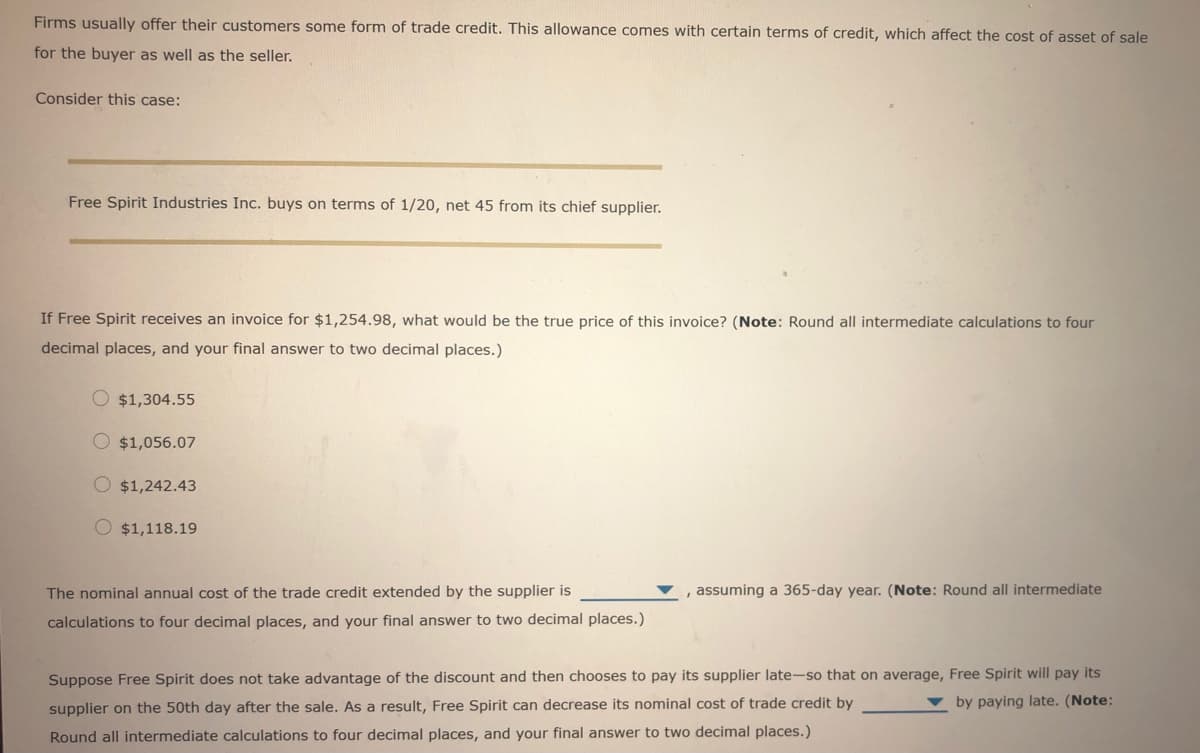

Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Free Spirit Industries Inc. buys on terms of 1/20, net 45 from its chief supplier. If Free Spirit receives an invoice for $1,254.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) O $1,304.55 O $1,056.07 O $1,242.43 O $1,118.19 The nominal annual cost of the trade credit extended by the supplier is , assuming a 365-day year. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) Suppose Free Spirit does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Free Spirit will pay its supplier on the 50th day after the sale. As a result, Free Spirit can decrease its nominal cost of trade credit by by paying late. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.)

Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Free Spirit Industries Inc. buys on terms of 1/20, net 45 from its chief supplier. If Free Spirit receives an invoice for $1,254.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) O $1,304.55 O $1,056.07 O $1,242.43 O $1,118.19 The nominal annual cost of the trade credit extended by the supplier is , assuming a 365-day year. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) Suppose Free Spirit does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Free Spirit will pay its supplier on the 50th day after the sale. As a result, Free Spirit can decrease its nominal cost of trade credit by by paying late. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 2E: Consider each of the following scenarios: a. A seller orally agrees with one of its best customers...

Related questions

Question

Practice Pack

Transcribed Image Text:Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale

for the buyer as well as the seller.

Consider this case:

Free Spirit Industries Inc. buys on terms of 1/20, net 45 from its chief supplier.

If Free Spirit receives an invoice for $1,254.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four

decimal places, and your final answer to two decimal places.)

O $1,304.55

$1,056.07

$1,242.43

O $1,118.19

The nominal annual cost of the trade credit extended by the supplier is

, assuming a 365-day year. (Note: Round all intermediate

calculations to four decimal places, and your final answer to two decimal places.)

Suppose Free Spirit does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Free Spirit will pay its

by paying late. (Note:

supplier on the 50th day after the sale. As a result, Free Spirit can decrease its nominal cost of trade credit by

Round all intermediate calculations to four decimal places, and your final answer to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning