Q: A borrower is making a choice between a mortgage with monthly payments or biweekly payments. The…

A: Present value of annuity Annuity is a series of equal payments at equal interval over a specified…

Q: Assess the potential conflict of needs and objectives among Tesco's stakeholders and the possible…

A: An "person or group that has an interest in any decision or action of an organization" is referred…

Q: Assume: • current stock price = $20 • stock price changes by +/-10% each 3 months with equal…

A: We have a stock, call option and risk free borrowing / lending to create a riskless hedge to exploit…

Q: You are evaluating a company's stock. The stock just paid a dividend of $1.75. Dividends are…

A: The Fair present value of stock is calculated by Gorden's Model. As per Gorden's Model the price of…

Q: Jerry has an opportunity to buy a bond with a face value of $10,000 and a coupon rate of 14…

A: The IRR is used to evaluate the profitability of a potential investment in terms of the returns from…

Q: What would you pay for an investment that pays you $5000000 after fifty years? Assume that the…

A: Present Value = Future Value /( 1 + r)n Where, r = periodic interest rate = 8% ( assuming 8%…

Q: A major repair on the suspension system of Jane's 3-year old car will cost her $3.000 every 3 years…

A: The equivalent annual cost is a capital budgeting tool used to measure the cost-effectiveness of the…

Q: Wonder Plc is considering two investment projects in another city and the estimated cash flows are…

A: Capital Budgeting: Using capital budgeting, investors determine the value of new investment…

Q: An investment will pay $50 at the end of each of the next 3 years, $250 at the end of Year 4, $400…

A: Given: The annual cash flows for the first 3 years is $50. The cash flow for year 4, year 5, and…

Q: Which of the following is not a dominant risk that might affect the price of a bond? A Deferred…

A: Bond is a fixed income instrument. Bond represent a loan made to corporate and government in return…

Q: In 2021, a standard 30-year fixed mortgage in the US could be had for somewhere around 3%. Following…

A: Data given: Option I Rate=3% Cost of house=$629,000 n=30 years Down payment= 20% Option II Rate=7%…

Q: Why would a company choose to have a low dividend payout ratio? A.The company has many…

A: Dividend payout ratio is the percentage of amount that is paid as dividend to the shareholders from…

Q: A firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of…

A: Sales = $20,000,000 Profit margin = 0.15 Total assets = $22,500,000 Return on assets (ROA) = ? ROA…

Q: You are saving for a house, and you would like to invest your money for the next year to reach your…

A: Risks associated with financial assets can be reduced by using the hedging method. The danger of any…

Q: Monthly payments of $75 are paid into an annuity beginning on January 31, with a yearly interest…

A: Solution:- When an equal amount is paid each period at beginning of the period, it is called annuity…

Q: Critically evaluate the sunk cost fallacy influencing investment decision-making

A: We have to critically examine the sunk cost fallacy and its impact on investment decision making.

Q: Using margin, a trader bought 100 shares of a $150 stock. The initial margin was 35 percent and the…

A: Number shares = 100 Stock price = $150 Initial margin = 35% Price after drop = $125

Q: Please explain why this statement is (False). For a given interest rate change, a 20-year bond's…

A: Bond Prices and Interest Rate Changes: Bond prices are sensitive to interest rate changes; i.e. they…

Q: All the securities below have annual payments. [Do not round interim calculations] Security…

A: The coupon rate is the interest rate used to determine the periodic payments to be made to…

Q: Suppose you took out a 20 year mortgage for $280,000 with an APR of 2.772%, but you want to pay it…

A: A mortgage is a loan taken out to purchase or maintain a property. The loan is covered as the…

Q: 5. Panadera Bakeshop involved in livestock production having a loan of P250,000 from City Savings…

A: We have to find the maturity value of a loan subjected to compound interest.

Q: If a certain stock sells for 626.659 dollars on the NYSE, how much will it sell for, in dollars, on…

A: 1) If a Stock trades at more than one stock exchange, then the price at all the stock exchanges will…

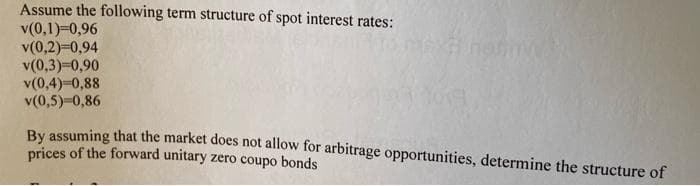

Q: What is the current one-year rate?

A: Current one year rate can be calculated as the yield of the zero-coupon bond. Zero coupon bonds are…

Q: Mr. Jonsson is a salesperson handling a line of computer software throughout Western Canada. During…

A: You have specifically asked how CCA and operating costs were calculated. This solution focuses on…

Q: Elaborate further on the settlement of a future contract based on the numbers in the diagram. (1)…

A: We have to explain and elaborate the settlement process evident in the diagram.

Q: Lassiter Industries has annual sales of $220,000 with 12,000 shares of stock outstanding. The firm…

A: Price earning Ratio - In simple words we can say how much money investor pay for the stock to earn…

Q: Based on the free cash flow valuation model, Advanele Corp, calculates that the value of their…

A: Given, The value of operations is $874,000 Number of shares outstanding is 283,000

Q: Suppose that you have to choose an optimal portfolio from a list of n stocks. Stock i has expected…

A: A portfolio that is created with the ideal ratio of risk to return is said to be optimum. The best…

Q: Which of the following statements is most accurate? A stop-sell order is placed by a bullish…

A: A bearish (or negative) investor believes that prices will fall and that significant wealth will be…

Q: apley Dental Supply Company has the following data: Net income: $240 Sales: $10,000 Total assets:…

A: Return on Equity is the ratio that shows the profitability of the business by the use of owner's…

Q: As a result of an accident due to faulty equipment at a shopping mall, Leslie is permanently…

A: The payments in an insurance contract are made through various methods to the insurer, some are…

Q: Jim makes a simple interest loan of $5,800 at 16.35% for 18 months. Assume the loan period is…

A: Loan Amount = $5,800 Period = 18 Months Simple interest rate = 16.35% Interest Amount = Loan…

Q: Tater and Pepper Corp. reported free cash flows for 2021 of $52.1 million and investment in…

A: Free cash flow = $52.1 million Investment in operating capital = $35.1 million Depreciation expenses…

Q: tephanie Carter has been gifted a sum of $50,000 by her grandparents on completing her graduation…

A: The intrinsic value of a stock: The intrinsic value of a stock refers to the fair value of the…

Q: Last year, the company paid a dividend of $3.40. It expects zero growth in the next year. In years…

A: The price of share will be calculated by Gorden's Model. As per Gorden's Model the share price will…

Q: Suppose Josh’s current salary is $72, 000 per year, and she is planning to retire 25 years from now.…

A: The FV of a payment series determines the value that the asset has at the time of maturity…

Q: Analyze the financials for Wal-Mart and its competitor(s) in the online market in 2012 and 2016.…

A: Analysis of top line growth: Description Walmart…

Q: Your firm has net income of $245 on total sales of $1,080. Costs are $610 and depreciation is $120.…

A: Here, Net Income = $245 Total sales = $1,080 Costs = $610 Depreciation expense = $120 Tax rate = 25%…

Q: You wish to retire in 30 years, so you begin a 401K program that pays $100 into your account weekly…

A: Data given: N=30 years Weekly payment= $100 Interest rate= 6.35% (Compounded weekly) Working…

Q: A portfolio invests in 35% in a stock S1 and the rest in another stock S2. The expected return and…

A: Portfolio refers to a combination or collection of financial instruments or securities stocks,…

Q: what is its market-to-book ratio?

A: Market to book ratio is calculated with the formula below. This is also called Price to Book…

Q: You can enter into a forward contract for a bond with a maturity in one year months that pays a…

A: We have spot rates, periodic coupon and interest rates. The same can be used to theoretically derive…

Q: Lean systems require large batch sizes to gain economies of scale. Question content area…

A: Lean system are designed to produce output with fewer resources than traditional planning.…

Q: Account A and Account B each receive a deposit at the same time. Account A earns interest at an…

A: In compound interest, the interest earned during a period gets added to the principal, and the new…

Q: Critically evaluate the influencing investment decision-making

A: Investment decision does not depend on a single factor. There are many factors that influence the…

Q: invest in each stock to maxime you You should invest s into Marky Inc. $ into JohnJohn Ltd, and s…

A: Information Provided: Total investment = $93,000 Investment in Garretts Spaghetti = $19,000 MarkyB…

Q: Solve the following: USE 4 DECIMAL PLACES Nominal Rate 5% compounded semi annually 5% compounded…

A: Equivalent interest rates are interest rates that produce the same return as the given annual…

Q: How do sellers benefit from allowing their customers to use credit cards? Do sellers bear any risk…

A: Credit cards A card distributed by the bank to its customers who have good financial records is…

Q: Here is a list of bond transactions on May 15, 2009. For each transaction list the transaction…

A: Quotes for several bonds that were transacted on a particular day had been given. We need to…

Q: Among pay-mix alternatives, base pay is largest in work-life balance Osecurity or commitment…

A: Pay mix is a composition of the ratio between the base salary and the variable pay. It depends on…

Step by step

Solved in 2 steps

- Which of the following statements is false? A. Other things being equal, an increase in a bond’s maturity will increase its interest rate risk. B. Other things being equal, an increase in the coupon rate of a bond will decrease its interest rate risk. C. Other things being equal, an increase in a bond’s YTM will decrease its interest rate risk. D. Effective duration is calculated as Macaulay duration divided by one plus the bond’s yield to maturity.Which of the following statements is correct assuming same market rates for all maturities (flat yield curve)? e a Extendible bonds allow bond issuer to extend the maturity date. O b. Callable bonds give the bond issuer an option to call the bond back before the maturity date at a predetermined price. Oc. When the market yield is equal to a bond's stated coupon rate, the bond's current yield is greater than its coupon yield. Od. The cash price plus the accrued interest on the bond is the quoted price of the bond. Current yield is the ratio of annual coupon payment divided by the par value. o e.The method used to value a default-free zero coupon bonds (such as T-bills) requires that the interest is deducted from the face value of the bonds in advance. a.rediscounting b.market price c.forward price d.discount interest

- The yield to maturity on a bond is A. below the coupon rate when the bond sells at a discount and equal to the coupon rate when the bond sells at a premium. B. the discount rate that will set the present value of the payments equal to the bond price. C. None of the options are correct. D. based on the assumption that any payments received are reinvested at the coupon rate.(a) Do you agree with the following statement, and explain why? “If two bonds have the same duration, then the percentage change in price of the two bonds will be the same for a given change in interest rates.” (b) Discuss the problems with the traditional bond pricing approach by using the yield to maturity. (300 words)Which of the following statements about the Macaulay duration of a coupon bond is true? Select one alternative: a.. The duration does not change after the bond is issued. b. The duration will decrease as the yield to maturity decreases. c. None of the other statements is true. d. The duration can precisely predict the price change of the bond for any interest rate change.

- A bond has a market price that exceeds its face value. Which one of these features currently applies to this bond? Group of answer choices Yield to maturity greater than coupon rate. Currently selling at par. Yield to maturity less than the coupon rate. Yield to maturity equal to the coupon. Discount bond.A bond has a market price that exceeds its face value. Which one of these features currently applies tothis bond?Select one:a. Yield to maturity less than the coupon rate.b. Currently selling at par.c. Current yield greater than coupon rate.d. Yield to maturity equal to the current yield.e. Discount bond.In the context of coupon-paying bonds, which of the following are most likely determined bymarket forces?I. The current yield.II. The yield to maturity.III. The coupon rate. A. I only.B. II only.C. I and II only.D. I and III only

- how will the modified duretion of a floating coupon bond be compared to the modified duration of a fixed rate coupon bond? (same, higher or lower?) (floating coupon adjust coupon accotding to interest rate level, ie higher interest rate results in higher coupon payment)1.Identify whether each of the following bonds is trading at a discount, at par value,or at a premium. Calculate the prices of the bonds per 100 in par value. If the couponrate is deficient or excessive compared with the market discount rate, calculate the amount of the deficiency or excess per 100 of par value. Bond Coupon Payment per Period Number of Periods to Maturity Market Discount Rate per period A 2 6 3% B 6 4 4% C 5 5 5% D 0 10 2%Consider the following pure discount bonds with face value $1,000: Maturity Price 1 952.38 2 898.47 3 847.62 4 799.64 5 754.38 a). Find the spot rates and draw a yield curve.b). Assume that there is a constant liquidty premium that is equal to 1% across all maturities. Find the forward rates and the expected one period future interest rates.