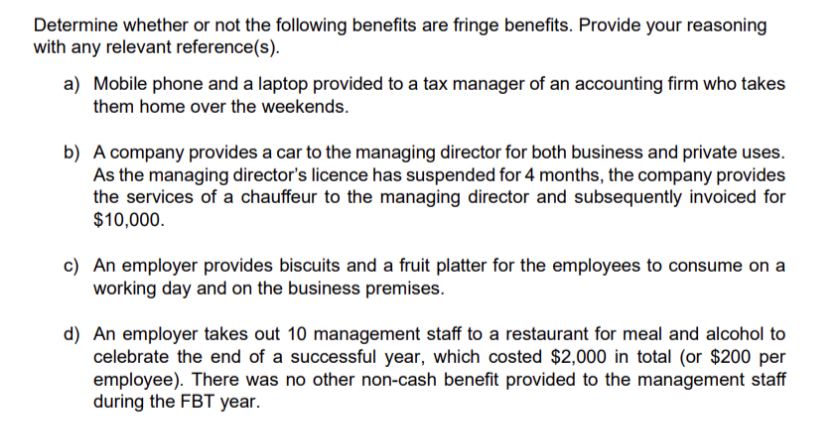

Determine whether or not the following benefits are fringe benefits. Provide your reasoning with any relevant reference(s). a) Mobile phone and a laptop provided to a tax manager of an accounting firm who takes them home over the weekends. b) A company provides a car to the managing director for both business and private uses. As the managing director's licence has suspended for 4 months, the company provides the services of a chauffeur to the managing director and subsequently invoiced for $10,000. c) An employer provides biscuits and a fruit platter for the employees to consume on a working day and on the business premises. d) An employer takes out 10 management staff to a restaurant for meal and alcohol to celebrate the end of a successful year, which costed $2,000 in total (or $200 per employee). There was no other non-cash benefit provided to the management staff during the FBT year.

Determine whether or not the following benefits are fringe benefits. Provide your reasoning with any relevant reference(s). a) Mobile phone and a laptop provided to a tax manager of an accounting firm who takes them home over the weekends. b) A company provides a car to the managing director for both business and private uses. As the managing director's licence has suspended for 4 months, the company provides the services of a chauffeur to the managing director and subsequently invoiced for $10,000. c) An employer provides biscuits and a fruit platter for the employees to consume on a working day and on the business premises. d) An employer takes out 10 management staff to a restaurant for meal and alcohol to celebrate the end of a successful year, which costed $2,000 in total (or $200 per employee). There was no other non-cash benefit provided to the management staff during the FBT year.

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 21MCQ

Related questions

Question

Transcribed Image Text:Determine whether or not the following benefits are fringe benefits. Provide your reasoning

with any relevant reference(s).

a) Mobile phone and a laptop provided to a tax manager of an accounting firm who takes

them home over the weekends.

b) A company provides a car to the managing director for both business and private uses.

As the managing director's licence has suspended for 4 months, the company provides

the services of a chauffeur to the managing director and subsequently invoiced for

$10,000.

c) An employer provides biscuits and a fruit platter for the employees to consume on a

working day and on the business premises.

d) An employer takes out 10 management staff to a restaurant for meal and alcohol to

celebrate the end of a successful year, which costed $2,000 in total (or $200 per

employee). There was no other non-cash benefit provided to the management staff

during the FBT year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub