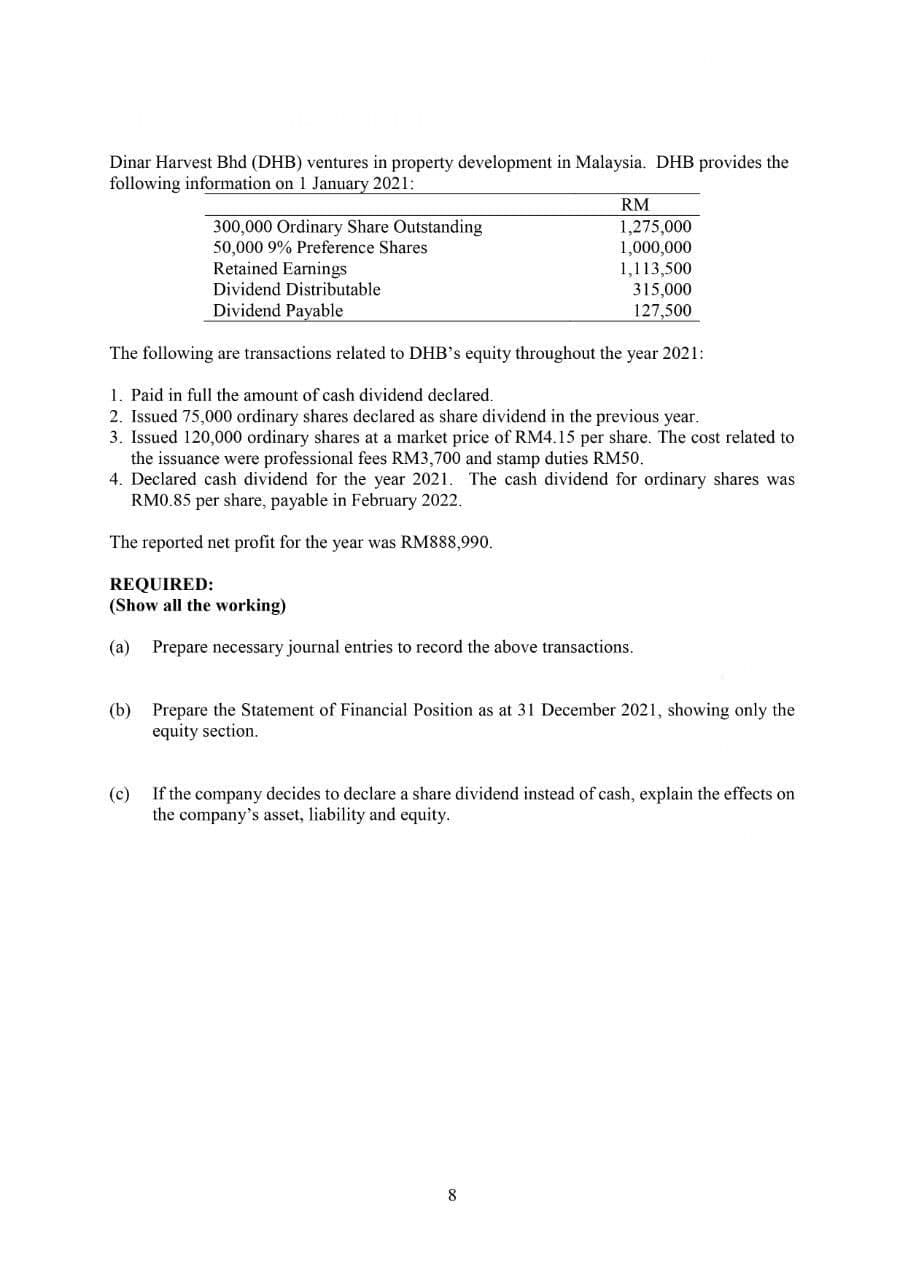

Dinar Harvest Bhd (DHB) ventures in property development in Malaysia. DHB provides the following information on 1 January 2021: RM 300,000 Ordinary Share Outstanding 50,000 9% Preference Shares Retained Earnings Dividend Distributable 1,275,000 1,000,000 1,113,500 315,000 127,500 Dividend Payable The following are transactions related to DHB's equity throughout the year 2021: 1. Paid in full the amount of cash dividend declared. 2. Issued 75,000 ordinary shares declared as share dividend in the previous year. 3. Issued 120,000 ordinary shares at a market price of RM4.15 per share. The cost related to the issuance were professional fees RM3,700 and stamp duties RM50. 4. Declared cash dividend for the year 2021. The cash dividend for ordinary shares was RM0.85 per share, payable in February 2022. The reported net profit for the year was RM888,990. REQUIRED: (Show all the working) (a) Prepare necessary journal entries to record the above transactions. (b) Prepare the Statement of Financial Position as at 31 December 2021, showing only the equity section. (c) If the company decides to declare a share dividend instead of cash, explain the effects on the company's asset, liability and equity.

Dinar Harvest Bhd (DHB) ventures in property development in Malaysia. DHB provides the following information on 1 January 2021: RM 300,000 Ordinary Share Outstanding 50,000 9% Preference Shares Retained Earnings Dividend Distributable 1,275,000 1,000,000 1,113,500 315,000 127,500 Dividend Payable The following are transactions related to DHB's equity throughout the year 2021: 1. Paid in full the amount of cash dividend declared. 2. Issued 75,000 ordinary shares declared as share dividend in the previous year. 3. Issued 120,000 ordinary shares at a market price of RM4.15 per share. The cost related to the issuance were professional fees RM3,700 and stamp duties RM50. 4. Declared cash dividend for the year 2021. The cash dividend for ordinary shares was RM0.85 per share, payable in February 2022. The reported net profit for the year was RM888,990. REQUIRED: (Show all the working) (a) Prepare necessary journal entries to record the above transactions. (b) Prepare the Statement of Financial Position as at 31 December 2021, showing only the equity section. (c) If the company decides to declare a share dividend instead of cash, explain the effects on the company's asset, liability and equity.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Q5

Transcribed Image Text:Dinar Harvest Bhd (DHB) ventures in property development in Malaysia. DHB provides the

following information on 1 January 2021:

RM

300,000 Ordinary Share Outstanding

50,000 9% Preference Shares

Retained Earnings

1,275,000

1,000,000

1,113,500

315,000

127,500

Dividend Distributable

Dividend Payable

The following are transactions related to DHB's equity throughout the year 2021:

1. Paid in full the amount of cash dividend declared.

2. Issued 75,000 ordinary shares declared as share dividend in the previous year.

3. Issued 120,000 ordinary shares at a market price of RM4.15 per share. The cost related to

the issuance were professional fees RM3,700 and stamp duties RM50.

4. Declared cash dividend for the year 2021. The cash dividend for ordinary shares was

RM0.85 per share, payable in February 2022.

The reported net profit for the year was RM888,990.

REQUIRED:

(Show all the working)

(a) Prepare necessary journal entries to record the above transactions.

(b) Prepare the Statement of Financial Position as at 31 December 2021, showing only the

equity section.

(c)

If the company decides to declare a share dividend instead of cash, explain the effects on

the company's asset, liability and equity.

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning