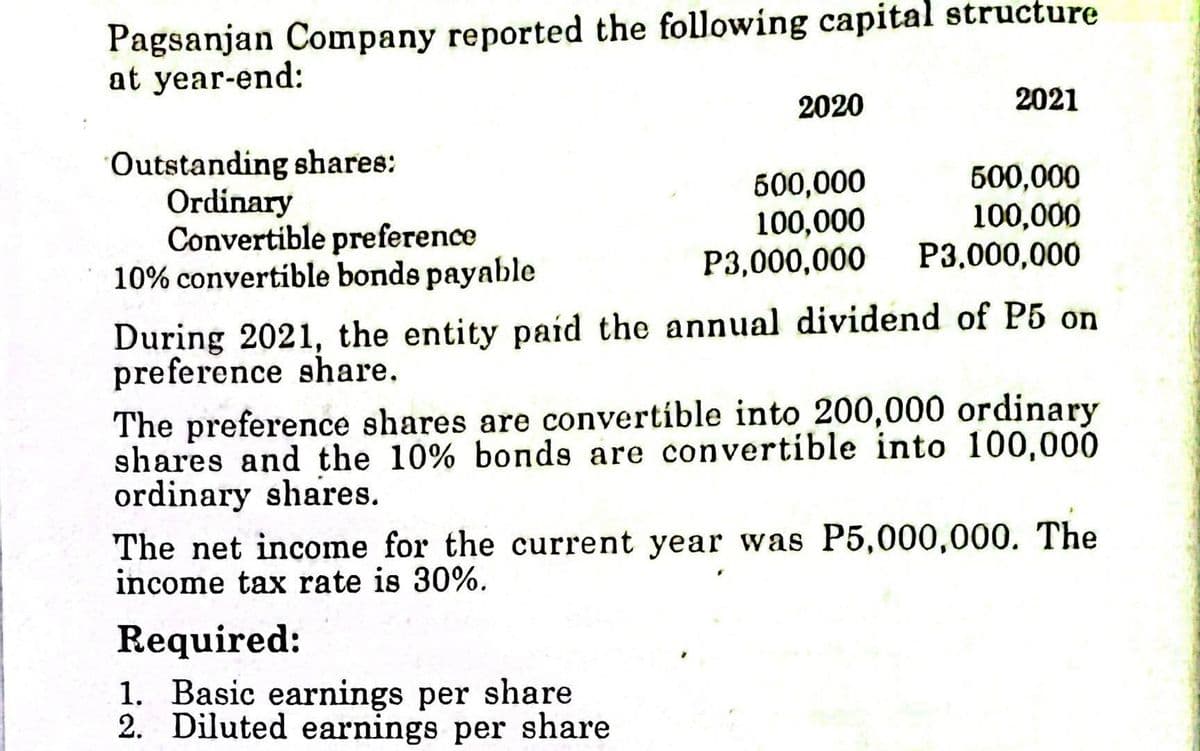

Pagsanjan Company reported the following capital structure at year-end: 2020 2021 Outstanding shares: Ordinary Convertible preference 10% convertible bonds payable 600,000 100,000 P3,000,000 500,000 100,000 P3,000,000 During 2021, the entity paíd the annual dividend of P5 on preference share. The preference shares are convertíble into 200,000 ordinary shares and the 10% bonds are convertible into 100,000 ordinary shares. The net income for the current year was P5,000,000. The income tax rate is 30%. Required: 1. Basic earnings per share 2. Diluted earnings per share

Pagsanjan Company reported the following capital structure at year-end: 2020 2021 Outstanding shares: Ordinary Convertible preference 10% convertible bonds payable 600,000 100,000 P3,000,000 500,000 100,000 P3,000,000 During 2021, the entity paíd the annual dividend of P5 on preference share. The preference shares are convertíble into 200,000 ordinary shares and the 10% bonds are convertible into 100,000 ordinary shares. The net income for the current year was P5,000,000. The income tax rate is 30%. Required: 1. Basic earnings per share 2. Diluted earnings per share

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:Pagsanjan Company reported the following capital structure

at year-end:

2020

2021

Outstanding shares:

Ordinary

Convertible preference

10% convertible bonds payable

600,000

100,000

P3,000,000

500,000

100,000

P3,000,000

During 2021, the entity paid the annual dividend of P5 on

preference share.

The preference shares are convertíble into 200,000 ordinary

shares and the 10% bonds are convertible into 100,000

ordinary shares.

The net income for the current year was P5,000,000. The

income tax rate is 30%.

Required:

1. Basic earnings per share

2. Diluted earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning