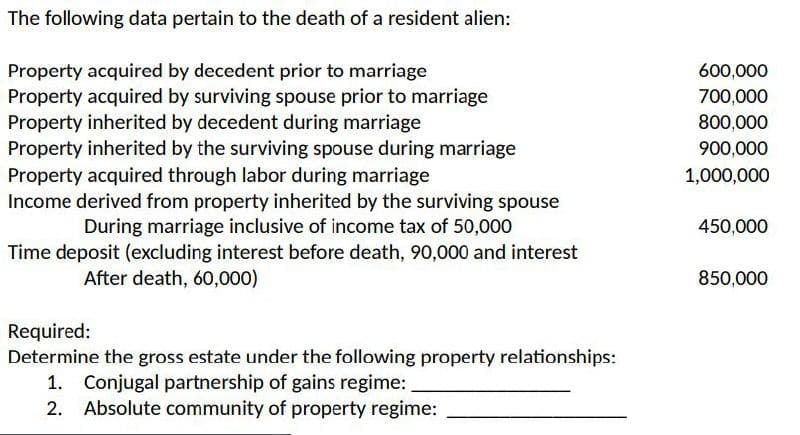

Transcribed Image Text:The following data pertain to the death of a resident alien:

Property acquired by decedent prior to marriage

Property acquired by surviving spouse prior to marriage

Property inherited by decedent during marriage

Property inherited by the surviving spouse during marriage

Property acquired through labor during marriage

Income derived from property inherited by the surviving spouse

During marriage inclusive of income tax of 50,000

Time deposit (excluding interest before death, 90,000 and interest

600,000

700,000

800,000

900,000

1,000,000

450,000

After death, 60,000)

850,000

Required:

Determine the gross estate under the following property relationships:

1. Conjugal partnership of gains regime:

2. Absolute community of property regime:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT