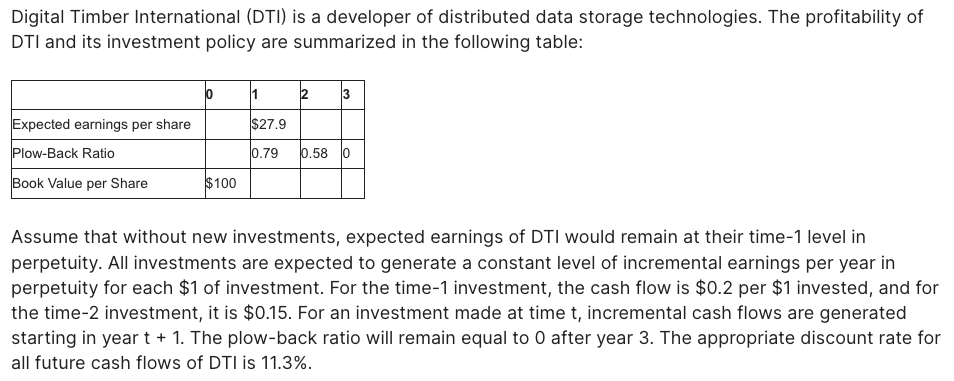

Digital Timber International (DTI) is a developer of distributed data storage technologies. The profitability of DTI and its investment policy are summarized in the following table: Expected earnings per share Plow-Back Ratio Book Value per Share b $100 1 $27.9 0.79 0.58 0 2 3 Assume that without new investments, expected earnings of DTI would remain at their time-1 level in perpetuity. All investments are expected to generate a constant level of incremental earnings per year in perpetuity for each $1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated starting in year t + 1. The plow-back ratio will remain equal to 0 after year 3. The appropriate discount rate for all future cash flows of DTI is 11.3%.

Digital Timber International (DTI) is a developer of distributed data storage technologies. The profitability of DTI and its investment policy are summarized in the following table: Expected earnings per share Plow-Back Ratio Book Value per Share b $100 1 $27.9 0.79 0.58 0 2 3 Assume that without new investments, expected earnings of DTI would remain at their time-1 level in perpetuity. All investments are expected to generate a constant level of incremental earnings per year in perpetuity for each $1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated starting in year t + 1. The plow-back ratio will remain equal to 0 after year 3. The appropriate discount rate for all future cash flows of DTI is 11.3%.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8TP: Fenton, Inc., has established a new strategic plan that calls for new capital investment. The...

Related questions

Question

(a) Compute the expected book value per share at time 1.

(b) Compute the expected earnings per share of DTI at time 2.

(c) Compute the expected value of the ex-dividend stock price at time 2.

(d) Compute the expected value of the ex-dividend stock price at time 0.

(e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).

Transcribed Image Text:Digital Timber International (DTI) is a developer of distributed data storage technologies. The profitability of

DTI and its investment policy are summarized in the following table:

Expected earnings per share

Plow-Back Ratio

Book Value per Share

0

$100

1

$27.9

0.79 0.58 0

2 3

Assume that without new investments, expected earnings of DTI would remain at their time-1 level in

perpetuity. All investments are expected to generate a constant level of incremental earnings per year in

perpetuity for each $1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for

the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated

starting in year t + 1. The plow-back ratio will remain equal to 0 after year 3. The appropriate discount rate for

all future cash flows of DTI is 11.3%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning