Dian Duty Free is a are retail outlets whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component. Attached the Financial ratios of Dian Duty Free in 2018 to 2019. Please analyze the Dian Duty Free Financial Ratios based on the table attached.

Dian Duty Free is a are retail outlets whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component. Attached the Financial ratios of Dian Duty Free in 2018 to 2019. Please analyze the Dian Duty Free Financial Ratios based on the table attached.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.17EX: Profitability ratios The following selected data were taken from the financial statements of...

Related questions

Question

100%

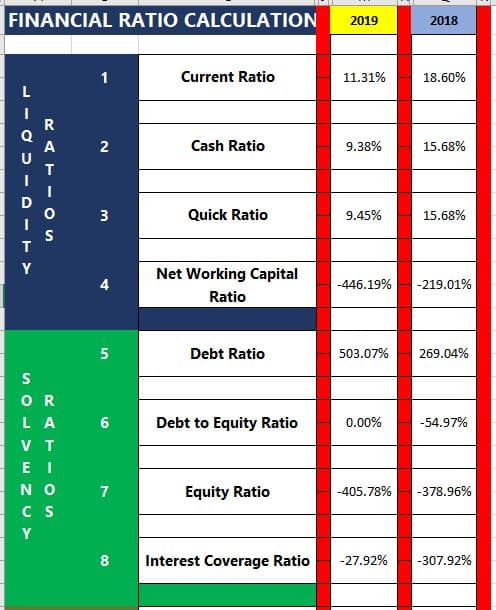

Dian Duty Free is a are retail outlets whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component.

Attached the Financial ratios of Dian Duty Free in 2018 to 2019.

Please analyze the Dian Duty Free Financial Ratios based on the table attached.

Transcribed Image Text:FINANCIAL RATIO CALCULATION

2019

2018

1

Current Ratio

11.31%

18.60%

L

Cash Ratio

A

U

2

9.38%

15.68%

3

Quick Ratio

9.45%

15.68%

Net Working Capital

-446.19%

-219.01%

Ratio

5

Debt Ratio

503.07%

269.04%

OR

LA

6

Debt to Equity Ratio

0.00%

-54.97%

V T

E I

NO

7

Equity Ratio

-405.78%

-378.96%

C S

Y

8

Interest Coverage Ratio

-27.92%

-307.92%

- D - TY

Transcribed Image Text:FINANCIAL RATIO CALCULATION

2019

2018

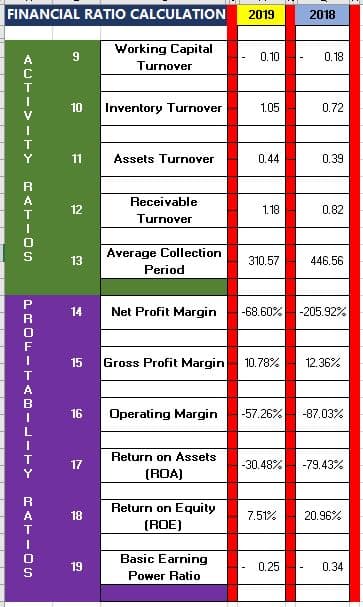

Working Capital

9

0.10

0.18

-

Turnover

10

Inventory Turnover

1.05

0.72

Y

11

Assets Turnover

0.44

0.39

R

Receivable

12

1.18

0.82

T

Turnover

Average Collection

Period

13

310.57

446.56

14

Net Profit Margin

-68.60%

-205.92%

15

Gross Profit Margin

10.78%

12.36%

16

Operating Margin

-57.26%

-87.03%

Return on Assets

17

-30.48%

-79.43%

(ROA)

Return on Equity

A

18

7.51%

20.96%

(ROE)

Basic Earning

19

0.25

0.34

Роwег Ratio

LROF-TABILITY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning